-- Published: Sunday, 16 November 2014 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

Something BIG changed after the collapse of the U.S. Investment and Housing Markets as a huge crack in the Fiat Monetary System took place. After the world nearly disintegrated under the debt-based U.S Dollar system in 2008, some of the Central Banks of the world finally found MONETARY RELIGION.

At this time, and according to some of the more enlightened Central Banks, gold was no longer a worthless piece of metal whose sole purpose in government was to be pawned off to support a worthless paper monetary system. In just a few years time, the huge flood of Central Bank gold into the market dried up and switched to become a large source of demand.

This can be clearly seen in the chart below:

From 2003 to 2009, the Central Banks flooded the world with 2,880 metric tons (mt) of gold. Not only was this a large liquidation of Central Bank gold at very low prices, but it also acted as means of suppressing the paper price by providing extra gold supply to the market.

The largest annual net flows of Central Bank gold were in 2003 at 620 mt and in 2005 at a peak of 663 mt. Then the trend continued downward (except for the 487 mt in 2007), until it reached a mere 34 mt in 2009.

I would imagine after the FED embarked on its wonderful QE MONEY PRINTING policy, some Central Banks finally said, “Enough is enough.” And in 2010, the tied finally turned as Central Bank demand for the precious yellow metal went positive for the first time as a net 77 mt of gold were taken off the market.

In 2011 Central Bank gold demand increased to 457 mt and then shot up even higher to 544 mt in 2012. Even though 2013 Central Bank gold demand was less than 2012, including the estimated 450 mt for 2014, it still represents more than 10% of total global gold supply… and that’s a BIG NUMBER.

So, instead of the 2,880 mt of Central Bank gold supply fed into the market from 2003-2009, we now have nearly 2,000 mt of Central Bank gold demand taken off the market in the past five years. I would imagine this will only grow larger over the next several years.

The figures in this chart are from the World Gold Council Demand Trends Report. Yes, I realize these are “Official figures” and we don’t know just how accurate they are, but they are the best we can go by. However, what is not included in these figures is Chinese Central Bank gold demand. We have no idea how much gold in heading into the Chinese Govt vaults as they have not made any public comments updating their official gold reserves.

So, if these World Gold Council figures are the best we can go by, and it does not include Chinese Govt demand… then total Central Bank gold demand is probably way off the charts.

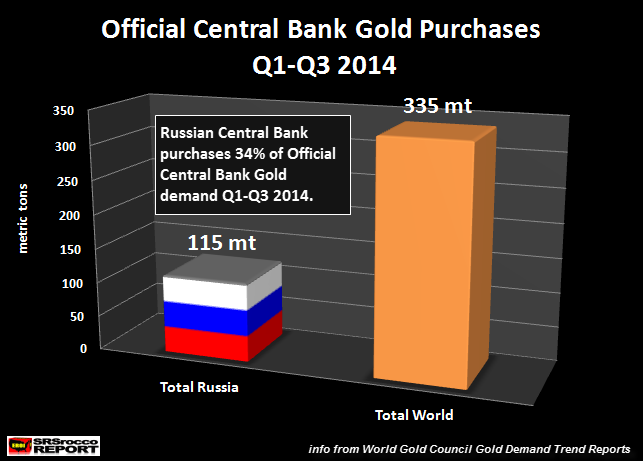

Russian Government Purchases 34% Of Total Known Official Central Bank Demand Q1-Q3 2014

Now, what we do know is that the Russian government purchased 34% of all official Central Bank gold demand in the first nine months of 2014… again, according to the World Gold Council:

Of the official reported 335 mt of gold purchased by Central Banks from Q1-Q3 this year, Russia purchased 115 mt (34%) of this total. Again, Chinese Govt demand is nowhere to be found in these figures. Which means, real Central Bank annual gold demand could be well north of 1,000 mt, or nearly a third of global gold mine supply.

The first chart in the article shows exactly when the DEATH of the FIAT MONETARY SYSTEM began… 2009. Of course it will take more time and a lot of additional Cow Excrement put forth by our wonderful brothers in the MSM, including continued rigging of the markets, but the death of the World’s Reserve Currency grows closer each and every day.

When the U.S. Dollar finally dies and goes down in history as just another one of the 100% of fiat currencies that perished before it, it may become quite a disorderly event. Trying to time this event may be the worst decision an individual could make rather than accumulating the precious metals when the opportunity remains.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below:

| Digg This Article

-- Published: Sunday, 16 November 2014 | E-Mail | Print | Source: GoldSeek.com