According to USGS, U.S. gold production declined 11% in October compared to same month last year. This was due to lower seasonal production in Alaska and lower grades at Rio Tinto’s Bingham Caynon Mine in Utah. U.S. gold production in October was 16.8 metric tons (mt) compared to 18.9 mt last year.

Even though domestic U.S. gold production was down significantly in October, it has trended lower throughout the year.

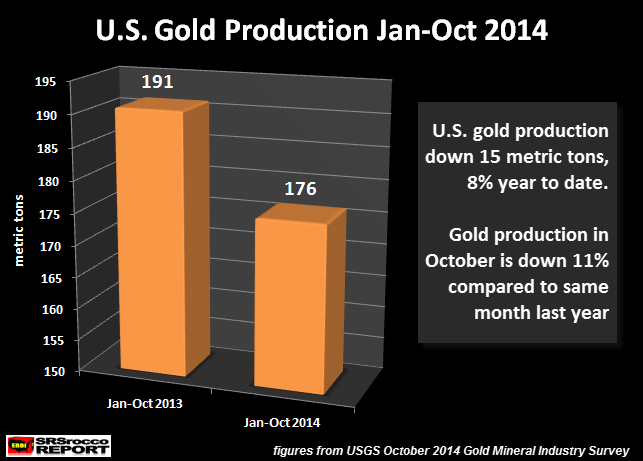

Total U.S. gold production from Jan-Oct declined 8% to 176 mt, compared to 191 mt during the same period in 2013. The biggest drop in gold mine supply came from Nevada as Jan-Oct was 126 mt, or 9% less than the 140.4 mt during Jan-Oct 2013.

This is quite interesting to see that Nevada is suffering the worst declines when many of the major mining companies in the state such as Barrick, Newmont and GoldCorp are high-grading their mines. I thought for sure, we would see higher production this year, when the opposite is the case.

If the trend continues for the remaining two months of the year, U.S. Gold production will probably come in at 211-213 mt compared to 230 mt in 2013.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: