-- Published: Thursday, 9 July 2015 | Print | Disqus

By Daniel R. Amerman, CFA, MBA, BSBA

Roth Individual Retirement Accounts are an uncommonly attractive and powerful method of creating wealth for retirement when viewed from the usual financial perspective. What sets them apart is that contributions are made with after-tax dollars, but withdrawals are made on a tax-free basis which is the reverse of most other retirement accounts.

This is among the reasons why Roth IRAs are enormously popular with many millions of retirement investors in the United States and why they are so widely recommended by financial planners, CPAs and many other financial professionals.

However, there's another level to Roth IRAs and a different perspective to be considered. Which is that for someone who is still currently saving, the actual advantages of Roth IRAs are not known today. That is, unlike other retirement accounts, with a Roth IRA there are no immediate advantages when making contributions. Rather the advantages are deferred until retirement and the time that withdrawals are being made which means that in practice they are entirely dependent on what tax laws are in effect at that time.

Viewed from that perspective, a Roth IRA is an act of pure faith in the trustworthiness of all future federal governments.

If we allow for even one Administration and Congress over the coming decades deciding that a future financial situation necessitates a change to the rules governing Roth IRAs, that then raises the possibility that Roth IRAs may not deliver the advantages that are promised today. Indeed, savers could end up losing much of the appreciated value of their accounts to something that may not be called taxation at all, even if the economic effects are identical.

Now which perspective turns out to be true remains to be determined, but surely the exploration of each side of both risks and rewards is worthwhile if prudent and informed decisions are to be made.

The Powerful Case For Roth IRAs

Under current law, what Roth IRAs deliver is a freedom from future taxes. This carries multiple major advantages.

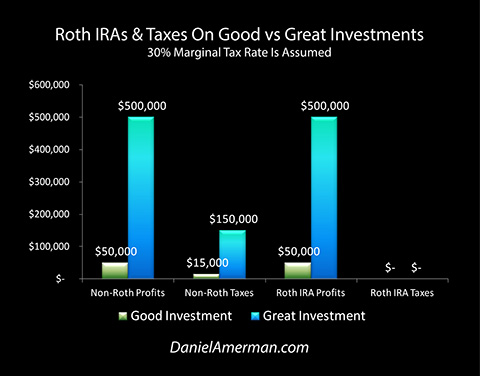

Perhaps the largest advantage from the perspective of the general public is as shown in the graphic above. One scenario is where an investor makes a good investment over a 20 year period and earns $50,000 in profits (the green bar). The other scenario is that the investor makes a great investment, and earns 10 times that amount, or a $500,000 profit (the blue bar) over that same twenty-year period.

Outside of a Roth IRA, earning 10 times as much generally means having to pay 10 times the taxes (leaving aside the many complexities of the tax code). So with a 30% tax rate, taxes would rise from $15,000 with a good investment to $150,000 with a great investment. This is true even inside a traditional retirement account, where the contribution is tax-advantaged, but the earnings are taxable at the time they are withdrawn.

The trade off with a Roth IRA is that you have to pay your taxes upfront. But in exchange you are supposed to be able to keep all of what you earn in the future, tax free, no matter how much it is. So even with ten times the profit, the Roth IRA tax bar is still zero, there are still no federal taxes.

The ability to earn tax free income is usually restricted to specialized vehicles such as tax-exempt bonds in the United States for example, where yields are quite low because of this potent tax advantage. The ability to earn potentially very high rates of return within a Roth IRA while investing within a wide range of other assets, and to keep every bit of those profits tax free is thus an extraordinary advantage for Roth IRAs over other investment vehicles. This is a core part of why Roth IRAs are so widely recommended. (There are other considerations such as the amount available to initially invest, but the bottom line is that potentially unlimited tax-free income is obviously a nice advantage.)

Another Major Roth IRA Advantage

There is a second level of advantage to Roth IRAs, which is in some ways even more distinctive and more powerful than the first one.

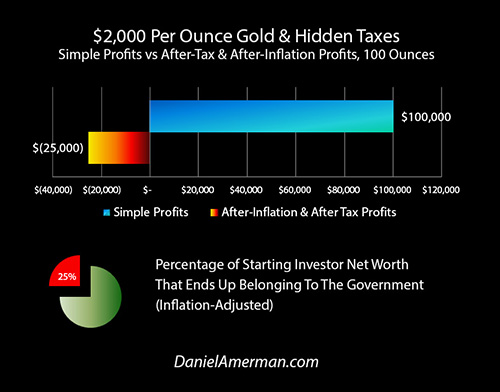

And that is that typically investors are taxed not only on actual profits, but on inflation whether they realize it or not.

So in the example of precious metals, as illustrated in the graphic above and explored in the analysis linked here, investors who think they have preserved their purchasing power against inflation may instead actually be giving much of their starting net worth back to the government. And the higher the rate of inflation goes and the higher precious metals prices therefore go the greater the percentage of the investor's beginning net worth that ends up belonging to the government.

This is also the case when it comes to stock investors, as shown below.

As explored here, over long periods in the stock market, most gains may not be "real" in terms of appreciating above the rate of inflation, but may in fact just reflect inflation itself. And because inflation is as equally taxable as real income in the United States and most other countries, this means that real tax rates may actually be confiscatory, and exceed 100% of real gains.

The remarkable advantage of the Roth IRA, then, is that it shields the investor not only from taxes on profits, but also from the extraordinary challenge of inflation taxes, even if the latter feature is not generally well-understood by investors.

So whether we are looking at very high rates of return, or persistent inflation, in each one of these cases holding assets inside a Roth IRA can be highly beneficial for long-term investors.

There are also advantages relative to traditional IRAs when it comes to early withdrawals in certain circumstances, and the ability to continue to make contributions during retirement rather than being forced to make mandatory withdrawals starting at age 70 1/2.

Who Really Benefits & When?

Let me ask you something: do you have complete, 100% confidence in the trustworthiness of the United States government?

That is, do you have complete 100% confidence that during the rest of your life, every future Congress and every future presidential administration will feel an almost sacred duty to honor the promises and the deals offered by previous congresses and administrations?

When phrased in those terms, even most non-cynical people would likely feel that 100% confidence is not warranted.

But again, what needs to be understood is that every time someone invests money inside a Roth IRA, they're taking a complete leap of faith that the laws governing these accounts will remain intact. Because with Roth IRAs there is no initial tax deduction the advantages are on the back end.

Now for the United States government on the other hand, Roth IRAs hold obvious major advantages in the here and now. With taxes being paid in full rather than being deferred as they would in a traditional retirement account, the government does not give up any of its income.

There are also immediate and ongoing advantages for major special interest groups, such as large corporations and the financial industry. As explored here, Roth IRA investors represent a huge pool of money in which people put in but they can't take out, at least not without paying penalties. This creates a steady upward pressure on stock prices, which works to the substantial financial benefit of corporate insiders, private equity funds, hedge funds and the like.

Trading commissions will be earned again and again over the years, as will account fees and other expenses. So each year that the Roth IRA remains outstanding, the financial industry is a direct beneficiary.

So while the actual benefits to the Roth's owner don't kick in until sometime in the future, everyone else benefits right from the beginning.

The Historical Trustworthiness Of The United States Government

Now, surely if the government says that Roth IRA distributions will be tax-free in the future the word of the government can be relied upon, can't it?

Let's briefly consider the history of the income tax in America.

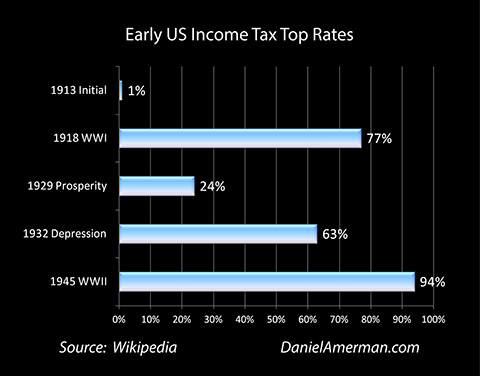

Income taxes in the United States were enabled by the passage of the 16th Amendment in 1913, and initially they were intended to be relatively small, and applicable only to the wealthy. The initial tax rate was 1%, and applied to incomes of $3,000 and above. Because the dollar was worth so much more at the time and the nation was generally poorer that meant ordinary workers did not have to pay.

This was how the income tax was sold to the American people: it would be a small percentage, it would be imposed only on the wealthy, and the majority of the population would never pay it.

That's not how things turned out, however. A mere five years later, the top income tax rate was at 77%. The rate slowly dropped to 24% by 1929. Then it soared back upward to 63% by 1932. And by 1945 the top marginal rate had reached 94%.

So we have the promise made by the federal government and their representatives that the majority of the population would never be subject to income taxes and yet here we are. And it only took five years to make a complete mockery of what the public had been told in order to enable passage of the constitutional amendment.

What brought on such a drastic change in the tax code?

Simply put, the government needed the money.

In 1918 the government needed the money to pay for World War I. In 1932 the government again needed the money because of the Depression. And then in 1945 the government needed the money to pay for World War II.

So as it turns out, no promises about taxes are binding if the government ends up really needing the money at a later point in time.

With that in mind, are there any reasons to suspect that the government could "really need the money" at some point in the future?

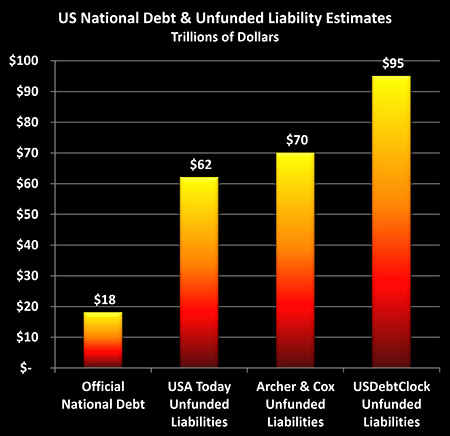

There may be close to one hundred trillion reasons to suspect just that. Making promises today about the future that will be paid for by future governments and taxpayers is one of the most common things that politicians do. Voter's love it, and it doesn't have to be paid for out of the current budget so this a very cost-effective way of winning elections.

And Roth IRA owners aren't the only ones receiving the promises.

As explored here, the US government has promised enormous sums to future retirees when it comes to Social Security and Medicare. Sums that can't possibly be paid unless there are wholesale changes to... the tax code. Either the government greatly increases the amount of money it takes in, or there will be a lot of very unhappy Social Security and Medicare beneficiaries.

Taxes That Aren't "Taxes"

So, on the one hand we have a government that historically has broken its promises every time administrations and congresses have felt there was a financial need to do so, and on the other we have some of the greatest financial needs in the history of the Republic arising over the next several decades.

But surely politicians wouldn't dare break such a clear cut promise and introduce taxes on something that's supposed to be tax-free, because of the fear of Roth IRA voter outrage. Or would they?

When we look at the history of the United States income tax rates as well as payroll tax rates we see that solemn promises have been broken many, many times.

But what's also worth considering is that with a little sleight-of-hand, so to speak, there are other ways of effectively taking money from savers other than just explicit "taxes". One such method of closing the gap between revenues and expenditures is the concept of "means testing", which has been discussed with regard to Social Security for some years now.

As shown in "Unfunded Liabilities" graph above, over the years to come we will have an increasingly bankrupt Social Security and medical system in which solemn promises simply can't all be paid. Even if income and payroll taxes rise sharply the time will come when the shortfalls will just be too great, and benefits will have to be cut.

For the many millions of people who have no savings, absent government support they may risk living in increasingly abject poverty. On the Medicare side which is the source of the great majority of the shortfall over the coming decades there is likely to eventually be rationing, and people may be dying of preventable medical causes because of a simple lack of available funds.

On the other hand as it may be expertly positioned by the media commentators, pundits and the politicians themselves during this coming time when there will be an acute shortage of funds, there will also be the many "haves" of the world who can in fact afford to contribute to paying for their own standard of living as well as contribute towards their own medical care.

Now because reducing the amount of the future cuts to Social Security and Medicare could have life changing implications for future retirees, it could become the single most important determinant of their vote. It is also worth noting that future retirees without significant savings will vastly outnumber Roth IRA account owners.

Hence there is a very reasonable and realistic possibility that some form of means testing will be implemented in order to qualify for Social Security payments as well as Medicare benefits in the future.

And what this means testing comes down to is that if you have the assets, or you have the income potentially in the form of retirement account assets or distributions then in fact you're not entitled to the payments that everyone else is. You have the means to pay, so you don't need the public assistance.

Now there are many different ways in which means testing could work, but one possibility would be to set a minimum threshold and say that no payments are made above that level.

So if someone has over $500,000 or perhaps even $100,000 in assets, they may not be entitled to full Social Security or Medicare payments, or perhaps not even any Social Security or Medicare payments.

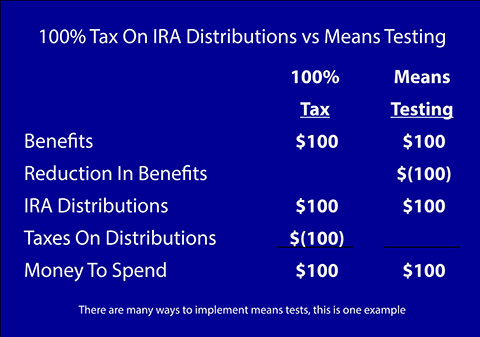

Or, there could be a dollar for dollar reduction in Social Security and Medicare payments, for distributions from retirement accounts.

And what does that really mean?

On the one hand, this isn't technically a tax, because the government isn't actually taking any money it is just withholding money that would have otherwise been paid.

But economically while means testing can work in different ways, for the saver it can be indistinguishable from up to a 100% income and asset tax on the amount of the foregone benefits.

Part II

Part II of this article explores the personal impact of means testing, as well as the possibility of triple effective taxation. There is also a discussion of how to incorporate this information into the Roth IRA decision making process.

Continue Reading The Article

Contact Information:

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: dan@danielamerman.com

This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

| Digg This Article

-- Published: Thursday, 9 July 2015 | E-Mail | Print | Source: GoldSeek.com