The Fed and Central Banks are in serious trouble and certain countries realize it. This can be seen by the change in the gold price and its impact on U.S. gold exports. If the Fiat Monetary Authorities believe a low gold price will discourage investors from purchasing the yellow metal… think again.

Ironically, the United States continues to export a great deal of gold because the majority of its citizens have no use for it. Unfortunately, Americans view gold as something to wear on special occasions, rather than a retirement asset or insurance for the upcoming financial calamity. Chalk one up for the clowns at the Federal Reserve.

While Americans were figuring out how to finance a new car, boat or recreational vehicle in 2014, the Chinese and Asians were buying gold hand over fist. What a difference in buying habits, aye? As Americans used increasing amounts of debt to purchase more crap they didn’t need, folks in the East were paying cash for West’s barbarous relic… gold.

How much gold did the United States fork out in 2014? Well, not as much as 2013, but it still turned out to be a great deal, especially during price take-downs. If we look at the chart below, we can see a direct correlation between falling prices and increased U.S. gold exports.

U.S. gold exports started off with a bang in 2014 as the price of gold fell to the $1,200 range in January as investors took advantage of a $200 price cut since its high of $1,416 in September. Of the 81 metric tons of gold exported in January, Hong Kong received 57 mt of the total. Those clever Chinese.

Then as the price of gold continued to rise to $1,336 in March, U.S. Gold exports declined significantly. U.S. gold exports fell to 30 mt in March and remained flat through August as the price of gold traded in a narrow range between the high $1,200’s and low $1,300’s.

If we look at the chart, U.S. gold exports jumped in September to 50 mt as the price of gold fell to an average $1,239 for the month. As the price of gold continued to decline gold exports increased slightly to 51 mt in October, but really surged to 71 mt in November as the price fell to a low of $1,130 (average $1,176 for the month).

So, where did the U.S. export all this gold?

80% of U.S. Gold Exports In 2014 Were Shipped To Three Countries

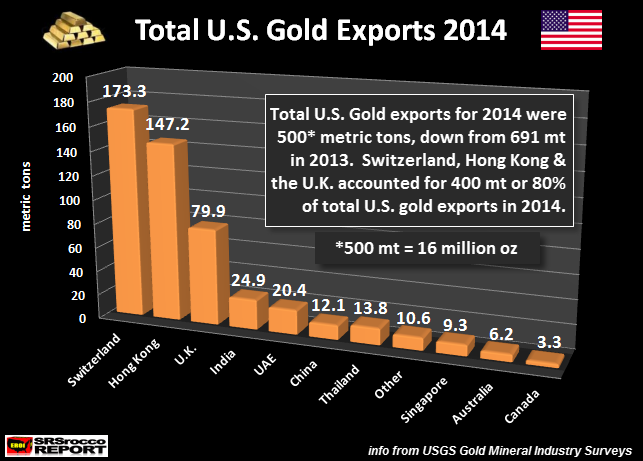

The U.S. exported 500 mt of gold in 2014, down from 691 mt in 2013. However, 80% of the total was shipped to just three countries. The chart below shows the breakdown of U.S. gold exports in 2014:

Switzerland received the most at 173 mt, while Hong Kong ranked second receiving 147 mt, followed by the U.K. netting 80 mt. These three countries received 400 mt of the total 500 mt of U.S. gold exports. If we scan across the graph, the remaining 100 mt were shipped to the likely suspects. You will notice there aren’t any noteworthy imports by Western countries, until we reach the bottom of the barrel as Australia and Canada received a meager 10 mt between them.

Furthermore, the majority of the U.S. gold exported to Switzerland and the U.K. were not meant for its own citizens, but rather just a temporary stopover before making its way to Eastern markets. Again, why should Western investors acquire physical gold that needs to be stored, insured and protected, when paper assets are much easier to own??

As I mentioned in the beginning of the article, the Western Central Banks are in real trouble. This shortsighted tactic of exporting gold to the East allowing the U.S. Suburban Leech & Spend Economy to keep its doors open a little longer, will have one hell of a serious side effect. And that is a tremendous financial hangover when the party ends.

Please check back for new articles and update at the SRSrocco Report. You can also follow us at Twitter below: