-- Published: Wednesday, 25 March 2015 | Print | Disqus

By Daniel R. Amerman, CFA

Suppose that you live in a capital city under siege, that is surrounded by revolutionary armies. And while you don't know the exact timing or specifics, you do believe that the overthrow of the current regime is close to a 100 percent certainty. So you take your life savings and enter into a series of binding contracts with the current regime, under advantageous terms for you. The revolutionary armies enter the capital city, the current regime is ousted, the new regime repudiates the contracts of the previous regime and you are left penniless.

Is your impoverishment a matter of pure bad luck or is it just possible you could have made some better decisions along the way?

That's an important question, for as we will explore this hypothetical scenario is a metaphor for the most common retirement planning mistake being made today in the United States.

The US government has made an extraordinary and indeed impossible amount of retirement promises for the coming decades when it comes to paying them all in full. This is reasonably well understood by most people, and is also the one of the largest reasons for saving money in retirement accounts as a back-up plan.

To put the issue in more personal terms, if we take the average of the various estimates of unfunded government promises, add in the official national debt, and divide by the number of above-poverty line households in the United States, then the average cost per household is a little over $900,000.

Are you good for your $900,000 share? Are your children and your neighbor's children good for their $900,000 shares (on top of making their student loan payments)?

So we know the "army" is outside the City walls in their trillions and their storming the City is only a matter of time.

But the most common way of preparing for "the fall" is effectively to enter into contracts with the current regime, under terms that are currently favorable to them, and in exchange, we are promised benefits in the distant future.

This what we are told to do. And this is what most everyone does. But does that make it a good idea?

Or should we instead be considering whether such a strategy would prevail under a tax code "revolution" that will almost certainly arrive at some point?

While this article focuses on the United States this is truly a global issue. Canada and Australia very much have their own issues in this area as well, and generally speaking, the Europeans and Japanese have even larger armies outside their own City walls.

The Encircling Army

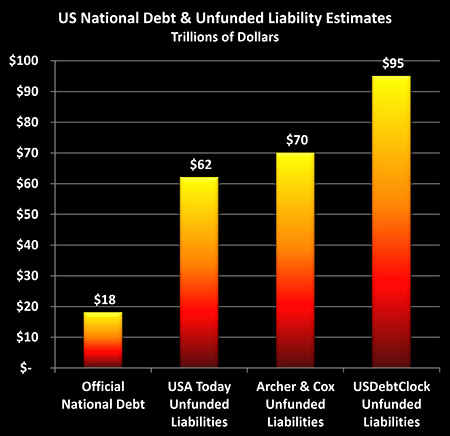

In 2012, the newspaper USA Today calculated that unfunded Social Security obligations alone were over $22 trillion an amount well in excess of the official national debt of $18 trillion. Add in other unfunded obligations primarily Medicare and in a 2011 article USA Today found that the total came to about $62 trillion of "off-balance sheet debt". That is, the federal government uses a very special accounting that is not legally available to corporations or individuals, precisely so that it can report lower debt totals and lower annual deficits than any other sort of entity would be able to do.

Add this to the official national debt of $18 trillion, and the total then came to an astonishing $80 trillion (although it has grown in the last 3-4 years since the report was done).

As reported in the Wall Street Journal in December of 2012, when Archer and Cox (former chairman of the House Ways & Means committee and former SEC chairman respectively) took a look at the true level of national debt, they found primarily based on the figures from the Social Security and Medicare trustee reports that the true national debt was $87 trillion, consisting of $17 trillion in (then outstanding) official debt, and $70 trillion in unfunded obligations, most of which were payments to future retirees.

And for those who are familiar with the well-known usdebtclock.org website, which keeps running real time totals of estimated US national debts and assets, as of March of 2015 they showed that the total unfunded obligations of the US government were about $95 trillion under GAAP (Generally Accepted Accounting Principles), which when added to the official debt in 2015, brings the total to $113 trillion.

All of these totals are based upon the assets of the Social Security Trust Fund which are effectively IOUs the government has written to itself as being real securities, real assets. Some say the assets are there, and others not, but as examined here, the full story is stranger still when it comes to the Trust Fund assets, and where the money will actually be coming from as the fund is spent down and money paid to retirees.

Given that it is impossible to pay these promises in full, we know there will be a necessary resetting of the financial and tax system at some point. Since the current system cannot continue indefinitely, we know a financial "revolution" is close to inevitable at some point.

Almost by definition, one aspect of a financial revolution is that the previous tax shelters are going to be in a highly precarious position. There will be a lot of assets in retirement accounts, the nation will be in crisis mode, and everyone will be called on to make sacrifices "for the good of the nation". Tax deferred retirement accounts and other tax breaks will have a prominent and very public "bulls-eye" on them, and may very well be one of the first victims of the financial revolution.

The Central Problem With Retirement Accounts

There is a basic political problem with retirement accounts that have existed from the very beginning. Ironically enough, this political problem owes its existence to the sensible and prudent approach taken by many millions of people, which is to fund individual private retirement accounts as a back up to the widely anticipated inadequacy (or even insolvency) of the public retirement entitlement system.

Over the last several decades, the government has encouraged people to save for retirement by offering carrots in the form of tax breaks when people put their money into dedicated retirement accounts. To get the tax breaks, savers have to agree to the government's terms, which are that people can put money in, but they can't take it out (without significant penalties) until they are of retirement age.

The message from the media, financial industry and government continues to be that making contributions to legally restricted retirement accounts is one of the basic attributes of a financially educated and responsible person. When this message is combined with the carrots of the tax breaks and all those financial schedules showing the (supposedly) reliable compounding of wealth for a comfortable retirement (read this for a mathematical truth test on that compounding), the result has been that tens of millions of middle-class and upper middle class people have deferred consumption and responsibly set aside significant sums of cash every year, which have been accumulating inside of legally segregated restricted retirement accounts.

So what we have are tens of millions of people with trillions of dollars of assets set aside for retirement coming into an extraordinary financial crisis in which all tax breaks and rules are almost certain to be rewritten.

Of course, we need to keep in mind that there are more people in society besides just responsible savers. There are the poor and lower middle class also in their many millions, who simply don't have the financial resources to accrue any savings. Moreover, the majority of the Baby Boomers don't have any significant savings in personal retirement accounts. Neither do the young, nor do the early middle-aged.

So, even though there are tens of millions of people who have worked hard and deferred gratification for many years to accumulate a great deal of retirement savings, they are in fact still very much in the minority within the overall US population.

Rephrased, when it comes to substantial retirement account savings: the "haves" are vastly outnumbered by the "have-nots".

From the reality-based perspective of the political process, of even more concern is that the truly wealthy have put only a tiny percentage of their overall financial assets into the usual tax-advantaged retirement accounts. This is generally due to the limitations on how much can be put into a retirement account on a tax advantaged basis, with the assets of the truly wealthy greatly exceeding the limits that can be contributed.

So when we consider not the average voters, but we instead concentrate on the people who in political terms really "matter" which we'll qualify as the kind of people who can pick up the phone and call a United States Senator, and the Senator will personally call them back for those kinds of people, retirement account assets are often a negligible part of their net worth.

Where things start to get really dangerous for conventional retirement account savers, however, is the next point. Which is that if someone with few or no financial assets of their own doesn't understand very much about tax accounting, and their only source of information is what they see on TV or read in the newspaper (if even that), then they are likely to see little difference between how the tax code affects a person who has accumulated a few hundred thousand in assets over the course of a lifetime, versus the effects on a billionaire as both people are considered to be among the "wealthy".

If you don't have savings, and you're looking at your entitlements being slashed or your job eliminated, you're not likely to see all that much difference between someone who has scrimped and saved to build $200,000 in retirement assets, and someone who has $200 million in inherited family wealth. Framed from the perspective of politicians and the media, both are (and will be) "haves" that could be giving more of their fair share in times of great need.

This may all sound a bit overly cynical, but for proof just consider the current US tax code. Wealthy politicians make thundering speeches about making "the wealthy" pay their share. They proceed to raise taxes on the federal and state levels, effectively targeting the people who have taken risks to build small businesses, or dedicated years of their lives to specialized training in such areas as medicine, to the extent that they pay in excess of 50% of their current income in marginal tax rates when aggregating federal, state, sometimes local income taxes as well as payroll taxes.

Meanwhile, the truly wealthy take their cash in forms that may not be considered "income" at all, or in ways that are subject to lower tax rates, or no payroll taxes. Even as the major corporations using high-dollar attorneys and high-powered lobbyists (to create and maintain the loopholes) may just move the whole thing overseas, and not pay a dime to the US government.

So then, given that we've already seen this process in action every day of our lives, is there truly any reason to believe that the coming tax "revolution" will work any differently?

The overall situation is that we have this huge and very tempting target in terms of wealth that is conveniently set aside into legally segregated assets, coming into a time of national fiscal emergency when "everyone must do their share". It is likely to be an enormously popular campaign theme among the people who do not have significant retirement account savings, that the Boomers and other retirees who have substantial assets going into retirement should be paying their "fair share" of the total retirement entitlement burden, as well as other entitlement spending.

It then becomes highly advantageous for the billionaires to throw the simple millionaires "under the bus," even as those with $200 million in assets are also throwing those with a $200,000 retirement account balance under the same bus.

Preparing For The Fall

The 2nd part of this article discusses the crucial personal choices that people have when they do see the "campfires" which are ignored by traditional retirement planning.

Continue Reading The Article

Contact Information:

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: dan@danielamerman.com

This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

| Digg This Article

-- Published: Wednesday, 25 March 2015 | E-Mail | Print | Source: GoldSeek.com