-- Published: Wednesday, 19 November 2014 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

Not only is Australia exporting a great deal of iron ore, base metals and energy resources to China, it’s also shipping a lot of gold to meet the country’s insatiable demand. How much gold?? Turns out to be one heck of a lot.

Just a few years ago, China received very little gold from Australia. However, since 2011, a trickle has now turned into a torrent. According to the Australian Government Bureau of Resources and Energy Economics China Resources Quarterly Reports, China received just 31 metric tons (mt) of gold from Australia in 2011.

Australia, the second largest gold mining country in the world, produced 259 mt of the yellow metal in 2011 (GFMS Gold Survey 2014). Thus, 31 mt of Australia gold exports to China that year was only 12% of its total mine supply.

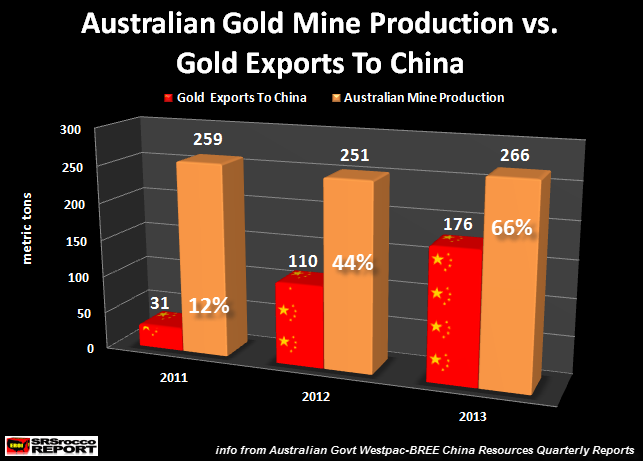

Looking at the chart below, we can see just how much more gold Australia exported to China in the following years:

In 2012, Australian gold exports to China more than tripled compared to the year before reaching 110 mt, representing 44% of its 251 mt gold mine supply. Then in 2013 when the paper price of gold was smashed (starting in April and then again in June), the clever Chinese couldn’t pass up on what they saw as a real bargain by loading up with even more of the precious yellow metal.

Australia enjoyed two gold records in 2013; 1) it had the highest gold production in over a decade at 266 mt, and 2) it exported a staggering 176 mt of the precious metal to China. In just two years, Australian gold exports to China increased from 12% of its mine supply in 2011 to 66% in 2013.

While it’s true that Australia also imports gold ($4.6 billion – 2013), exporting 66% of its of total gold mine supply to China alone is a significant figure.

Now, in the first nine months of 2014, Australia’s gold exports to China are down compared to the same period last year, but not by much Here are the figures, according to the Australian Government’s most recent China Resources Quarterly Report:

2013 Q1-Q3 Australia Gold Exports to China

Q1 = 36.9 mt

Q2 = 44.5 mt

Q3 = 43.3 mt

Total = 124.7 mt

2014 Q1-Q3 Australia Gold Exports to China

Q1 = 47.0 mt

Q2 = 40.1 mt

Q3 = 29.7 mt

Total = 116.8 mt

Year to date gold exports to China are only down 8 metric tons (6%). However, if gold demand in China picks up in the last quarter of the year (due to lower prices in October), total Australian gold shipped to the Chinese mainland could reach 160 mt in 2014.

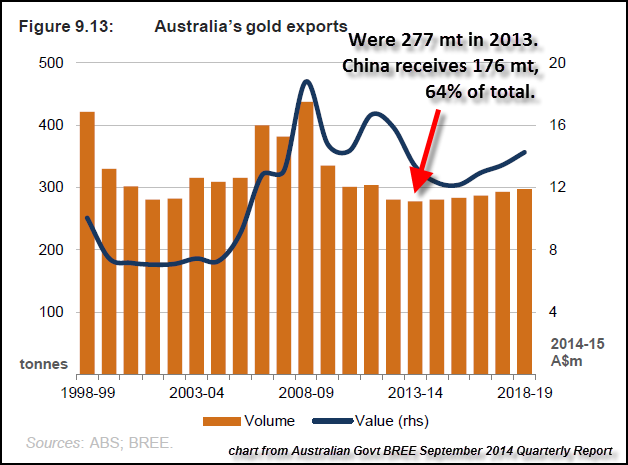

This next chart shows Australia’s total gold exports, including forecasted figures out to 2018. In 2013, Australia exported a total of 277 mt of gold. Gold exports to China alone were 176 mt or 64% of this total.

(chart courtesy of Australian Govt (BREE) – Bureau of Resources and Energy Economics September 2014 Quarterly Report)

According to the Australian Govt. BREE September 2014 Quarterly Report:

In the past three years, gold exports to China increased 1173 percent and the share of exports to China has increased from 5 percent in 2010, to 64 percent in 2013.

As the world continues to produce record annual gold production, the majority of it heads to China. As we can see from the data presented in this article, the Australians are just another example of the trend taking place in the West. Thus, the Aussies believe PAPER ASSETS & FIAT CURRENCY are a much better investment than owning gold.

Which is why they continue to export the majority of their barbarous relic to the Chinese… and of course, the Chinese are more than happy to exchange fiat currency for real money.

Please check back for new updates and articles at the SRSrocco Report. You can also follow us at Twitter below:

| Digg This Article

-- Published: Wednesday, 19 November 2014 | E-Mail | Print | Source: GoldSeek.com