-- Published: Sunday, 2 August 2015 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

In just one day, a big chunk of JP Morganís gold was withdrawn from the COMEX. Itís been a while since we have seen such a large single withdrawal. According to the CME Groupís Friday Warehouse Depository gold stocks, a whopping 200,752 ounces of gold were removed from JP Morganís Eligible category.

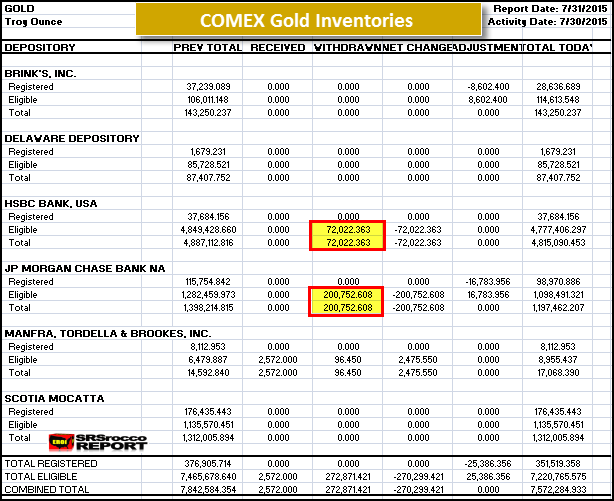

If we look at the table below, we can see JP Morganís total gold inventories fell from 1,398,214 oz on Thursday (7/30/2015) to 1,197,462 oz:

Basically, JP Morgan lost nearly 15% of its total gold inventories in one day. You will notice that JP Morgan only has 115,754 oz of gold in its Registered category. This is gold that is ready to be delivered. This 200,752 oz gold withdrawal would have totally wiped out JP Morganís Registered gold inventories.

Furthermore, there was another large 72,022 oz gold withdrawal from HSBC for a total of 272,871 oz from the two banks. Not only are investors starting to be concerned about the Greek situation in Europe spinning out of control, there is growing fear of a possible meltdown of the broader stock markets this fall.

This has sparked a huge increase in physical gold and silver buying shown by the record 170,000 oz of Gold Eagles sold in the month of July, including 5.5 million oz of Silver Eagles (even with the U.S. Mint suspending Silver Eagle sales for two weeks).

If you look at the COMEX Gold Inventory table closely, you will notice that the total Registered Gold inventories are a lousy 351,519 oz. This is less than peanuts. Two withdrawals like JP Morgan experienced on Thursday, would totally wipe out the Bankers Registered gold inventories.

I believe things will become quite interesting this fall. Investors need to WAKE UP to the fact that there are very few excellent stores of wealth going forward. Gold and silver are probably two right at the top of the list.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below:

| Digg This Article

-- Published: Sunday, 2 August 2015 | E-Mail | Print | Source: GoldSeek.com