-- Published: Thursday, 20 November 2014 | Print | Disqus

The Ebola crisis has faded from headlines but remains a risk after the death of another Ebola patient in Nebraska and the death of a suspected victim in New York yesterday. This brings the number of confirmed deaths to two in the U.S. and possibly three if the New York victim is confirmed as having had Ebola.

The toll in the Ebola epidemic has risen to 5,420 deaths out of 15,145 cases in eight countries, the World Health Organization (WHO) said today. Transmission of the deadly virus still "intense and widespread" in Sierra Leone.

The figures, through November 16, represent a jump of 243 deaths and 732 cases since those issued last Friday. Cases continue to be under-reported, the WHO said in its latest update.

Tragic scenes unfolded in Brooklyn yesterday afternoon when a woman collapsed, dead, in a salon with reports of bleeding from her mouth and nose. This is frequently how Ebola victims die as Ebola disables the body’s coagulation system, leading to uncontrolled bleeding. By the time the body can rally its second line of defense, the adaptive immune system, is frequently too late.

The unfortunate woman, who had travelled from Guinea three weeks ago and was on a watch list of the New York Health Department, showed no prior symptoms of having Ebola and was apparently being checked daily.

Her remains were collected by an emergency medical team wearing hazmat suits and the salon was later sterilized. While she is believed to have died of a suspected heart attack it seems protective measures to prevent the spread of the virus, if tests determine that Ebola was indeed the cause of death, were rather lax.

The salon remained open for business and none of the staff were decontaminated.

A death also occurred yesterday of Martin Salia, a doctor who was flown into the U.S. on Saturday for treatment. Initial tests for the virus came back negative but as his condition deteriorated he was found to have contracted Ebola.

Salia is the second person to die of Ebola in the United States. Thomas Eric Duncan, a Liberian man living in Texas, contracted the disease in his native country but was not diagnosed until after his return to Dallas.

“We are reminded today that even though this was the best possible place for a patient with this virus to be, that in the very advanced stages, even the most modern techniques that we have at our disposal are not enough to help these patients once they reach the critical threshold,” said Jeffrey Gold, chancellor of the University of Nebraska Medical Center, lamenting Salia’s death.

The latest Ebola death shows danger remains and the fact that U.S. trained doctors working in west Africa have been contracting Ebola demonstrates the virulent nature of the virus. It also contradicts the suggestion that it is the incompetence on the part of African healthcare professionals that has allowed Ebola to get out of hand.

It also suggests that the means by which Ebola spreads are not fully understood. The government of Liberia have achieved some success in bringing the epidemic under control. Public transport is rigorously monitored. Bus passengers are scanned with laser thermometers. Those with high or low temperatures are not admitted and are reported. Passengers must wash their hands upon boarding.

The statistics relating to the epidemic are difficult to interpret. In the three countries where Ebola has been most prevalent there is quite a discrepancy between the death rates of those that contract the virus.

In Guinea the death rate has been about 60%, in Sierra Leone it has been around 21% and in Liberia it has been 40%. One would expect Guinea to have the least proportion of fatalities given the dire poverty suffered by the other two nations who are emerging from civil wars.

In war-ravaged Congo the fatality rate is very high although the number of incidents has been quite low at 66.

Ebola has spread from Africa to the U.S, UK, France, Germany, Italy and Spain.

All the focus has rightly been on the medical implications and the tragic human consequences in Africa. Understandably, there has been little attention on the financial and economic consequences of a pandemic. Unless it is contained in the U.S. and Europe, it will likely soon impact consumer confidence and already fragile economic growth.

The outbreak and spread of Ebola is a worrying development and should remind people and companies, the world over, to be aware of the risks and become prepared.

A primary focus of ours is on financial and economic risk which we believe is underestimated by people, companies and governments. Our modern financial and economic systems are more complex and this more fragile than is realised.

We warned of this prior to the Irish and global financial crisis and believe there are many unappreciated financial and economic risks again today - one of which is a global pandemic.

Global economic growth remains weak and vulnerable and the global financial system remains fragile. Confidence and psychology is key.

Concerns about the Ebola virus and the likelihood of a pandemic are likely overblown. However, more cases in the western world will likely badly impact on already fragile economic confidence. This has the potential to be the straw that breaks the proverbial camel’s back with ramifications for financial markets and the global economy.

