-- Published: Monday, 25 May 2015 | Print | Disqus

- Why the Economist is wrong on Gold.

- There are no new replacements for Gold.

- QE will come again.

When reading the financial press, the amount of coverage one sees on the topic of precious metals, is almost nonexistent. Most pundits don't care for the metal, nor do they understand it. In fact, former Federal Reserve Chairman Ben Bernanke told Congress that he doesn't understand gold.

Yet, when you read articles on gold from media pundits, all one hears is negativity about why you shouldn't invest in the yellow metal. The best example of this is a recent article I read in the Economist. It is called, Russia is buying gold, but few others are. This article claims that despite the low interest rate, easy money environment, combined with the fact that half the gold mining companies are generating negative cash flows, gold is still stuck at a stagnate price of $1200 per ounce. The economist claims, that this is due to the fact that no one is buying the yellow metal, except for Russia. They end the article by stating that gold has lost its luster to real estate, bitcoin, and contemporary art.

I believe the Economist only views gold from a short time frame from the year 2011 to 2015. People claim that gold has declined due to weak fundamentals. I believe it has declined for different reasons. I am going to debunk some of the facts cited by the Economist, make my case for gold, and explain why I believe gold declined from the year 2011 till now.

The first reason I believe the gold price has decreased from over $1900 an ounce, to roughly $1200 an ounce, is because gold was due for a normal market correction. From 2001-2011, the price of Gold increased every year. The price of gold increased from roughly $250 an ounce, to over $1900 an ounce. Any upward move such as that will certainly be followed by a long and sharp correction. That is just the normal nature of markets.

The Economist is also incorrect when it states that only Russia is buying Gold. Currently, China buys more gold than the world produces. Now most gold bulls believe that consumption exceeding production will ultimately lead to a price increase, but the problem with that assumption, is that you can't analyze gold production and consumption levels, like you would oil or coppers. This is due to the fact that when gold is produced, it's not consumed like oil, and that all the gold produced stays above ground. This means that all Gold purchased, will eventually be resold into the market at a later date. As a result, Gold production metrics won't have a similar affect on the price of gold, as it would on oil, copper, or other consumption based commodities.

In terms of the Economist's theory on new alternatives to Gold, I believe they are incorrect based on past history. Real Estate has always been available for people to own in the US. In fact, George Washington was a land speculator. In terms of art investments, people have been investing in art for hundreds of years, and art prices have been in a current upward trend since the 1950s. When it comes to Bitcoin, the price of Bitcoin has decreased drastically since its high of $1,200. In reality, that hasn't proven to be a viable alternative to gold.

I believe the main reason the price of gold has declined since 2011, is because Wall Street investors believe that the economy is in recovery, and that the Fed is going to raise interest rates. When people believe interest rates are going to rise, non-yielding assets such as gold become less attractive to investors.

This incorrect Wall Street assumption is why I believe gold will become relevant again. What Wall Street is ignoring is the recent data that has been released lately. In Q1, the gross domestic product (NYSE:GDP) only expanded at .2 percent, the US manufacturing PMI index is reporting its lowest numbers in 16 months, and the ISM manufacturing index is reporting its lowest numbers since May of 2013.

These less than stellar numbers can be attributed to the Federal Reserve's ending of QE. In my opinion, once Wall Street and the Fed finally admit that the economy isn't healthy, a rate hike will no longer be considered by the Fed, and quantitative easing will come back into the picture. That will be the catalyst for the next bull market in gold. These actions will cause a huge short covering rally, followed by traders initiating new long positions.

This is why I believe within the next 12-18 months, gold will enter a new bull market.

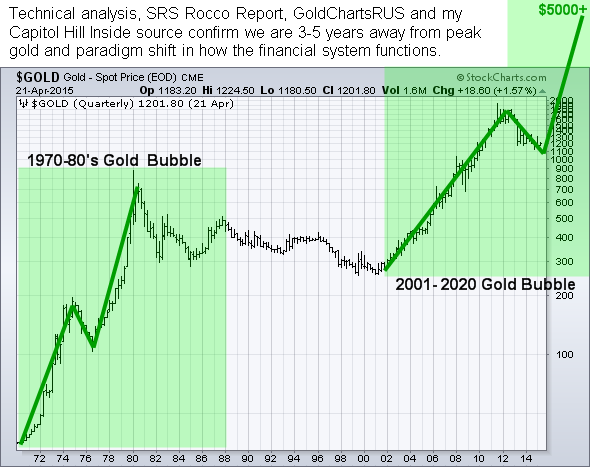

One analyst believes that when it comes to price movements, that $5,000 dollar gold is realistic when looking at historical charts such as the one above.

| Digg This Article

-- Published: Monday, 25 May 2015 | E-Mail | Print | Source: GoldSeek.com