-- Published: Friday, 10 July 2015 | Print | Disqus

By Gary Tanashian

Excerpted from an extensive multi-market NFTRH update (including global stocks, commodities and precious metals) yesterday morning:

Volatility. It is what we expected and it is what we have with Tuesday’s big down and upward reversal, down hard again yesterday and today very green in pre-market. This volatility applies to most assets markets including the precious metals. It is the nature of the beast during a news-rich summer, with many operators on vacation or semi-vacation (with some players not able to resist peeking?).

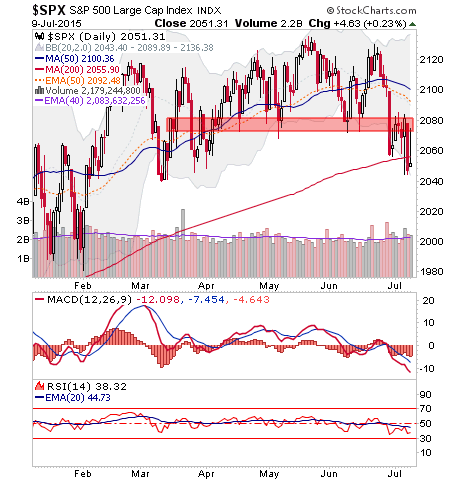

The S&P 500 has satisfied the 1st level of anticipated correction by weekly chart. It does not look like much, does it?

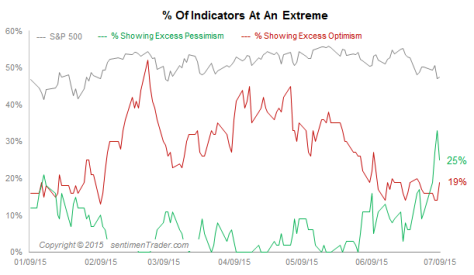

But it has been enough to launch pessimism to its highest level in many months. One definition of volatility: “liable to display rapid changes of emotion.” This is perfect for the whipsaw up and down backdrop going on by daily charts.

SPX daily shows that story clearly, with large swings up and down with a downward bias (series of lower highs and lower lows) since topping in mid-May.

Given the fading participation we noted last week (by Bullish % indexes) and the daily down trends (weekly remains up), the market is now bearish until it proves bullish on a short-term basis. Long-term it remains in bullish trends until it proves otherwise. In the meantime, welcome to volatile Whipsaw City.

Here is the updated sentiment indicator graph (courtesy of Sentimentrader.com) showing that people got a little braver yesterday.

With this morning’s burst of joy about some Greek noise this reading should get tamped down some more. Meanwhile, the pre-market pop implied in the futures will only bring SPX back to the top of the recent range and resistance. More resistance is at the EMA 50 and SMA 50 around 2100.

Bottom Line

Sentiment became unsustainable in its bearishness and the market had to bounce to clear this condition. The whipsaw continues and parameters are clear. Until these resistance parameters are cleared and held it is a risky thing to be buying stocks just because the whipsaw happens to be whipping upward today.

NFTRH.com and Biiwii.com

| Digg This Article

-- Published: Friday, 10 July 2015 | E-Mail | Print | Source: GoldSeek.com