Get Breaking News and Updates On Gold Markets Here

MARKET UPDATE

Today’s AM fix was USD 1,194.00, EUR 953.60 and GBP 762.65 per ounce.

Yesterday’s AM fix was USD 1,200.75, EUR 957.61 and GBP 766.08 per ounce.

Gold prices fell $13.80 or 1.15% to $1,183.00/oz yesterday. Silver slipped $0.08 or 0.49% to $16.14/oz.

Gold in USD - 5 Days (Thomson Reuters)

Gold declined for a second day in volatile trade. The market rose following the Russian central bank gold announcement but priced were then capped in mid morning trading in London.

Some attributed the weakness to the negative gold poll in Switzerland. However, gold had fallen prior to the release of the Swiss poll and was trading below $1,180/oz and near the lows of the day at 1600 BST when the poll results were released.

The poll yesterday showed Swiss voters will likely reject an initiative that would require the nation’s central bank to boost bullion holdings. 47% percent of voters are seen as voting “no” on the Nov. 30 Swiss gold proposal and 15 percent were undecided, according to a gfs.bern poll for Swiss public broadcaster SRF. It was conducted Nov. 7 to Nov. 15 and had a margin of error of 2.7 percentage points.

Although many such polls favouring the establishment position have been very wrong in recent years.

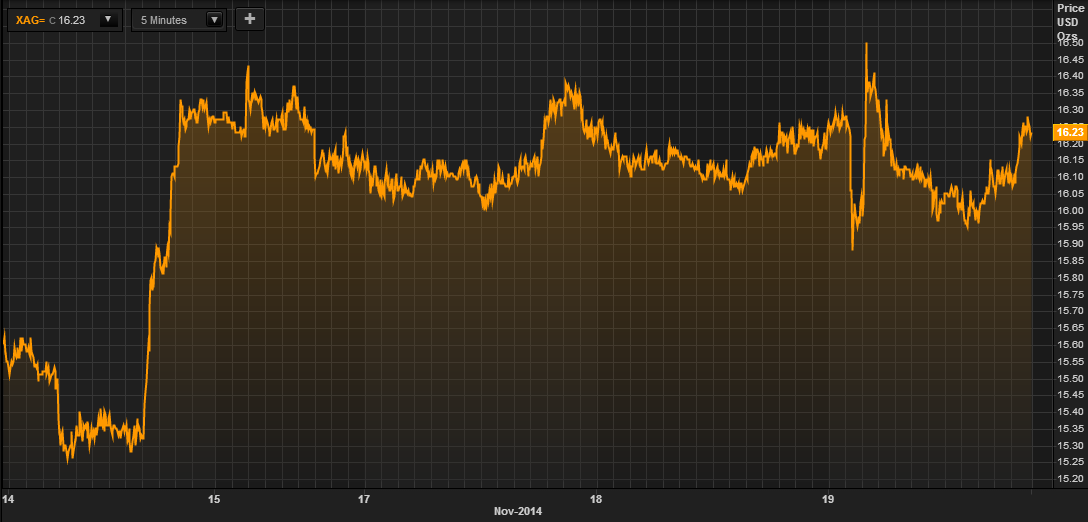

Silver in USD - 5 Days (Thomson Reuters)

One way or another, gold and silver quickly bounced higher again. Gold retested $1,200/oz prior to further weakness set in once again in less liquid markets after the close in New York.

Besides ongoing manipulation, gold’s weakness may also be related to traders selling as the dollar remains firm and oil prices weak. For now they are ignoring the continuing ultra loose monetary policies globally and focussing on the Fed’s ‘jawboning’ and signalling that they will increase interest rates. We will believe it when we see it.

Monetary policies globally have actually become looser in recent days due to Japan’s monetary ‘bazooka’ and the threat of ‘Super Mario’s’ bazooka.

Futures trading volume on the Comex was more than double the 100-day average for this time of day, data compiled by Bloomberg show. Holdings in gold ETFs fell 1.9 metric tons to 1,616.7 tons yesterday, the lowest since May 2009 as traders and weak hands sell and gold flows to stronger hands in allocated storage and in Asia.

- www.GoldCore.com

| Digg This Article

-- Published: Thursday, 20 November 2014 | E-Mail | Print | Source: GoldSeek.com