-- Published: Monday, 30 March 2015 | Print | Disqus

- Goldman warns that peak gold may happen in 2015

- New report says there are only “20 years of known mineable reserves of gold”

- Discoveries of new sources of gold production peaked in 1995 despite major bull market

- Production lags new finds in 20 year cycle – Indicates 2015 may be year of peak gold production

- Production in major gold mining countries has dropped in recent years

- This will provide support and should lead to higher prices in long term

For many years, we have written about ‘peak gold’ and the ramifications of the underappreciated peak gold phenomenon for the gold market.

Major gold mining countries have seen declines in their gold production in recent years despite the strong bull market of the last decade.

On Friday, Zero Hedge highlighted a report from Eugene King of Goldman Sachs which supports our assertion. According to King, there are “only 20 years of known mineable reserves of gold and diamonds.”

Discoveries of new, mineable gold reserves peaked in 1995 at around 140 million ounces. This followed steady annual increases since 1991 when global discoveries were at around 60 million ounces.

In 2013, new discoveries totalled less than 10 million ounces. While this, in part, reflects the severe pullback in gold prices – and hence, profitability of mining – data shows that new discoveries were in decline even as gold prices continued to rise.

Following the 1995 peak, new discoveries have been in a dramatic downward trend. Discoveries rose from 2002 till 2008 along with gold prices.

However, there was a dramatic fall-off in new discoveries from 2008 even as prices surged to record nominal highs in 2011 when one would expect the search for new deposits to have intensified.

Gold production tends to lag discoveries by around 20 years. Data shows that production steadily increased from 2008 to 2014. It may be that 2015 is the year that gold production peaks – 20 years after the 1995 peak discovery.

As we have pointed out for many years, the traditionally strong gold producing countries like South Africa, the U.S. and Australia have seen falls in production in recent years which supports the argument for peak gold production.

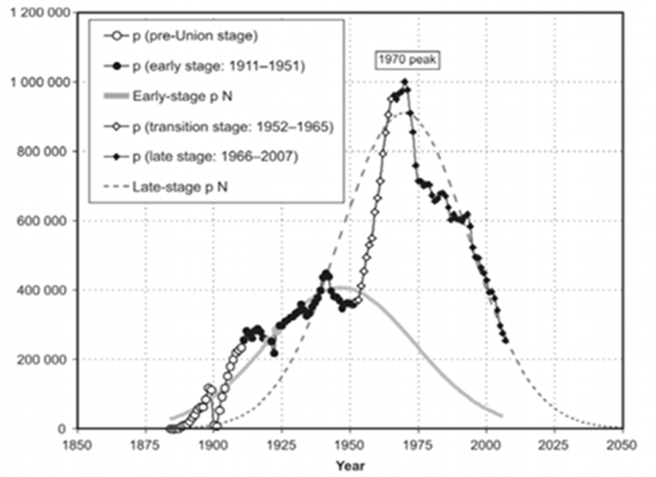

South African Gold Production

Peak gold has happened or will soon happen. The geological evidence suggests that it may happen in the near term due to the lack of major discoveries and the growing difficulty large and small gold mining companies are having increasing their production.

It is also signalled in the fact that most of the larger gold producing countries, not just Australia, the U.S. and South Africa but also Canada, Peru, Indonesia and others, have all seen production drops in recent years.

China and Russia are the two only large producers to have seen production increases.

Peak gold has yet to be considered and analysed by the international financial community. Goldman’s report may begin to change that and lead to debate of this important topic.

The implications of this trend – if the assertion proves to be correct – are manifold.

The ability of bullion banks to manipulate the price of gold downwards on futures markets will be impaired in an era of declining gold production. As China, Russia and other eastern central banks continue to accumulate gold in massive volumes with which to back their currencies it will be highly unlikely that gold prices will be suppressed for much longer.

U.S. Annual Gold Production

There is a risk that peak gold has happened or will happen soon with a consequent impact on the gold mining industry and on gold prices in the coming years.

The fact that peak gold may take place at a time when the world is engaged in a risky monetary experiment involving massive fiat paper and electronic money creation bodes very well for gold’s long term outlook.

MARKET UPDATE

Today’s AM fix was USD 1,187.40, EUR 1,095.01 and GBP 800.36 per ounce.

Friday’s AM fix was USD 1,198.00, EUR 1,106.70 and GBP 805.32 per ounce.

Gold and silver were both 1.3% higher last week – the second consecutive week of gains which is positive from a momentum perspective.

Gold in British Pounds - 1 Week

Gold dropped 0.39 percent or $4.70 and closed at $1,198.70 an ounce on Friday, while silver lost 0.59 percent or $0.1 at $16.95 an ounce. Overnight in Singapore, gold prices fell nearly 0.4 percent to $1,187 per ounce and weakness continued in London.

Holdings in gold-backed exchange-traded products rose on Friday for the first time in four days.

Silver fell 1.8 percent to $16.76 an ounce in London but is set to climb 6.1 percent this quarter. Platinum lost 1.1 percent to $1,127 an ounce, heading for a third straight quarterly loss.

Updates and Award Winning Research Here

| Digg This Article

-- Published: Monday, 30 March 2015 | E-Mail | Print | Source: GoldSeek.com