-- Published: Friday, 24 July 2015 | Print | Disqus

By Frank Holmes

While the media and investors are focused on Greece, Puerto Rico is having a debt meltdown of its own. The U.S. territory owes lenders over $70 billion, $5.4 billion of which is due in the next 12 months. But without some form of debt restructuring, says Governor Alejandro García Padilla, it will be unable to meet its obligations. Countless municipal bond fund investors—many of them unaware they have exposure to the Caribbean island—could be affected.

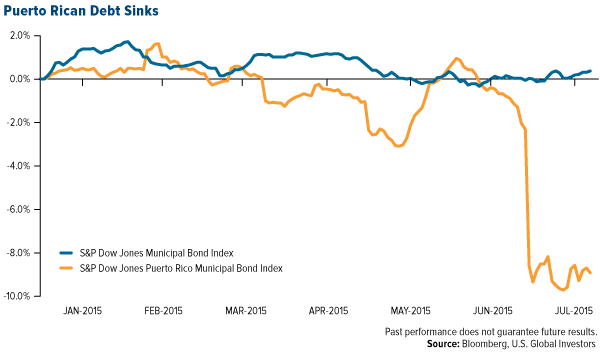

Year-to-date, Puerto Rican munis have lost 9 percent while U.S. munis have gained 0.4 percent.

click to enlarge

Our Near-Term Tax Free Fund (NEARX) has no exposure to Puerto Rico. NEARX invests predominantly in high-quality munis, and our investment team prudently adjusted fund allocations when it became clear the commonwealth would face serious problems paying back bondholders.

The same can’t be said for many other funds in the U.S., however. Over 20 percent of American bond funds owns Puerto Rico’s bad debt, according to Morningstar. Sixteen of the 20 mutual funds with the highest ownership by percentage are run by a single investment management firm. The same firm owns nearly half of all Puerto Rican debt that’s owed by U.S. funds. Another firm offers a fund that has half of its investments in Puerto Rican bonds.

You might be wondering why these funds have invested so heavily in the island. Because they carry a “junk” rating, Puerto Rican bonds offer a higher yield than more conservative bonds. They also provide what’s called “triple tax exemption,” meaning they’re tax-free at the federal, state and local levels.

The tradeoff, of course, is that investor assume a greater deal of credit risk. That’s why it’s crucial for investors to be familiar with their funds’ holdings.

To Bail Out or Not to Bail Out?

On Monday, Governor Padilla asked Congress to grant Puerto Rico the ability to declare bankruptcy. The problem, though, is that like all U.S. states, the territory can’t file for Chapter 9 bankruptcy protection. That’s an option available only to municipalities and cities such as Detroit, whose own bankruptcy exactly two years ago was the largest in U.S. history by debt, estimated at between $18 and $20 billion.

Whether to bail out the commonwealth is currently being debated. Some officials believe Puerto Rico is “too big to fail.” Others argue that its leaders haven’t done enough to reverse years of economic slowdown. Forty-six percent of all native-born Puerto Ricans who moved to the U.S. mainland between 2006 and 2013 did so for job-related reasons, according to the Pew Research Center.

“Puerto Rico is a beautiful island with a rich culture, but currently its government isn’t doing enough to encourage young professionals to stay,” says Kat, USGI’s web designer, who moved from Puerto Rico to San Antonio in 2007. “The cost of living keeps going higher while wages haven’t improved. I don’t know what needs to be done, but raising the sales tax and doing nothing to prevent talent from leaving the island aren’t the answer.”

Highly-Rated Municipal Bonds Remained a Relatively Safe Asset Class

Just as investors should know what assets they own, it’s important for them to realize that Chapter 9 filings—at least among highly-rated municipalities—have been the exception, not the norm. According to ratings agency Moody’s, Baa-rated munis historically had similar default rates as Aaa-rated corporate bonds.

Average Cumulative Default Rates, Municipals vs. Corporates: 1970-2013 |

10-Year Period |

Ratings | Corporate | Municipal |

Aaa | 0.49% | 0.00% |

Aa | 0.99% | 0.01% |

A | 2.73% | 0.05% |

Baa | 4.61% | 0.32% |

Ba | 19.27% | 3.53% |

B | 40.48% | 15.14% |

Caa-C | 66.02% | 14.64% |

Source: Moody’s, U.S. Global Investors

Again, NEARX invests in quality, short-term munis. Having provided investors with over 20 straight years of positive returns, the fund holds five stars overall from Morningstar, among 184 Municipal National Short-Term funds as of 6/30/2015, based on risk-adjusted return.

Let’s hope our friends to the south can reach a solution to the debt crisis.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Total Annualized Returns as of 6/30/2015:

Fund | One-Year | Five-Year | Ten-Year | Gross Expense Ratio | Expense Cap |

Near-Term Tax Free Fund | 0.90% | 2.27% | 2.98% | 1.08% | 0.45% |

Expense ratio as stated in the most recent prospectus. The expense cap is a contractual limit through April 30, 2016, for the Near-Term Tax Free Fund, on total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest).Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Morningstar Ratings are based on risk-adjusted return. The Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

The S&P Municipal Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. municipal bond market. The S&P Municipal Bond Puerto Rico Index is a broad, market value-weighted index that seeks to measure the performance of bonds issued within Puerto Rico.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

| Digg This Article

-- Published: Friday, 24 July 2015 | E-Mail | Print | Source: GoldSeek.com