-- Published: Thursday, 4 December 2014 | Print | Disqus

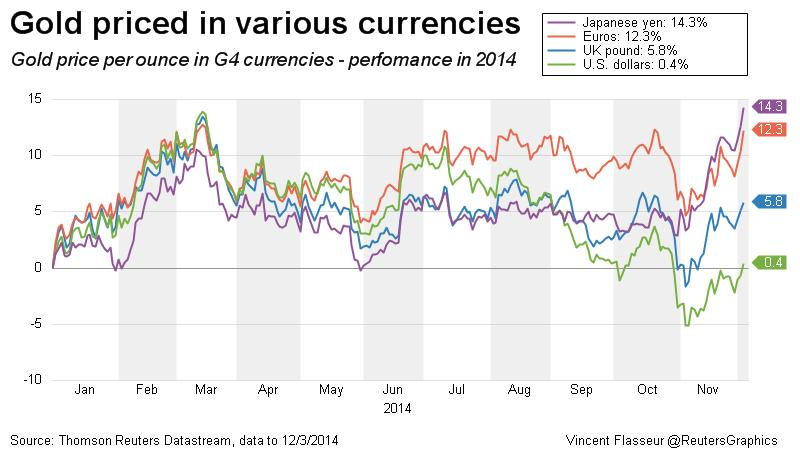

Despite the worst sentiment towards gold we have seen since the brief 30% price fall in 2008, gold continues to eke out gains in all major currencies. So far in 2014, gold is 14.3%, 12.3%, 5.8% and 0.4% higher in japanese yen, euros, sterling and dollars respectively (see chart).

Gold is again acting as a hedge against currency weakness and the ongoing devaluation of currencies as stealth currency wars continue. Overnight, gold rose to over EUR 986/oz and looks set to challenge the significant and important level of resistance that is EUR 1,000/oz due to euro weakness and concerns that Draghi may launch the ECB money printing ‘Bazooka’ in 2015.

There is a perception that gold has performed badly recently and in 2014 due to the recent dip in gold prices in dollar terms and despite the fact that gold is actually higher even in dollar terms in 2014.

This focus on gold solely in dollar terms is misleading. It shows a peculiarly dollar centric way of looking at the world. It is important for investors in the UK, EU, Japan and elsewhere to always consider performance in local currency terms.

Gold is not “priced in dollars” solely as is frequently, simplistically asserted.

Rather the COMEX price of gold in dollars is a leading benchmark price and is one of the most commonly quoted prices of gold in the world. Traders and speculators tend to speculate on gold in dollar terms.

However, investors internationally buy gold in their own currency. Investors in Switzerland and Germany buy gold in their banks and are quoted Swiss franc and euro prices and pay in Swiss francs and euros. Irish investors buying gold are quoted in euros and pay in euros. UK investors buying gold are quoted in sterling and pay in sterling.

Similarly, in the two largest gold buying markets in the world, India and China, gold is quoted in rupees and yuan and people buy gold in rupees and yuan respectively. In most countries throughout the world, investors are quoted in local currency terms and pay in local currency terms. Indeed, we allow people to pay us in any major currency, they wish to pay us in.

This almost sole focus on gold in dollar terms is can mislead regarding gold’s performance and is contributing to poor sentiment in the gold market.

The mood music and the psychology is as bad as we have seen it in the gold market – worse than after the sharp 30% fall in 2008 after Lehman. It is even worse than very low level of public interest shown towards gold in the period prior to the crisis in 2007.

Sentiment then was neutral. Today it is negative. There is little or no new buyers coming into the market. Demand in western markets is primarily from existing bullion owners adding to allocations and from investors opting to own gold in safer allocated and segregated storage. This is bullish from a contrarian perspective.

In terms of the cycle of market emotions, we are as close to ‘depression’ as we have seen.

Momentum is clearly down and gold remains technically vulnerable going into year end. We subscribe to the market adage to never catch a falling knife and are cautious in the short term and advise dollar cost averaging into positions.

However, we remain confident that the recent price falls are setting the stage for a new bull market as there are still strong fundamentals including very high demand from the Middle East, India and China.

Official sector and central bank demand from large creditor nation central banks is continuing and they are set to be net buyers again this year. Not to mention, very high levels of demand from the Bank of Russia and the stealth buying of the Peoples Bank of China (PBOC).

The recent price falls were not a surprise. We said in an interview when gold was near $1,900 that there was going to be a correction and that in a worst case scenario gold could replicate the 1970s pattern when gold fell nearly 50%.

It is always worth looking at gold’s last bull market in the 1970s when gold rose from $35/oz in 1971 to over $197/oz by January 1975. In the next 21 months, gold fell in value by nearly 50% to $103/oz by late August 1976. This led to many pronouncements that gold’s bull market was over and the bubble had burst.

In the next 40 months from August 1976 to January 1980, gold rose 8 fold from nearly $100/oz to $850/oz.

We think there is a real possibility of the same pattern playing out in the coming months and years. An 8 fold increase is very unlikely but we believe that gold will conservatively double from here given the scale of debt in the western world, continuing QE and potentially QE in EU and the risk of a global recession or depression.

Negative real interest rates are set to continue for the foreseeable future. Gold will continue to rise until we see positive real interest rates for a period of time. That day is a long way off.

Get Breaking News and Updates On Gold Markets Here

MARKET UPDATE

Today’s AM fix was USD 1,204.00, EUR 977.59 and GBP 767.42 per ounce.

Yesterday’s AM fix was USD 1,203.25, EUR 975.24 and GBP 768.95 per ounce.

Gold climbed $12.20 or 1.02% to $1,210.50 per ounce yesterday. Silver slipped $0.03 or 0.18% to $16.42 per ounce.

Gold in EUR - 2014 YTD (Thomson Reuters)

Gold consolidated above $1,200 again today ahead of today’s ECB rate meeting and despite the dollar reaching a 5 year high.

Gold for immediate delivery fell 0.5% to $1,204 in late morning trading in London. Silver for immediate delivery added 0.5% to $16.50 an ounce. Platinum rose 1% to $1,237 an ounce. Palladium gained 0.5% to $800.75 an ounce.

Today, the European Central Bank (ECB) will give its official interest rates at 1:45 p.m. CET. Following this Draghi will hold a press conference in Frankfurt from the central bank’s new premises in the city’s east end at 2:30 p.m. CET. Starting next month, the ECB will switch to a six-week cycle of monetary-policy decisions, with the first meeting on January 22.

Last month the head of the ECB, Mario Draghi pledged to raise inflation in the euro zone “as fast as possible”. However, Draghi now faces a stalling from multiple members of the Governing Council. Amid German worry over bond-buying and a wait-and-see approach by his own vice president, Draghi is looking for consensus on what further action the ECB can take and when.

Demand from Asian store of wealth buyers has been strong again this week. India, the world's second biggest gold buyer after China, last week scrapped a rule mandating traders to export 20% of all gold imported into the country.

Gold trading on China’s largest physical bullion bourse is already exceeding last year’s record volume as the world’s biggest gold buyer seeks to exert its influence on the global market according to Bloomberg.

The volume of all contracts on the Shanghai Gold Exchange (SGE), including those in the city’s free-trade zone, was 12,077 metric tons in just the 10 months to October, compared with 11,614 tons during all of 2013, according to data on the bourse’s website. This may climb to 17,000 tons by the end of the year, the exchange’s Chairman Xu Luode told a conference in Shanghai today.

See the 7 Key Storage Must Haves

| Digg This Article

-- Published: Thursday, 4 December 2014 | E-Mail | Print | Source: GoldSeek.com