-- Published: Sunday, 7 December 2014 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

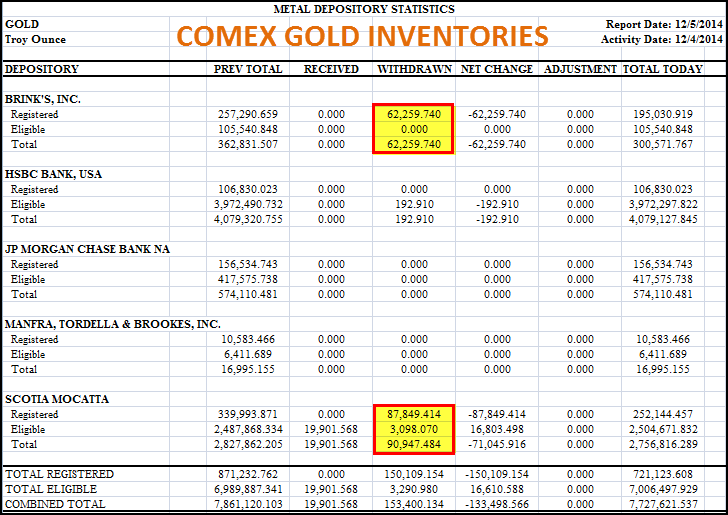

In a surprising update, there were two large gold withdrawals from the Comex on Friday. Not only were these large withdrawals, they came from Brinks and Scotia Mocatta’s Registered inventories. Even though the Comex holds a total of 7.7 million ounces of gold, only 10% of this amount is stored in the registered category.

On Thursday, Brinks held 257,290 oz of gold and Scotia held 339.993 oz in their registered inventories. Then on Friday, when CME Group released an update on its Comex gold warehouse stocks, Brinks registered inventories declined 62,259 oz and Scotia Mocatta fell 87,849 oz.

In one day, Brinks registered gold inventories fell 24% and Scotia Mocatta’s dropped 26%. While both of these depositories experienced a large percentage decline of their registered gold inventories, it impacted Brinks a great deal more than Scotia. If we look at the table below, we can see that Brinks only has a total of 300,571 oz of gold remaining in its inventory:

So, not only did Brinks registered gold inventory fall 24% in one day, its total stocks including its Eligible, fell 17%. On the other hand, Scotia Mocatta has more than 2.7 million oz of gold in its warehouse. However, Scotia’s registered gold inventories (252,144 oz) are now less than 10% of its overall warehouse stocks (2,756.816 oz).

Total Comex registered gold inventories are now at 721,123 oz compared to the 7,006,497 oz in the Eligible category. To understand the difference between the “Registered” and “Eligible” gold inventories, here is a good description from Jesse Cafe Americain Blog (Note: I substituted gold for silver):

“Comex has two categories of silver in its warehouse.

The eligible category means that the gold is in a condition that conforms to the standards of delivery. Size and quality of the bar in other words. It is being stored at the Comex warehouse, but is not offered for delivery into contracts.

Registered means that the gold is available for delivery to those who demand bullion by being registered as such with a bullion dealer, in addition to being in a fit condition to satisfy the contract.

Eligible gold can become registered and deliverable if the owner of the gold declares it saleable at some price. And of course if it is there, and otherwise unemcumbered by senior obligations or conspicuous absence.”

Thus, the five Comex bank depositories only hold 721,123 oz of registered gold bullion that is available for delivery. Again this is less than 10% of the total gold inventory held at the Comex.

Of course, we could see future transfers of gold from Eligible to the Registered category, but I would imagine investors who are storing their gold at the Comex, may be less inclined to give up their physical gold for a paper receipt when conditions in the financial markets deteriorate.

Please check back for new updates and articles and the SRSrocco Report. You can also follow us at Twitter below:

| Digg This Article

-- Published: Sunday, 7 December 2014 | E-Mail | Print | Source: GoldSeek.com