Americans are in big trouble and they don’t even know it. The financial system in which they are totally invested, is heading towards an epic collapse. Printing money and increasing debt (exponentially) are not sustainable business practices. These artificial techniques to prop up a Zombie Economy have a certain lifespan… one that will end much sooner than later.

Unfortunately, the precious metal community had no idea how long the Fiat Monetary Authorities could prop up the Leech & Spend U.S. Economy. Many now believe this can go on for quite a long time. However, this is a terrible assumption to make. Why? Because the length at which the Fed and member banks were able to keep a Dead Financial System alive and its inevitable collapse, will both come as a surprise.

Many precious metal investors are now under the trance that the Fed and member banks are totally in control of the financial and economic system. The evidence is perfectly clear when we look at physical gold investment demand. According to the World Gold Council’s Quarterly Demand Trend Reports, physical coin and bar investment is down significantly compared to 2013, and will be less than half of what it was in 2011.

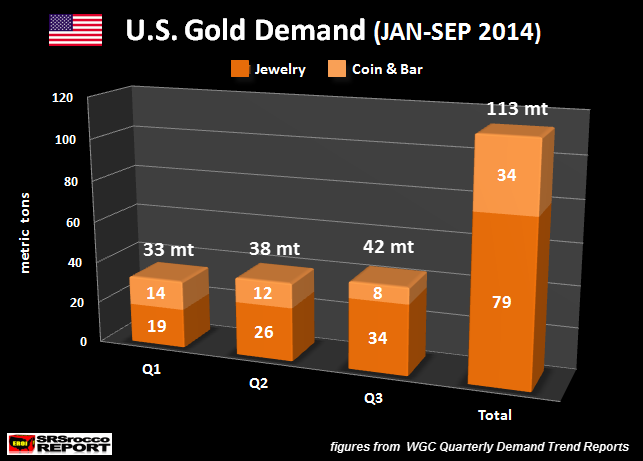

The data from the World Gold Council shows Americans purchased a paltry 34 metric tons (mt) of physical bar and coin and 79 mt of gold jewelry JAN-SEP 2014:

We can see an interesting trend took place in American gold buying habits as the price of gold declined from a high in March to a low in September (2014)… physical bar and coin demand fell while gold jewelry purchases nearly doubled. Thus, physical bar and coin demand fell from 14 mt in Q1 to 8 mt in Q3, whereas gold jewelry demand increased from 19 mt in Q1 to 34 mt in Q3.

What do these gold buying trends reveal? When the price of gold declines, Americans on an increasing basis, (and stupidly so) spend their hard-earned fiat money on gold for adornment purposes, rather than acquiring it as an investment. Let me tell you, when gold was really cheap back in the early 2000’s, Americans were buying gold jewelry at three times the rate they are presently. Then of course, they took that gold jewelry and pawned it off into the scrap market after the severe 2008-2009 economic and financial recession for much-needed cash.

Now, you won’t see the Indians being this foolish. According to the data put out by Thomson Reuters GFMS 2014 Gold Survey, total U.S. gold scrap supply hit a record of 160 metric tons in 2011 compared to 58 mt for India. So, when the price of gold hit an all time high of $1,900, the Indians were holding onto their precious gold jewelry, while Americans pawned it off as fast as they could.

What is even more interesting, that 58 mt of Indian gold scrap in 2011 was the lowest annual amount during the decade (2004-2013), in contrast… it was the highest for the United States. Which perfectly describes the mentality of the typical American, they choose gold for adornment only and load up on paper assets for wealth.

NOTE: Yes, I realize many do not trust the World Gold Council figures, but they are best official source we can go by. Furthermore, sales of U.S. Gold Eagles and Canadian Gold Maples have been trending lower since 2011. Even though its impossible to know the actual data, physical gold investment by the west has declined… just as the Fiat Monetary Authorities planned.

U.S. Gold Market: Supply To Dry Up When Price Skyrockets

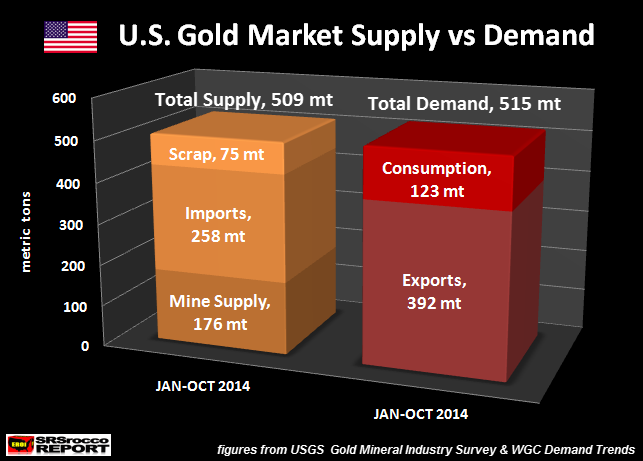

If we look at the current supply and demand figures for the U.S. Gold Market, it is experiencing a slight deficit. According to the figures put out by the USGS Gold Mineral Industry Surveys as well as the World Gold Council Demand Trends, total supply of 509 mt is less than total demand of 515 mt (JAN-OCT 2014):

The USGS reports total mine supply for JAN-OCT 2014 of 176 mt, imports at 258 mt and (my) estimated scrap at 75 mt for a total of 509 mt. Total demand comes from adding the USGS total U.S. gold exports of 392 mt and 123 mt of consumption for a total of 515 mt.

The World Gold Council stated total gold demand for JAN-SEP at 113 mt, which I estimated another 10 mt for October to give a total of 123 mt for the period. Furthermore, my forecasted gold scrap of 75 mt comes from taking the total 107 mt figure for 2013 (GFMS 2014 Gold Survey), and then reducing it by 15% for 2014. GFMS shows U.S. gold scrap supply declined 28% in 2013… so a 15% decline rate is conservative.

Even if U.S. gold scrap was a bit higher in 2014 than my estimate, it wouldn’t change the overall supply demand situation. As we can see, the current U.S. Gold market barely has enough supply to meet demand.

So… what happens when we finally get the BIG GOLD PRICE REVALUATION? Americans purchased 34 mt of gold bar and coin during the first nine months of 2014 and it will be an estimated 42 mt for the entire year. This isn’t that much gold when we convert it… 1,350,000 troy ounces.

Sure, maybe some of the jewelry demand will fall precipitously as the price of gold rises significantly, but that still doesn’t leave much gold supply. If half of the gold jewelry demand in 2014 became physical coin and bar demand, it would be an additional 75 mt, or 2.4 million oz of gold. Adding these two together we arrive at total of 117 mt or 3.75 million oz.

How is 3.75 million oz worth of physical gold bar and coin going to satisfy the demand of the American public? Some may say, “Well, we could export less gold and use that to supply the increased gold bar and coin demand.” Unfortunately, when the world finally experiences the GREAT GOLD REVALUATION, everyone will be demanding gold, not just Americans.

Thus, if U.S. gold exports are cut to meet increased domestic investment demand, it’s rather easy to assume, gold imports into the United States will be cut as well. Moreover, the U.S. continues to ship a great deal of gold East. In my article, U.S. GOLD EXPORTS TO HONG KONG & CHINA: Doubled In October, of the total 51 mt of gold exports in October, 52% were shipped to Hong Kong, China and India. Also, I would imagine the majority of U.S. gold exports to Switzerland (17.6 mt) that month also made its way to Asia.

The writing is on the wall. When the price of gold rises to its true fundamental value (virtually overnight), Americans will be the BIGGEST PAPER BAG HOLDERS on the planet. At this point, there will be no physical gold available for Americans to invest in… now long gone, as the majority flowed EAST while the WEST fell asleep.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: