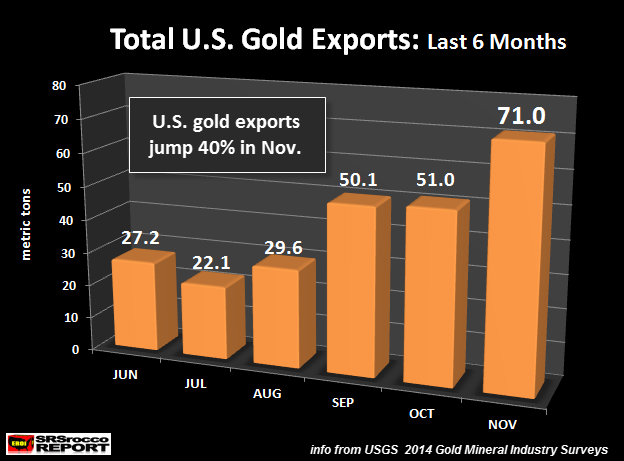

After the price of gold fell to a new low in November, total U.S. gold exports jumped 40% compared to the previous month. When the USGS released their October Gold Mineral Industry Survey, total gold exports that month were the second highest of the year.

However, the most recent data shows U.S. gold exports shot up significantly to 71 metric tons in November, compared to 51 mt in October. If we look at the chart below, we can see that U.S. gold exports increased considerably in September after a lull in demand during the summer.

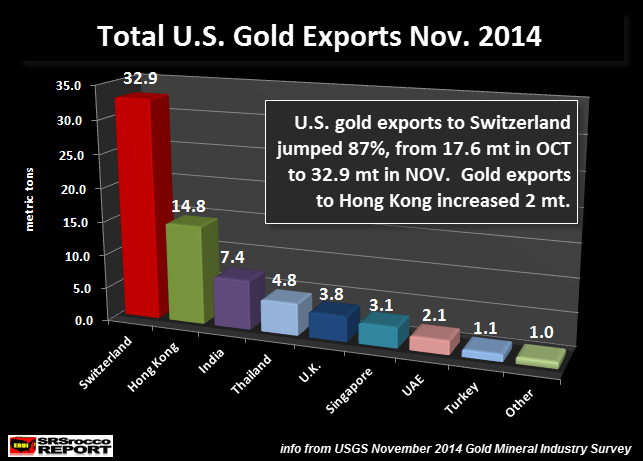

Not only was November’s 71 mt the second highest month for U.S. gold exports (Jan was 80.7 mt) in the year, Switzerland received nearly half of the total amount. In just one month, U.S. gold exports to Switzerland jumped from 17.6 mt in October to a staggering 32.9 mt in November.

Furthermore, gold exports to Hong Kong increased from 12.9 mt in October to 14.8 mt in November, while India’s grew by 1.3 mt to 7.4 mt. As it turns out, November is another deficit month for the U.S. gold market. Here are the figures:

U.S. Gold Market November 2014

Mine Supply = 17 mt

Imports = 20 mt

Est. Scrap = 8 mt

TOTAL SUPPLY = 45 mt

Exports = 71 mt

Consumption = 10 mt

TOTAL DEMAND = 81 mt

DEFICIT NOV. = 36 mt

As we can see, the United States continues to send GOLD (Real Money) to Switzerland, Asia and India while it creates more debt and derivatives. This is another stupid practice for a country that leads the world in FINANCIAL INSANITY.

Lastly, the future value of the precious metals will skyrocket as the value of most paper assets implode. Why? This will be due to the peak of unconventional oil sources and the continued falling EROI. I recommend reading my recent article on this subject if you have not:

Click on the image on you can get access to the article by the following link: DECLINE OF U.S. EMPIRE: Due To The Worst Oil Productivity In The World

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: