-- Published: Monday, 23 February 2015 | Print | Disqus

By Bob Loukas

The Gold market appears to be in reverse gear at present. Itís at fresh 6 week lows with a 2nd Daily Cycle that continues to wind lower, and is showing nothing thatís at all positive. Gold is trading very lethargically, and is uninteresting from most perspectives.

Assets move higher or lower in direct relation to the sentiment of traders and investors. And sentiment swings like a pendulum, from bullish to bearish and then back again. Sentiment is the primary driver of demand, with greater buyer engagement Ė both in numbers and enthusiasm Ė required to drive prices higher. Unfortunately for Gold bulls, it appears that the sentiment pendulum has already peaked, and is heading back toward bearish lows. We see this clearly in the COT reports, with traders continuing to shift from net Long to net Short positions. The reportís actual survey data confirms that sentiment for the current Investor Cycle has topped, and is now in decline.

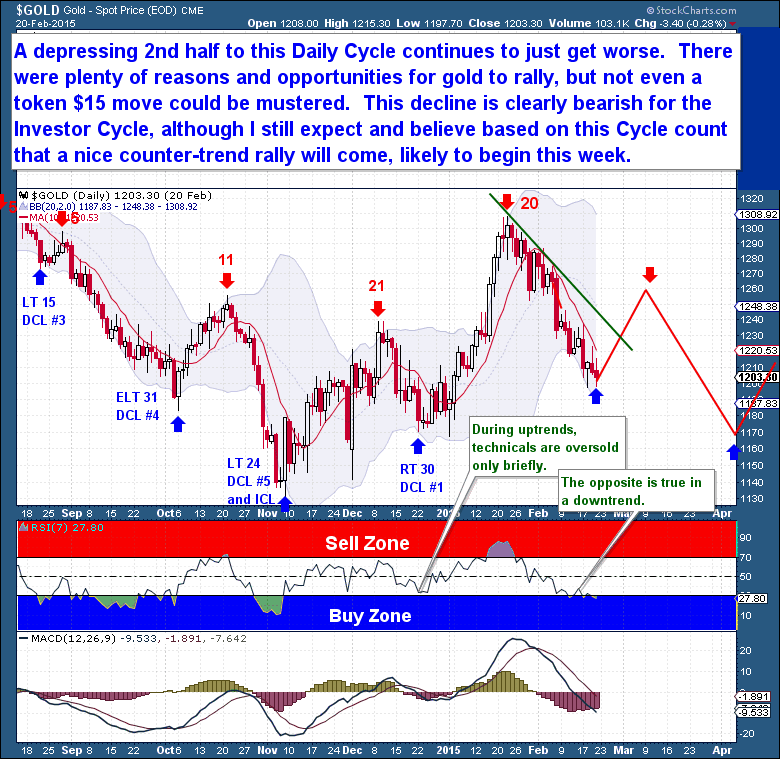

Ultimately, price action rules. In this case, with the current Daily Cycle having declined for 22 days (and counting), Goldís price shows clear confirmation of an Investor Cycle decline. Bullish Cycles generally contain declines of no more than 10 days.

Headlines donít always drive asset prices, but if Gold were inclined to move higher, last weekís sound bites around both a potential Greek exit and a breakdown of the Ukraine ceasefire offered plenty of fuel for it. Instead, Gold continued moving lower without a hint of strength. Given the geopolitical backdrop, Goldís lack of upside movement speaks volumes about its underlying demand.

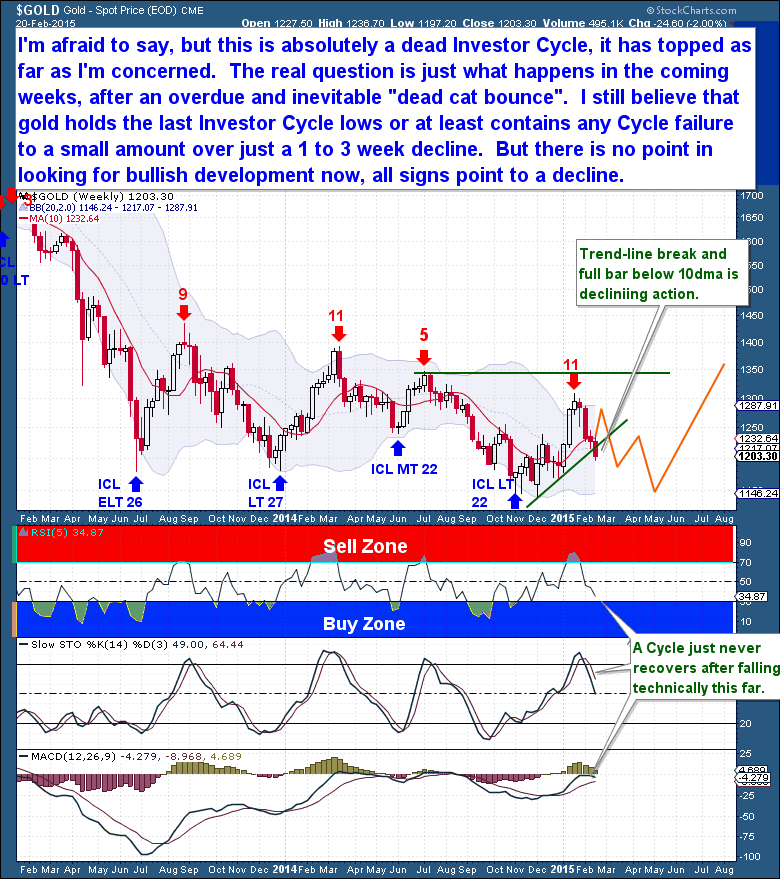

On the Investor Cycle timeframe, the current 4 week decline also creates problems for bulls. There is no way to sugar coat it: the action has been downright bearish. In my opinion the evidence clearly shows that the current Investor Cycle has topped and is on the way to a Investor Cycle Low.

From a review of past Cycles, especially those of the past 4 years, itís clear that the week 11 high is almost certainly the top of the current Investor Cycle. Having price fall through the weekly trend-line is one issue, but the firm close below the 10 week moving average creates even more of a concern. In addition, an Investor Cycle in an uptrend rarely sees price spend an entire week below the 10 wma, but thatís what happened to Gold this week.

With Gold now 15 weeks into the current Investor Cycle and with a 10 wma that has turned lower, itís clear that the current Investor Cycle is in decline and on its way to a trough. At this point, the evidence is conclusive, so only an outlying Cycle development would shift our outlook. Traders need to be aware that an oversold Daily Cycle rally should come this week, but that is an opportunity to sell on strength and capture the larger move lower over the coming months.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bondís, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

| Digg This Article

-- Published: Monday, 23 February 2015 | E-Mail | Print | Source: GoldSeek.com