-- Published: Sunday, 5 July 2015 | Print | Disqus

By John Mauldin

What the Labor Markets Tell Us About the Future of Rate Hikes

Shanghai Falls to Earth

Caribbean Credit Woes

Greece Hits Mediterranean Bottom

Operation Albani?

New York, Denver, Maine, and Boston

“In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

“There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.

“Yet this difference is tremendous; for it almost always happens that when the immediate consequence is favorable, the later consequences are disastrous, and vice versa. Whence it follows that the bad economist pursues a small present good that will be followed by a great evil to come, while the good economist pursues a great good to come, at the risk of a small present evil.”

– From an essay by Frédéric Bastiat, “That Which Is Seen and That Which Is Unseen,” 1850

If you’re a news addict, the last ten days or so were probably a dream come true. It’s hard to know where to start, but I will limit myself to just four stories … but they’re four big ones. And as Bastiat suggested, we will try to look beyond what we can see to probe the deeper implications in what may be unseen.

- The employment report’s relevance to an interest-rate increase

- China’s stock market lost a year’s worth of momentum – there is a breathtaking crash going on.

- Puerto Rico’s governor says the US territory can’t pay its $72 billion in debt. This is one of the most irrational debt stories, and I try to offer some actual mathematical analysis of how it came about.

- Greece is holding a referendum on Europe’s latest bailout offer. What political genius designs a referendum where, no matter how the vote turns out, everyone loses?

We Americans are celebrating our Independence Day this weekend. The news our ancestors read on this day in 1776 wasn’t so great – but the US survived its rough start. China, Puerto Rico, and Greece will survive, too. But the decisions their government make, just like the ones our fledgling government made all those years ago, will make a great deal of difference. Let’s get past the gloom and doom to see if we can find some good news.

What the Labor Markets Tell Us About the Future of Rate Hikes

Yesterday’s employment report can charitably be described as so-so. Some 223,000 new jobs were added last month, all of them in the private sector. That number has to be balanced with losing 60,000 jobs over the last two months through negative revisions. As I have often discussed, the employment number is subject to a great deal of revision in later months and years. Perhaps more important to watch than the actual number is the trend of the revisions. If the revisions are positive, that means more jobs are bubbling up from beneath the surface of the survey, and that is a good thing. If the trend of the revisions is down, which it typically is for quite some time before a recession ensues, that’s not so good.

For the previous three months (March, April, May), the average number of jobs created was 187,000; but for the three months before that (December, January, February), the average was 265,000 jobs; so we’re in a clear downward trend. Recently, many of the new jobs have been in low-paying sectors (bars and restaurants being particularly good places to find work), and the trends for average pay and hours worked have been flattish. From the standpoint of the average worker, the trend is pretty disappointing. The unemployment rate fell two-tenths to 5.3% – a level that the FOMC didn’t expect to be reached until later this year – though the decline reflected an outsized drop in the labor force participation rate, so the drop is not for a good reason.

But it does demonstrate that labor slack is decreasing. And while that might seem an “inside baseball” type of statistic, we have to remember that Janet Yellen is a labor market specialist, and she really pays attention to this metric. She and the rest of the FOMC do not want to get to what is called the NAIRU (nonaccelerating inflation rate of unemployment, which is the level of unemployment below which inflation rises) until they are well into the process of raising rates.

Former Fed Governor Larry Meyer is reiterating his call for a September rate hike. He is joined by a number of members of the FOMC, who think we should have been raising rates a long time ago. (For what it’s worth – and it’s not worth much – if I were on the FOMC, I would want to be raising rates as well.) The consensus of the committee is that the Fed rate will be at 1.75% (up from today’s 0.1%) by the end of 2016.

Trying to discern what the Federal Reserve will do by reading the committee’s minutes is a fraught proposition. Back in March 2004, three months before the Fed’s initial rate hike, the FOMC said in their minutes that “With inflation quite low and resource use slack, the committee believes that it can be patient in removing its policy accommodation.” Does that sound to you like they were getting ready to raise rates? Or that they would be raising rates for 17 consecutive meetings thereafter?

It has been nine years since the Federal Reserve last raised interest rates. It is difficult for me to see how even a 1% interest rate could not be seen as remarkably accommodative.

As an anecdotal aside, I had dinner with some of the usual suspects Wednesday night: Art Cashin, Barry Ritholtz, Rich Yamarone (Bloomberg chief econ), Dan Greenspan (BTIG econ), Lakshman Achuthan (ECRI forecaster and business cycle expert), and a hedgie who prefers to remain anonymous. In short, a relatively clued-in, on-top-of-the-data group. Art asked a very simple question, “Will the Fed raise rates this year?” Not, when will they start, but just, will they do it this year? Of course, with this crowd, everybody had to talk about when they will start as well.

To say there was no consensus would be an understatement. I don’t think any two people agreed on whether and when the Fed will raise rates. Barry thinks they will raise rates every other meeting until they reach 2%. Dan is firmly in the camp that they will raise rates this year and sooner rather than later. Several questioned how the Fed could possibly raise rates with the economy being so close to stall speed. As for me, I sense that the Fed feels the need to raise rates but is going to do it more slowly than any of us expect, perhaps by only 1/8 of 1% per meeting, in an effort not to overwhelm market expectations.

Interestingly, the hedgie in the group seems to think the potential for all hell breaking loose in the middle of September is significant. The pushback he got from the rest of the table was interesting. I would just observe that he has a rather significant amount of money in play, as opposed to the rest of us.

Bottom line: you can read into this latest employment report whatever you want. You can look at all the minutes and the speeches and see whatever you want to see. Janet Yellen knows she has to begin to raise rates now – if for no other reason than that she wants to be able to lower rates in response to some future recession. If we have a Federal Reserve managing interest rates for short-term results, then we are in a great deal of trouble.

Now let’s scan the international landscape for further evidence of the unseen.

Shanghai Falls to Earth

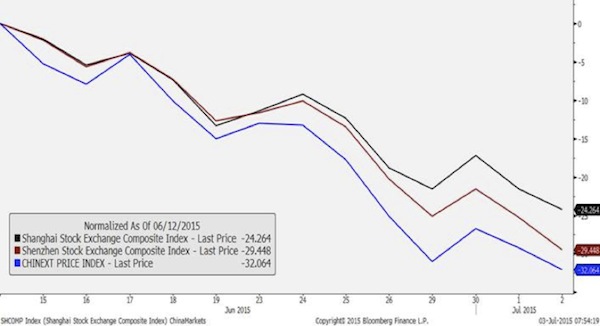

Last Monday we learned that recent losses in Chinese stocks had so rattled the People’s Bank of China that over the weekend it had both cut interest rates and lowered bank reserve requirements. They were hoping to stem the rather dramatic fall of their stock markets. Clearly, it didn’t work. The Chinese markets continued to fall this week, down by 30% from their previous rise in less than two weeks! (hat tip Dan Greenspan):

Bill Griffeth and Kelly Evans were kind enough to invite me on “Closing Bell” to talk about China, where I shamelessly worked in a plug for my new book, A Great Leap Forward?

I told them that the current pain is really a result of both Beijing’s grand plan and part and parcel of the unique Chinese cultural phenomenon. As I’ve written about in previous letters, China is now at a long-foreseen point in their development where they have to shift away from the previous top-down command economy and let markets function more organically. Inevitably, this transition is causing pain for people accustomed to the old ways. President Xi Jinping has to manage the pain and maintain order, but, as they say, “No pain, no gain.” Xi is very astutely framing the whole reform process as a crackdown on corruption. I suppose that’s what it is, in a way, but now that he has begun, he has to stick with it.

With regard to the markets, Xi has the advantage of knowing what Xi will do next; the rest of us don’t. The government lets markets do as they will up to some point the leadership must have defined, takes charge again, and then steps back to watch. I suspect their intent is to intervene less and less frequently as the grand plan unfolds.

Last weekend, in the most recent intervention, the PBOC cut interest rates and reserve requirements. This was a dramatic move, but with the Shanghai Composite down 20% in two weeks, they must have wanted to make a splash.

If so, it didn’t work. Chinese stocks fell another 3% or so on Monday and another 5 to 6% since then. Western traders sniffed panic and headed for the exits. This development points us to another emerging Chinese phenomenon. It’s critically important, but people aren’t seeing it.

China’s fast-growing middle class absolutely loves playing the stock market. Chinese families are opening accounts and borrowing money to trade on margin at an astonishing pace. Check out these Goldman Sachs charts, courtesy of Ed Harrison at CreditWritedowns.com.

The Chinese, as a broad generalization, don’t invest with the same perspective that Western investors do. Chinese individual investors are not primarily “value” investors. Sky-high valuations don’t seem to faze them. They are primarily momentum investors who buy whatever is moving and sell whatever is falling.

According to my friends who go to casinos and watch the Chinese gamble, they tend to jump on a “trend” such as red coming up on the roulette table repeatedly – never mind that the odds are only ever 50-50. Red is seen as hot and therefore the way to bet. That carries over into trading styles. (By the way, please don’t get the idea that I’m being derogatory about momentum investing. It’s a perfectly reasonable way to approach trading, and there are many investors who are quite good at it.)

The number of new Chinese trading accounts went vertical this year. Further, many of the world’s largest index funds are either adding China to their indexes or increasing their exposure, resulting in a tidal wave of Chinese stock buying. That’s what made China indexes double and some individual stocks triple and quadruple. It’s breathtaking to watch.

I expect more volatility from China in the second half of this year and, really, for years to come. If you want to know why, read (from our book) Louis-Vincent Gave’s chapter, “The Importance of RMB Internationalization,” which I ran in Outside the Box last month.

Beijing gave the world another little tease last week, too. According to Bloomberg, the Ministry of Finance posted draft regulations that would allow one of the nation’s largest pension funds to buy stocks. Between that and the renminbi opening that Louis Gave expects, Chinese stocks still have plenty of fuel to move higher – but I think the volatility is going to astonish us.

Would I invest in China right now – today? As a trade? Probably not – at least until we see more signs of a bottom and Chinese buyers piling in again. China is a trader’s market right now and will be for some time. The best you can do: follow the momentum and get out quickly when it starts to fade. Yes, I think that longer-term, China is going to be a fabulous market, but most people are just not going to be able to handle the volatility.

Will China’s economy keep growing at 7% a year or more? No – even Xi can’t sustain those growth rates. He can probably manage 3–4% a year, though, after the economy normalizes. In a country as big as China, that is still mind-boggling growth. Wouldn’t we love to be able to get back to 3 to 4% growth in the US? There is a lot of money still waiting to jump into somebody’s wallet. The last few weeks notwithstanding, China is still a land of investment opportunity.

China is perhaps one of the most important question marks in the economic world today, and so it can’t help but matter to your investments. The mainstream media is focused on Greece, but the reality is that Greece is a sideshow compared to China. Quick shameless plug for our e-book, A Great Leap Forward? Worth Wray and I asked some of the world’s top China experts to decode the future for us. They answered in spades. It’s a fantastic book for anyone interested in China. For now it’s available only in electronic form. Go here to learn more, read some excerpts, and order from your preferred e-bookstore.

Caribbean Credit Woes

Next trouble spot: Puerto Rico. Sunday the Commonwealth acknowledged that it can’t keep up payments on its $72 billion debt, something that many of us have known for some time.

At this point, Puerto Rico’s debt is approximately 15 times larger than the per capita median debt of the 50 US states. And Puerto Rico is dramatically poorer than the 50 states. Forty percent of the population lives below the poverty line, and the Puerto Rican economy has been in recession for nine years! Another factor is that government aid can provide Puerto Rico residents with $1,743 per month in benefits, compared with the average take-home earnings on the island of $1,159 per month for a minimum-wage worker. That imbalance can act to discourage people from seeking work. The unemployment rate in Puerto Rico stood at 12.4 percent in May, or more than double that of the US.

Puerto Rico is a tiny island of 3.6 million people. They carry an average of about $20,000 of debt per man, woman, and child. At the 8% yield that Puerto Rico currently pays, that is about $200 per month per person just in interest costs. That comes to $10,000 a year for a family of four. And that’s before the government pays anything for healthcare, education, police, fire, pensions, etc., etc. It’s simply not a sustainable business model.

Complicating the situation is the fact that Puerto Rico cannot declare bankruptcy the way US cities and municipalities can, and there is no impetus in either Congress or the White House to bail out Puerto Rico. That being said, nearly all of the $72 billion that Puerto Rico owes is owed to US institutions and funds. While that debt is not going to zero, a lot of municipal bond funds are going to take a hit on their holdings. Presumably the vast majority of funds are diversified, but it won’t be a good day at the office when Puerto Rico starts offering to give haircuts.

The New York Times “broke” the story that everyone online already knew, with an interview they had done a few days earlier. Here is their lead.

Puerto Rico’s governor, saying he needs to pull the island out of a “death spiral,” has concluded that the commonwealth cannot pay its roughly $72 billion in debts, an admission that will probably have wide-reaching financial repercussions.

The governor, Alejandro García Padilla, and senior members of his staff said in an interview last week that they would probably seek significant concessions from as many as all of the island’s creditors, which could include deferring some debt payments for as long as five years or extending the timetable for repayment.

The debt is not payable,” Mr. García Padilla said. “There is no other option. I would love to have an easier option. This is not politics, this is math.

We talked about the public pension problem in Illinois two weeks ago. That situation still looks dire, but Puerto Rico appears more urgent and is not a much smaller problem.

Give Gov. García Padilla applause for his candor. I wish mainland politicians would speak so directly. Puerto Rico is rapidly running out of cash. Of course, there are always options, but none that don’t involve a haircut of some kind for creditors. Neither Puerto Rico nor Illinois can declare bankruptcy under current US law. Puerto Rico apparently plans to play hardball with its creditors.

Those creditors include numerous US municipal bond funds whose managers thought PR bonds were a good way to juice their yields. Michael Lewitt of The Credit Strategist pointed out that just last year the funds snapped up $3.5 billion in 8% 20-year PR general-obligation bonds. He says that was a bad idea at the time and only looks worse now. It could be a big problem for bond insurers, too. Here’s Michael:

Of course buyers piled into these bonds, attracted by the discounted price and high yield (although the yield was not nearly high enough for the risk involved). One firm (that will go unnamed to protect the innocent) even opened a special fund for its investors to get in on the fun; the same firm, along with others, now claims that it owns other insured Puerto Rican bonds and will be protected from losses when the default comes.

The market is not so sanguine: shares of bond insurers Assured Guaranty Ltd. (AGO), MBIA Inc. (MBI) and Ambac Financial Group, Inc. (AMBC) were down 13.35%, 23.40% and 11.89%, respectively, after the governor’s comments on June 29. MBIA and Ambac insured roughly one-fifth or between $14.0 and $15.0 billion of Puerto Rican bonds.

According to BTIG analyst Mark Palmer, Ambac faces potential losses of $4.5 billion while MBIA is looking at a $4.9 billion hit, which suggests that the insurance may not be there when needed or that the insurers will suffer losses that will materially damage their capital bases, credit ratings and ability to keep writing business. Moreover, like any insurance company, bondholders can be certain that these companies will do everything legally possible to avoid or delay paying these claims. Since there are restrictions on Puerto Rico’s ability to file for bankruptcy and other complications in this situation, an immediate insurance payout upon a payment default is highly unlikely. Glibly depending on the kindness of bond insurers is likely to prove to be a fool’s game.

So what good news could possibly hide in all this? Economically, Puerto Rico looks a lot more like Greece than like a part of the United States. Per-capital income is low; unemployment is high; and the government has no money.

But Puerto Rico has one ace in the hole. It is an American territory but doesn’t have to pay American taxes. Local officials are trying to play that card, too. From Forbes (3/2/15):

As the US Treasury Department continues to tighten its noose around offshore accounts, a new tax haven has sprung up under its nose in the Caribbean. Welcome to Puerto Rico–island of tropical breezes, and (for new arrivals only) a 0% tax rate on certain dividends, interest and capital gains.

Puerto Rico is about the same size as Connecticut but with more palm trees, twice the unemployment rate, a third the median household income and a tiny fraction of the hedge funds–a deficiency the financially teetering territory aims to correct by turning itself into a refuge for tax-oppressed millionaires and billionaires.

Yes, this is legal. While the U.S. asserts a sweeping right to tax citizens’ income wherever they live and wherever it’s earned, Section 933 of the tax code exempts residents of Puerto Rico from paying US income tax on their Puerto Rico-sourced income. Instead, the Commonwealth of Puerto Rico has the exclusive right to tax local income as it sees fit.

“The way the US tax code is written, I could be on Mars and be taxed on intergalactic income but not if I’m sitting on this island in the Caribbean. It’s kind of in a twilight zone,” marvels Irvine, Calif. money manager Mohnish Pabrai.

To exploit this special status and help rescue its economy, Puerto Rico’s Legislative Assembly adopted two laws in 2012 and expanded them last year. Act 20 entices hedge funds, family offices, professional service firms and even software developers to locate there by taxing their corporate profits from exported services at a flat 4% rate and allowing those profits to be paid out to the owners free of Puerto Rico income tax. So far the government has okayed 346 export companies, with 400 approvals expected this year.

Pabrai used Act 20 to set up a new private equity venture in Puerto Rico last year and figures he’ll save as much as $10 million in tax a year, as well as half a million in operating costs. (There’s an abundance of educated Puerto Ricans ready to work for less than their California counterparts. Office space is cheaper, too.)

Act 22 grants new Puerto Rico residents (including, after a recent amendment, returning Puerto Ricans who left before 2006) a 0% rate on locally sourced interest and dividends as well as all capital gains accrued after they become residents, a particular benefit for active traders. So far 509 tax refugees have been granted Act 22 status and another 600 will get it this year, Puerto Rico’s Department of Economic Development & Commerce projects.

As you might expect, this tax bonanza is attracting some serious wealth to Puerto Rico. It is a potential choice if your business doesn’t depend on being physically present in New York or Chicago. Puerto Rico has modern internet and phone service and is only one time zone away from the East Coast.

I have personally been approached by three different people trying to get me to move to Puerto Rico, extolling the incredible tax benefits. I know of a half a dozen individuals and businesses that have moved in the last 12 months. However, while Puerto Rico is a lovely island, there is this pesky rule that comes along with the tax benefits that says you have to live outside of the US for six months plus one day every year, which is something that for the vast majority of us simply won’t work.

This will be an interesting experiment if nothing else. In theory, Puerto Rico has all the ingredients to become the Singapore of the Caribbean. The tax breaks should attract a critical mass of talented, entrepreneurial people with capital to invest. If they can double or triple the local economy, Puerto Rico’s debt will start to look a lot more manageable.

I don’t know if they can do that. I don’t think it will work if the newer, wealthier residents simply set up shop in their fortified enclaves. The growth needs to trickle down far more rapidly to the native-born Puerto Ricans than we see happening today, in order to create a true growth dynamic. We’ll see what happens. If you hate paying taxes, then forget about muni bonds and go on a house-shopping vacation to San Juan.

We’ll come back in about 20 or 30 years and see if tax incentives were enough to push Puerto Rico over the top.

Greece Hits Mediterranean Bottom

Finally, we come to Greece. The situation there looked dire when I sent last week’s letter, and it hasn’t gotten better. The country failed to make an IMF payment that was due June 30. Greek banks are all closed and are rationing cash withdrawals. The Athens Stock Exchange was offline all week.

The ECB clamped down on emergency loans to the Bank of Greece, so the country’s entire financial system is on the brink of collapse. The next big decision point is the Greek popular referendum that Prime Minister Tsipras unexpectedly called for Sunday, July 5.

This referendum is another odd twist. Greeks will vote yes or no on accepting the European bailout offer that expired on June 30. Tsipras and most of his Syriza party are urging a no vote. If they get it, Tsipras will go back to the creditors and demand new negotiations, with the nation behind him. I doubt that popular support will sway Germany or the rest of Europe. Seriously, when your teenage daughter stamps her foot and demands that you give her back the credit card after she runs up a monster bill, you’re not really inclined to relent. And while that’s not the way the Greeks see it, ask the average German voter.

If Greeks vote yes on the referendum, they still won’t get the bailout, because it expired and the Eurogroup nations refused to extend it. A “yes” outcome will more than likely force Tsipras to resign and make way for another government.

And then it gets even more depressing. The sad fact is that Greece cannot pay its debts under any scenario. The amounts are just too large. We know this from documents the Troika sent to the German parliament just last week. The Guardian reports:

Greece would face an unsustainable level of debt by 2030 even if it signs up to the full package of tax and spending reforms demanded of it, according to unpublished documents compiled by its three main creditors.

The documents, drawn up by the so-called troika of lenders, support Greece’s argument that it needs substantial debt relief for a lasting economic recovery. They show that, even after 15 years of sustained strong growth, the country would face a level of debt that the International Monetary Fund deems unsustainable.

Think about that for a moment. Precisely what is going to cause strong growth in a Greek economy that is subject to the austerity measures that are being proposed, and without any debt relief? Greece’s ratio of debt to GDP, rather than shrinking, will increase under any realistic scenario. Back to The Guardian:

The documents admit that under the baseline scenario “significant concessions” are necessary to improve Greece’s chances of ridding itself permanently of its debt financing woes.

Even under the best-case scenario, which includes growth of 4% a year for the next five years, Greece’s debt levels will drop to only 124%, by 2022. The best case also anticipates €15bn (£10bn) in proceeds from privatisations, five times the estimate in the most likely scenario.

I bolded the key phrases. The IMF says Greece is hopeless even in the best-case, most Pollyanna-ish scenarios. We are far from seeing such scenarios, too. We haven’t seen anything resembling a best-case scenario in Greece for seven years

I don’t mean to be trite, but unpayable debts are debts that won’t be paid. Greece’s creditors know this, yet they still demand payment.

Why demand something you know you won’t get? The only reason is that you have some other unspoken objective. As a financial matter, it seems likely the creditors will have to take huge haircuts and Greece will enter an extended depression, either with or without the euro.

The ECB has been gaming Greece for some time. Reports suggest they think they have Greece ring-fenced such that it won’t set off a market contagion. I wrote five years ago that Europe (read Germany) would be willing to let Greece go as soon as European (read German) banks had gotten rid of most of their Greek debt. That Greek debt is now largely on the books of state actors (governments, the IMF, and central banks) who will just absorb the losses and pass them on to their loyal taxpayers.

I came across this fascinating note from my friend Dennis Gartman Friday morning, on where Greek bank debt actually resides:

The situation in Greece just keeps on keepin’ on as they say, so we thought we’d take a look this morning at the countries who are really at risk if the crisis worsens, and by this we mean which nations’ banks have the greatest exposure. Leading the way is Turkey, and that really shouldn’t be all that surprising given the geography involved. The others are, in billions of dollars:

Turkey $32 billion

Romania 15 billion

Cyprus 10 billion

Bulgaria 10 billion

The UK 10 billion

Serbia 5 billion

The Marshall Islands 4 billion

Liberia (really?!!) 3 billion

Germany 2 billion

The US 2 billion

Liberia? Really? Liberia? We can understand Turkey; and we can understand Romania and Cyprus having reasonable exposures, but the modest sums involving the US and Germany rather surprised us. But again, Liberia? Haven’t they enough problems at home with Ebola and corruption? Have Liberia’s banks really had to go abroad and to Greece of all places? Again, sometimes you cannot make this stuff up.

Operation Albani?

I understand that the ECB and the European Commission have to be making contingency plans in case Greece leaves the euro. They need to deal with potential bank runs in other countries, especially the smaller countries near Greece (for countries with potential problems, see the list above of Greek debt holders), and to protect all markets from the negative consequences of a possible Grexit. They would be derelict in their duties if they were not making contingency plans.

But to call those contingency plans Operation Albani? Seriously?

Who picks these names? However, according to El Pais (a major Spanish paper), that is the name of a contingency plan that has been on the drawing board since 2012. After Tsipras’ referendum announcement, the plan is now on the front burner, as no one really knows how the vote will go. The major polls (or at least the ones that seem credible) seem to show the contest to be relatively even, with a significant number of “not sures” thrown in. My peripatetic friend David Zervos (the chief economist at Jefferies), who still has a lot of family in Greece andis in Greece today (and who told me about the El Pais story), offers this anecdotal comment about the election (emphasis mine):

At this point I actually have no idea how to handicap the results. In my family circle, for example, there exists quite a split. My cousins, and their friends, who are all in their 30s/40s, will firmly vote in the NO camp. But many of them are not actually voting because they must travel to their birth village to cast a ballot. Most of them do not have money to travel. [Really?!?!? This is the cradle of democracy? Who still has these rules?] My uncles, aunts and their friends are split. The YES voters are doing it purely for pension money, not because of some allegiance to Europe or a strong austerian/reformist political view. The NO voters are casting a ballot with their heart not their wallet. Of course, the views on the islands where my family reside are far more left leaning than in Athens. But I do not think one can generalize too much geographically as we head into Sunday. Even the people in Athens seemed more skewed to NO than I would have thou ght. The NO rally had 35,000 participants and the YES rally had only 5000.

This will be a very complicated vote for the Greek people. And whether it's YES or NO, the situation in Greece will be terrible for years to come. Many nasty forces across ALL of Europe have led us to this crucial point. And to be sure, turning any Eurozone nation into Albania is nothing to be proud of. It will unfortunately mark one of the largest European failures in the last 70 years.

The referendum on Sunday is essentially Greek voters deciding which type of disaster they want. Do they want the disaster of staying in the euro, or the disaster of leaving the euro? Each choice will bring a different type of poverty and significantly different outcomes for different groups of people: pensioners, government workers, businesspeople, and young people all have potentially different outcomes. The fact that the Greeks did it to themselves (with a helping hand from the Germans, et al.) does not make the situation any less sad. The irony is that no matter what the vote is, whoever picks up the pieces will be overseeing a total disaster and is likely to be discredited in the near term. Greece cannot begin to grow without massive debt relief and bureaucratic reform, neither of which seems to be in the cards. The collapse that leaving the euro would entail could either usher in a total reset of the Greek economy or a semi-authoritarian government that tries to enforce even more bureaucratic rules. The correct answer five years ago was to leave the Eurozone. Given the politics of the day, I have no idea what the correct answer is now. Whatever they choose, the situation is likely to worsen over time, perhaps a very short time if their answer is “OXI!”

On the other hand, the Greek islands make for a marvelous vacation, and Athens is a phenomenal cultural attraction. There may be no better time to start planning your next Greek vacation. You can save a little money and do your bit to help the Greek economy.

