-- Published: Tuesday, 24 February 2015 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

The Shale Energy Industry suffered another big blow as Chevron terminated its last European operations in Romania due to poor exploration results and ongoing anti-fracking protests. Chevron also suspended all operations in Poland last month and cancelled shale gas agreements in Ukraine and Lithuania.

This is just another bad sign for the Shale Energy Industry. A few years ago, the hype put out by the Main Stream Media (MSM), was that there was an endless amount of shale oil and gas reserves all over the world. Of course, this was pure nonsense as a few of the more enlightened energy analysts knew better.

According to the article, Chevron Ditches Last European Fracking Project In Romania:

While the US Energy Information Administration had previously estimated that Romania could potentially recover enough gas to cover domestic demand for more than a century, the exploration failures resulted in the country’s prime minister, Victor Ponta, saying last year that it looks like Romania “does not have shale gas.”

Globally, Chevron’s 2014 failure rate stood at 30 percent, as compared to 18 percent in 2013, according to Bloomberg. Sixteen of the 53 wells the company drilled were found to have had no commercially viable quantities of oil or natural gas.

As the article stated, the U.S. Energy Information Agency (EIA) first estimated that Romania had enough shale gas reserves to supply the country for more than a century. So a SHALE ENERGY BANG turned into a WHIMPER as Chevron’s shale gas exploration projects turned out to be an utter failure.

We also must remember, most citizens in other countries who own property, do not own their mineral rights as do Americans. So, it’s no benefit to them to have thousands of rigs and fleets of fracking trucks taking over the landscape.

In just a few years, Romania’s supposed 100 years worth of shale gas reserves evaporated into thin air. This reminds me of President Obama saying the same thing during his public address to the nation last month. Unfortunately, Obama was misinformed just like Romania’s Prime Minister, Victor Ponta, that the United States also has 100 years worth of shale gas.

How much shale gas does the United States really have? Well, according to energy analyst Art Berman in his Peak Prosperity interview, Why Today’s Shale Era Is The Retirement Party For Oil Production, Art believes the U.S. has about 8 years worth of economically recoverable shale gas reserves at current annual consumption rates.

If Art is correct that the U.S. had less than ten years worth of shale gas supply, this spells real trouble for our economy and highly leverage financial industry…. both totally dependent on growing energy supply to function.

Major Oil Companies Such As Chevron Are Already In Big Trouble

As Americans continue to believe the United States is heading for energy independence, $1.50 gallon gasoline and the never-ending expansion of the Great Suburban Dream…. serious cracks are beginning to appear on the balance sheets of the major U.S. energy companies.

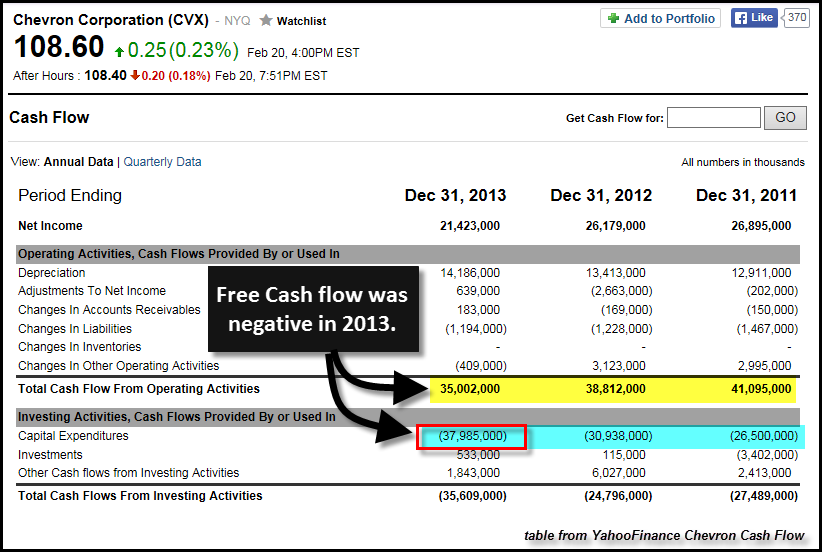

Looking at Chevron’s cash flow statements over the past three years, we can spot a troubling sign. In 2011, Chevron’s produced $41 billion in cash from operations, while it spent $26.5 billion on capital expenditures. Thus, Chevron enjoyed a FREE CASH FLOW of $14.5 billion that year (excluding dividends).

Normally, when we look at a companies free cash flow, we take cash from operations and deduct capital expenditures and shareholder dividends. However, in the example above, I am excluding the $6.2 billion in dividends that Chevron paid to their shareholders in 2011. So, if we were to deduct the $6.2 billion (dividends) from the $14.5 billion (operating cash minus CAPEX), we would end up with $8.3 billion in free cash flow for 2011.

Which is still positive for Chevron. This was also true in 2012, when operating cash of $38 billion, minus CAPEX of $30.9 billion and dividends of $6.9 billion (not shown in the table above), gave Chevron a free cash flow of $200 million in 2012.

Unfortunately, things got worse for Chevron in 2013 when cash from operations of $35 billion was less than the $37.9 billion the company spent on CAPEX that year. Furthermore, Chevron paid a whopping $7.6 billion in dividends in 2013, which the company netted a NEGATIVE $10.5 billion in free cash flow.

Basically, Chevron is suffering from the CASH FLOW PINCH…. falling operating cash flow and rising capital expenditures. It’s no wonder Chevron finally decided to get out of all shale oil and gas exploration in Europe when it can’t even make enough cash from operations to pay its shareholder dividends. I took a look at Chevrons Q1-Q3 results for 2014, and it isn’t any better than 2013.

According to my back of the napkin calculations, Chevron’s free cash flow Q1-Q3, including dividends, was a negative $6.7 billion. So, for the past two years, Chevron had to either borrow or come up with additional funds to pay its shareholder dividends as it didn’t have enough cash from operations to do so.

Folks, the world is starting to wake up to the fact that GLOBAL PEAK OIL is here. It’s only a matter of time before overall production begins its inevitable decline. Some energy analysts believe 2015 or 2016 will mark the year the world finally peaks in total petroleum liquid production.

Once we begin to see actual production decline figures, the market will start to realize the sobering reality that GROWTH FOREVER is over. This will have profound implications for NET PRESENT VALUE, the financial formula that provides value to most stocks, bonds and paper assets.

With a declining global oil supply, economic growth will only go in one direction. Thus, the value of most paper assets which are based on economic growth via a growing energy supply will experience a great mass exodus.

This is why I believe in owning physical gold and silver. I don’t care how much the paper prices of the precious metals have fallen since 2011. Investors need to realize that purchasing gold and silver is like any other retirement account… it’s a long-term buy and hold strategy.

The key to understanding the future value of gold and silver is by following the global energy market. Finance does not run the global economy… energy does.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below:

| Digg This Article

-- Published: Tuesday, 24 February 2015 | E-Mail | Print | Source: GoldSeek.com