-- Published: Sunday, 21 June 2015 | Print | Disqus

The gloomy economic situation of Greece has been the topic of many. It is high time to analyze more thoroughly the relationship between Greece’s debt crisis and gold. But first we must examine the institutional foundations of the Eurozone and its currency, as they not only did not prevent, but actually encouraged imprudent Greece’s fiscal policy, which led to the current crisis.

The Eurozone consists of several independent governments and one common central bank – a unique structure, since usually there is one government with its own banking system. But why is it important? Well, normally when the central bank monetizes government debt, the costs of the deficit monetization are distributed among one nation, not several countries.

Oh yes, the direct monetization of governments deficit by the European Central Bank (ECB) is prohibited by law (with exception of quantitative easing, apparently). It does not matter, though, because the deficits are monetized indirectly. The governments spend more than they receive in tax revenues, so they typically issue government bonds, which are bought by the commercial banks and eventually used by them as collateral for new loans from the European Central Bank. The effect is practically the same: more government spending, more sovereign debt… and more inflation, since banks are purchasing public debts by creating new money thanks to operating under the fractional reserve system.

Therefore, each Eurozone’s member can externalize part of the costs of its deficit in the form of higher prices throughout the whole monetary union. The crucial thing to understand is that the first users of the new money benefit at the expense of the latecomers (economists call these Cantillon effects). In that way peripheral countries of the Eurozone profit, because they have more money whilst prices have not yet been bid up. In particular, the PIIGS countries can import more goods and services from other Eurozone members, where prices have not yet risen. The Eurozone allows for the financing of import surpluses via money creation, so the peripheral countries do not have to conduct structural reforms, but continue their excessive government spending and remain uncompetitive.

Additionally, southern countries benefit from the implicit guarantee by the fiscally sounder countries, like Germany. Therefore, when the Eurozone was created, interest rates on their bonds converged to the level of Germany because of the drop of the risk premium and inflation premium (the ECB was expected to act like the prudent Bundesbank).

The construction of the Eurozone is a classic tragedy of the commons. According to this economic theory, individuals acting rationally and independently according to their own self-interest will deplete a shared resource, even if it is contrary to the best interest of the group. This theory is usually brought up when people discuss environmental issues, e.g., in fishing, where the property rights are not well-defined or defended. The oceans and seas are public; hence each fisher would try to catch as many fish as possible, even if all the other fishers do the same thing, resulting in depletion of the shared resource. However, the tragedy of the commons also applies to monetary issues and the Eurozone’s construction in particular. Therefore, as Phillip Bagus, the author of The Tragedy of The Euro, explained, the tragedy of the euro is the incentive to incur higher deficits faster than other member in order to make the whole euro group carry the burden of the costs of irresponsible policies and profit from the resulting redistribution.

Please notice that the Eurozone designers were completely aware of this misconstruction and this is why they implemented The Stability and Growth Pact, aimed to curb these flawed incentives. Not surprisingly, the agreement failed, because Eurozone members were judges in their own causes. Even Germany ran excessive deficits for some time.

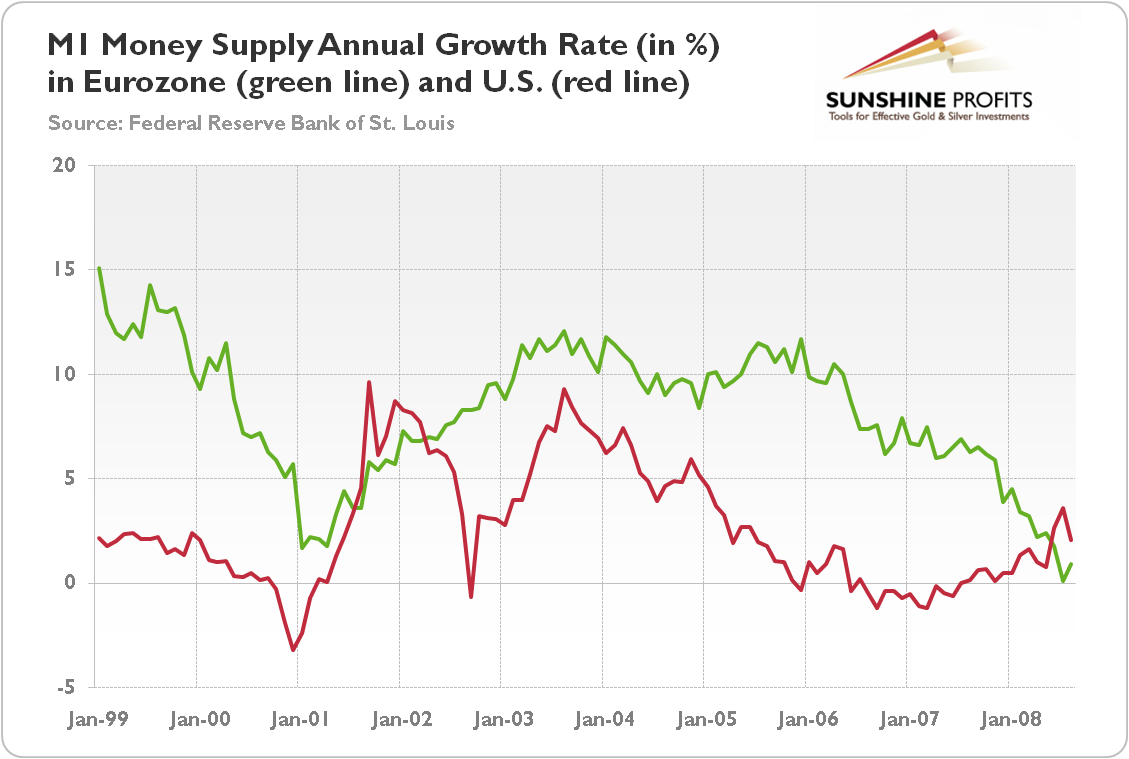

Now, it should be clear that euro is a political project without much economic sense, implemented to achieve more political integration and to dethrone the hated conservative Bundesbank (according to Bagus, Germany agreed to give up the Deutschmark in exchange for the approval of German reunification after the fall of the Berlin wall). In its current shape it cannot compete with gold or even the U.S. dollar. The euro is another fiat currency, just like the greenback, but with a flawed, inflationary institutional background. The tragedy of the euro makes the common currency more prone to inflation and to collapse. Indeed, as you can see in the chart no. 1, the pace of monetary inflation in the Eurozone was higher than in the U.S. until the outbreak of global financial crisis.

Chart 1: Monetary inflation, measured by the M1 money supply annual growth percentage rate, in Eurozone (green line) and U.S. (red line) between January 1999 and August 2008

Given the unstable nature of the Eurozone and its currency, the current Greek debt crisis was inevitable. Either some countries will be bailed out, or the euro will collapse. The uncertain future of the euro, the second largest reserve currency and the currency of the second largest economy in the world, is a fundamentally supportive factor for gold prices, which should encourage buying gold as a safe-haven.

Thank you.

Arkadiusz Sieron

Sunshine Profits

www.sunshineprofits.com

| Digg This Article

-- Published: Sunday, 21 June 2015 | E-Mail | Print | Source: GoldSeek.com