New York, Denver, Maine, and Boston

I’m in New York for one more week before I return to Dallas. Then I get one night in my own bed before I fly to Denver for the Inside Alternatives conference for investment advisors and brokers. My friend Larry Kudlow will be delivering the other keynote. I will be there on behalf of my good friends at Altegris Investments and am looking forward to being with Jack Rivkin, whom I should congratulate for being named their new chief executive officer. Jack has a storied history on Wall Street, where he ended up running Neuberger Berman and being responsible for much of the success there. He retired but never really quit working, and now at 75 is ready to go build something else. His energy and enthusiasm are inspirational to me.

I look forward to getting to spend a long Sunday evening with Jack, going over investments but also sharing our mutual fascination with future technology. Jack is on the board of Idealab and has been an influential venture capitalist involved with many startups. He is the one who introduced me to the brainwave training I’ve been undergoing here in NYC. He is further down the road with it and raves about it. I look forward to being able to write about it sometime soon and tell you about my experience with it. It is coming to a future near you.

The first week of August will see me for one or two nights in New York before I go on to Grand Lake Stream, Maine, for the annual economist fishing event that is known alternatively as Camp Kotok (after David Kotok of Cumberland Advisors, who organized the first gathering, many years ago) or, as some of the press have called it, the Shadow Fed. I bet we have more fun than they do at Fed meetings. And we certainly do less damage.

Later in the month I will return to New York City for a few days before going on to Gloucester and Boston for a few days of vacation with friends. Then I’ll spend a few more days on the East Coast before returning home.

Sometimes the light’s all shining on me

Other times I can barely see

Lately it occurs to me

What a long strange trip it's been.

– “Truckin',” by the Grateful Dead

My friend Doug Kass was reminiscing yesterday about his youth – before he became a famous investment guru – when he was actually a Deadhead, traveling around digging one Grateful Dead concert after another. He was musing about the fact that the Dead are now on their final tour, called the “Fare Thee Well Tour.” And then he realized it had been “only” 50 years ago that they gave their first concert.

You know how a song gets on your mind? Maybe I was singing it to myself when I realized that the young girl sitting next to me was looking at the old man next to her singing a song and wondering if I was just another New York crazy. “Sorry,” I offered, “it’s a Grateful Dead song,” as if that explained something. She gave me this blank look, and I said, “The Grateful Dead, the band.”

“Never heard of them.”

“You really never heard of the Grateful Dead?”

“No, who are they?”

Who raises these kids?

But then it happened again at the dinner I mentioned at the beginning of the letter. It was either Barry or Rich who brought up a reference to The Odd Couple. I know that Dan Greenhaus is young, but he was looking around at the rest of us chuckling, and he clearly didn’t get it. Barry looked at him and said, “You know, the Odd Couple. Oscar and Felix.” There was still that blank look. “The ’70s sitcom on TV. Surely you’ve seen it once or twice,” I offered, trying to be helpful and believing that surely he had at least seen the movie.

He had no clue. I will be 66 in a few months, and I find that more and more of my clever cultural references and witty repartee simply go over the heads of my audience.

Truly, what a long strange trip it has been. I have to say that mine has been fun and seems to get more exciting and interesting every year; but guys, really, teach your children well. Or something to that effect.

Have a great week. I’ve been invited by my friend Murat Köprülü to watch the fireworks from the roof of the new Whitney Museum. The Whitney had actually been one of the things I wanted to see what I was in town, and so now I get to watch the fireworks from possibly one of the best vantage points in New York and see the art as well. What a great way to spend July 4. I hope there are a few fireworks in your world as well.

Your just keep on trucking analyst,

John Mauldin

subscribers@MauldinEconomics.com

| Digg This Article

-- Published: Sunday, 5 July 2015 | E-Mail | Print | Source: GoldSeek.com