Very few Americans realize just how bad the domestic energy situation will become in the next several years. While U.S. shale oil production has surged over the past five years giving Americans a false sense of energy security, the next five years will certainly destroy this myth once and for all.

Unfortunately, there still seems to be no shortage of articles pushing for U.S. Energy Independence. One article that provided me with a good laugh was, Why American Energy Independence Makes Sense. Here were the two best jokes in the article:

1) Oil is sucking hundreds of billions of dollars a year out of the U.S. economy. If we became energy independent, our trade deficit would be cut tremendously. Not only that but our money could begin to go to American-owned energy producers.

2) With technological breakthroughs, we have been able slowly rise again to our feet, but we still have a way to go. The U.S. needs to free itself from the dependence of foreign oil. Call your Congressman and Senators and let them know that you are for energy independence!

The author states that energy independence would allow money to flow to American-owned energy companies. I find this simply hilarious as the majority of U.S. shale oil and gas companies haven’t made any positive free cash flow and are hemorrhaging from increasing levels of debt. And, this took place when the price of oil was more than double the current price today. Can you imagine what will happen to the balance sheets of these shale energy companies this year with an oil price of $50?

The second joke was even more amusing. The author finishes the article asking Americans to call their Congressmen and Senators and let them know, “You are for Energy Independence.” LOL.

This kind of thinking reminds me of the famous line from the movie Aliens when Sigourney Weaver (found after being in suspending sleep lost in space for quite a while) attended a meeting with the typical business suits saying, “Did IQ’s drop sharply when I was away.”

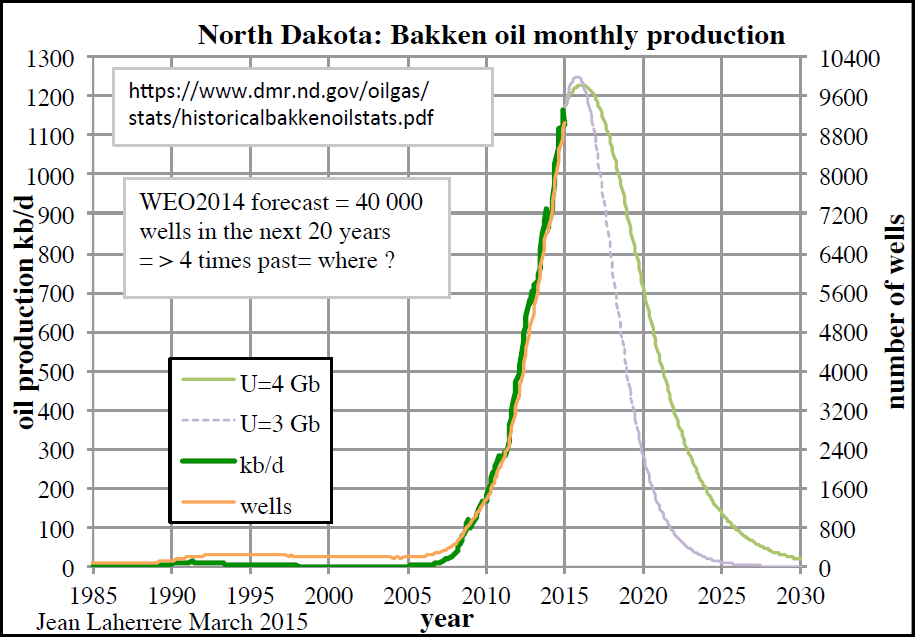

So, why will the U.S. not become energy independent? Well, if we look at the chart below, it should give us a pretty good idea:

This chart from Jean Laherrere, is U.S. Bakken oil production based on using Hubbert Linearization. Jean sent me this chart which estimates the peak and decline of the Bakken using a total of 4 billion barrels (Gb) of ultimate reserves. As you can see the peak takes place shortly, and by 2025 the Bakken is producing a mere pittance compared to its current rate.

The Eagle Ford shale oil field will also follow the same sort of peak and decline trend as the Bakken. There are two huge problems with notion of U.S. energy independence based on shale oil production:

1) Shale oil well annual decline rates are 40-50% per year.

2) Shale oil needs very high prices to be commercial

Shale oil will not allow the U.S. to become energy independent due to the fact that peak and decline of the Bakken and Eagle Ford were forecasted to take place by 2015-2017. This was according to the work of David Hughes in his excellent report, Drilling Deeper.

Unfortunately, Mr. Hughes based his forecasts at the time when the price of oil was much higher. Thus, the peak of U.S. shale oil may occur even sooner.

To get a good idea of the short lifespan of the Great Bakken Oil Field, here is another chart by Jean Laherrere from August 2014:

This chart of the Bakken is over a longer period of time. Shale oil production at the Bakken started to take off in 2007, and is projected to peter out twenty years later by 2027, and be a stripper play by 2035. So, how the U.S. becomes energy independent based on this sort of production profile baffles me to no end.

The United States will be in serious trouble by the turn of the next decade. As shale oil production declines, the U.S. will have to import more oil. However, the U.S. Dollar may lose a great deal of its world reserve currency status as more countries move to alternative trade systems with the BRICS countries.

How will the U.S. purchase oil with worthless Dollars if no one wants paper Dollars anymore??

Got gold and silver?

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: