-- Published: Friday, 22 May 2015 | Print | Disqus

Based on the literature, we have often claimed that gold is the best asset class during slowdowns. However, it is worth digging rather more deeply into this complex issue, also examining gold’s performance during recessions. The yellow metal behaves relatively well as an investment during economic contractions, but consumer demand may drop during weak GDP growth, when real incomes fall or rise very sluggishly. For example, Pushpa and Muruganandam found that the growth rate of real GDP foresees the trend of the ensuing gold prices (at least for China, India and the U.S.). When consumers’ purchasing power increases, the demand for gold also raises, which in turn moves gold prices up, and vice-versa. However their analysis was conducted for the period of 2005-2011, i.e. only during the gold prices boom.

The World Gold Council also examined the connection between gold and GDP growth and found in its seventh volume of the Gold Investor that during expansionary periods, a good portion of investment demand for gold falls, but a part of it increases alongside long-term savings rates (which benefit from positive economic growth). Additionally, rising incomes boost jewelry (every 1 percent increase in global GDP lifts jewelry consumption by an average of 5 percent) and technological demand (every 1 percent increase in global GDP raised electronics’ demand for gold by 5.1 percent).

On the other hand, during economic slowdowns, the investment demand for gold rises, but jewelry and technological demand decreases. What is important, however, is that “investment demand is much smaller than jewelry [and electronics] demand, but shifts in investment demand can be large and play a critical swing role in the market.”

The demand of central banks is not directly linked to GDP and responds to monetary policies. However, it is often said that central banks purchase gold because they are uncertain about the condition of the global monetary system, the U.S. economy and the greenback.

According to other analysts, the gold price is only moderately correlated with the U.S. GDP or there is no statistically significant correlation between returns on gold and changes in GDP. One of the explanations may be that large above-ground stocks of gold partially insulate the yellow metal from the demand shocks. Because the stocks can be supplied with almost perfect elasticity, the increase in the demand over the business cycle may be met through the increase in the supply without significant pressure on the gold prices. This feature of gold strengthens the view that investment demand for gold exerts the stronger effects on its price.

GDP is an aggregate and complex measure of the economic production of a country, which itself is not relevant when people are making decisions about buying gold. What is relevant is the comparison with other assets and the level of uncertainty about the strength of the economy. Thus, the same pace of the GDP growth may affect the gold market in completely different ways. Everything depends on the GDP trend, expectations and their broader economic context. This is why gold prices were rising a few years after the last recession. People have become aware that the crisis has not been truly resolved, but only swept under the carpet by the bailouts and quantitative easing programs.

Thus, gold may be considered as a protection against a ‘tail risk’ or an indicator of the economy's health. The rise in gold prices signals that the economy is struggling, whereas, when gold prices drop, it usually means that the economy is healthy, because investors have left gold for other, more risky and lucrative investments like stocks. Thus, the gold prices might have been trending more or less sideways for two last years because investors are not sure about the outlook for the U.S. economy.

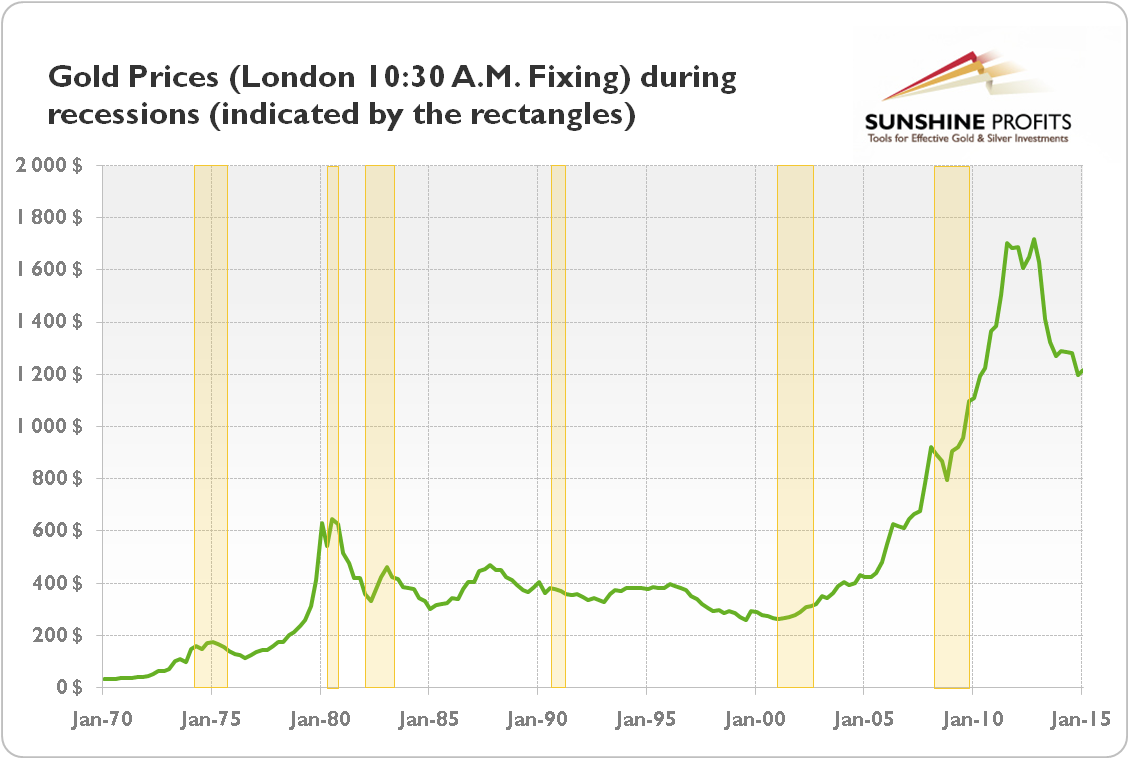

So much for the theory. Now it is high time for some empirical data. How do gold prices behave during recessions? We have already shown how the yellow metal performs during slowdowns, so to have a full picture of gold during contractions we have to deal with recessions too. As can be seen in Figure 1, gold gained during most of the several last recessions (the timing of recessions is only approximately reflected by the rectangles).

Figure 1: Gold prices (London 10:30 a.m. fixing) during recessions (indicated by the rectangles) from January 1970 to January 2015

The yellow metal generally performed better than stocks during recessions, standing out as having the best combination of return and risk. Even during the 2008 crash, gold still finished the year with a 5 percent gain, although it initially lost due to fire-sales. However, investors should be aware that gold did not perform in the same way during different recessions. According to this research study, “gold performed best in recessions caused by uncertainty and inflation”. Although we are not forecasting high inflation, we are probably entering a period of an economic slowdown, which may turn into recession, since the commodities have already plunged (commodities are usually first to correct in price when the economy starts to contract), while the stock market is much above the 2007-2008 heights, and manufacturing activity and credit markets are weak. Therefore, now it may be smart to accumulate precious metals (if one didn’t have any as insurance in their gold portfolio) and some cash (and be ready to enter the precious metals market when the technical conditions improve).

Thank you.

Arkadiusz Sieron

Sunshine Profits

www.sunshineprofits.com

| Digg This Article

-- Published: Friday, 22 May 2015 | E-Mail | Print | Source: GoldSeek.com