“Bureaucracy destroys initiative. There is little that bureaucrats hate more than innovation, especially innovation that produces better results than the old routines. Improvements always make those at the top of the heap look inept. Who enjoys appearing inept?”

– Frank Herbert, Heretics of Dune

“Economies naturally grow. People innovate as they go through life. They also look around at what others are doing and adopt better practices or tools. They invest, accumulating financial, human and physical capital.

Something is deeply wrong if an economy is not growing, because it means these natural processes are impeded. That is why around the world, since the Dark Ages, lack of growth has been a signal of political oppression or instability. Absent such sickness, growth occurs.”

– Adam Posen, “Debate: The Case for Slower Growth”

Today’s letter will be shorter than usual, because I’m at Camp Kotok in Grand Lake Stream, Maine, where the first order of business today is trying to outfish my son (not likely to happen, this year). But I’ve been looking closer at productivity barriers, and I want to give you some points to ponder.

The New Normal?

Like many of you readers, I’m old enough to remember a time when 2.3% annual GDP growth was a disappointment. We always knew America could do better. Not anymore, apparently.

Some people actually cheered last week’s first estimate for 2Q real GDP growth. It was 4.4% in nominal terms, but inflation brought the figure back down. While certain segments are growing like crazy, for the most part we are muddling along in a slow-growing malaise. You might even call it “stagnant.”

I for one still think the United States can do more. We have a large population of intelligent people who want to build a solid future for their children. They’re willing to work hard to do it. If that’s not happening – and clearly it isn’t – some barrier must be standing in their way.

What is this barrier to productivity and growth? There are actually several, but government red tape is one of the biggest. I thought about this after reading an excellent Holman Jenkins column in the Wall Street Journal last week.

Jenkins led me to an audio recording of an interesting discussion on “The Future of Freedom, Democracy and Prosperity,” conducted at a symposium held at Stanford University’s Hoover Institution last month.

Government research & development funding has fallen off considerably from its peak in the 1970s moonshot days. This holds back worker productivity. The federal government is doing too much to slow down business and not enough to boost it.

The three economists who spoke at Stanford all pointed to important productivity barriers emanating from Washington DC:

One of the participants, Hoover economist John Cochrane, spoke of fears that America is drifting toward a “corporatist system” with diminished political freedom. Are rules knowable in advance so businesses can avoid becoming targets of enforcement actions? Is there a meaningful appeals process? Are permissions received in a timely fashion, or can bureaucrats arbitrarily decide your case by simply sitting on it?

The answer to these questions increasingly is “no.” Whatever the merits of 1,231 individual waivers issued under ObamaCare, a law implemented largely through waivers and exemptions is not law-like. In such a system, where even hairdressers and tour guides are subjected to arbitrary licensing requirements, all the advantages accrue to established, politically connected businesses.

The resources that businesses put into complying with government regulations is staggering. I have often envied people outside the highly regulated financial industry for their freedom to operate rationally. In my business we seem to spend half our time – and an ungodly fraction of our money – just maneuvering through the regulatory morass.

Intrusive federal regulations touch every part of the economy:

- Energy and mining companies have to deal with environmental protection rules.

- Drug companies and health care providers must satisfy the FDA and Medicare.

- Cloud technology companies have to process FBI and NSA demands for user information.

- Retailers and consumer product makers are required to abide by the fine print on millions of product labels.

I could go on, but you get the point. Anything you do attracts bureaucratic oversight now. We may laugh at “helicopter parents” hovering over their children at school, but we all have a helicopter government looking over our shoulders at work.

Before anyone calls me an anarchist, I think some government regulation is perfectly appropriate. We all want clean drinking water. Everyone appreciates knowing our cars meet crash survival standards. I’m glad FAA is keeping order in the skies.

The problem arises when agencies enforce confusing, contradictory, and excessive regulations and try to micromanage the nation’s businesses. Every business owner I know is glad to play by the rules. They just want to know what the rules say, and that is frequently very hard to do.

A few weeks ago, in “Productivity and Modern-Day Horse Manure,” I explained that growth is really quite simple: if we want GDP to grow, we need some combination of population growth and productivity growth.

The US population is growing, thanks mainly to immigration, but the effectiveness of the workforce is another matter. Baby Boomer retirements are rapidly removing productive assets from the economy. To offset that trend, we need to make younger workers more productive.The red tape that constantly spews out of Foggy Bottom is not helping matters.

Regulatory Capture

The red tape hurts the economy overall, but it does help certain parties. The largest players in any niche often “capture” their regulators. Then they use their influence to tilt enforcement away from themselves and toward smaller competitors.

Put simply, new regulations can be great for your business if you are already well established and have the resources to comply with government mandates. New entrants rarely have those resources. The resulting lack of competition boosts profits for the big players but hurts consumers. The competition that would normally lead to better, less-expensive goods and services never happens.

Holman Jenkins makes another great point about how overregulation affects growth.

Another participant, Lee Ohanian, a UCLA economist affiliated with Hoover, drew the connection between the regulatory state and today’s depressed growth in labor productivity. From a long-term average of 2.5% a year, the rate has dropped to 0.7% in the current recovery. Labor productivity is what allows rising incomes. A related factor is a decline in business start-ups. New businesses are the ones that bring new techniques to bear and create new jobs. Big, established companies, in contrast, tend to be net job-shrinkers over time.

Recall our economic growth formula: population growth plus productivity growth. The US population grew at a peak rate of 1.4% in 1992, and growth has been trending down ever since. Now it is around 0.75% per year. Add that to 0.7% productivity growth, and you see why Jeb Bush’s 4% growth target will be so hard to hit.

Blame Flows Downhill

Business leaders love to complain about the bureaucrats who run Washington’s alphabet-soup agencies. I think the problem goes deeper.

With only a few exceptions, the regulators I’ve met over the years have been competent professionals. They weren’t intentionally trying to hurt my business. Often the regulations confused them as much as they confused me.

The real blame, I think, starts on Capitol Hill. Our legislative process is a sausage factory. Congress passes vague, complicated laws riddled with exceptions for this and zero tolerance for that. The result is superficially attractive but a mess inside. People in the alphabet agencies then have to remove the sausage skin and make sense of the contents. This would be a tough job for anyone. I certainly don’t envy them.

Jenkins mentions Obamacare’s convoluted waivers and exemptions. Even its advocates admit the law is a crazy mess. But how and why did it get that way?

Like most major programs, the Obamacare law is a giant collection of compromises and favors.

All these provisions were necessary to make Obamacare palatable to various and sundry legislators and the interest groups whose pockets they’re in. Quite literally no one wanted what the process created. The left wing wanted a public option, or “Medicare for everyone.” The right wing wanted tax credits and across-state-line insurance sales. Nobody wanted the bloated, half-rotten sausage of a law we have now.

The much-hated individual mandate, for instance, wasn’t part of the original plan. Healthcare reform was a big issue in the 2008 Democratic primary. Hillary Clinton insisted everyone should have to buy insurance. Barack Obama opposed a mandate for adults and wanted it only for children. They argued about this several times in their early debates.

Obama was elected and then didn’t deliver on his preferred option. He changed course and accepted the individual mandate. He may have had no choice – forcing healthy people into the pool was the only way insurers would agree to cover preexisting conditions.

Once the law passed, the IRS then had to enforce the individual mandate and identify who deserved tax credits and how much they should get. They did it the only way they could: by making our tax returns even more complicated than they already were.

That’s only one law. Multiply this by hundreds of similarly convoluted strings of sausage that have emitted from the Congress in recent decades. We can laugh about China’s economic central planning, but here in the US we have the opposite of central planning: our form of government delivers an inefficient, uncoordinated mess.

This isn’t simply wasteful and expensive. Businesses expend precious productive resources trying to follow crazy, conflicting rules. And big companies use regulations to stifle smaller competitors.

All this unproductive effort makes the economy less likely to innovate, grow, and create new jobs. We see the results in persistently low employment, wages, and GDP growth.

A Hopeful Note

Holman Jenkins correctly points out that this mess is the fault of both political parties.

Tea party types talk a good game, but many are dependent on an unreformed Social Security and Medicare, and lately some have rallied to Donald Trump, who distracts them by blaming immigrants without actually offering a solution to immigration or consecutive sentences on any policy question. Meanwhile, the Barack Obama–Hillary Clinton Democratic Party offers bigger, more intrusive government as the solution to the problems of traditional minorities, the economically insecure, and target blocs like single women or the LGBT community.

Electing the right president or the right Congress isn’t going to fix this. Either party will always do whatever its donor class demands. We might get a slightly different set of problems, but they will be no less problematic for the economy.

Jenkins wraps up on a hopeful note, though. How, he wonders, did the Carter and Reagan administrations manage to deregulate energy and transportation? Voters weren’t demanding those changes, and plenty of big players opposed both moves. Yet uber-liberal Ted Kennedy led a fight that decontrolled airline fares. What was going on back then?

If we can figure that out, and make it happen again, we might be able to close the Congressional sausage factory. Unfortunately, that isn’t the only big problem on Capitol Hill.

Starving for R&D

We’ve established that government regulations stifle economic growth. That’s bad enough, but Congress compounds the problem by authorizing too little of the kind of government spending that helps growth.

Government spending helps growth? I know that statement is heresy to some. I, too, would prefer to have government stay completely out of private affairs. In the real world, however, many useful technologies had their origins in federal programs: nuclear power, jet engines, satellites, microchips, the Internet, GPS, and more.

Would the private sector have produced these? That’s a counterfactual speculation that no one can prove or disprove. We do know that government research that depended on support from agencies like the National Institutes for Health (NIH) and the Defense Advanced Research Projects Agency (DARPA) helped drive innovation in the economy. Do we need more of it?

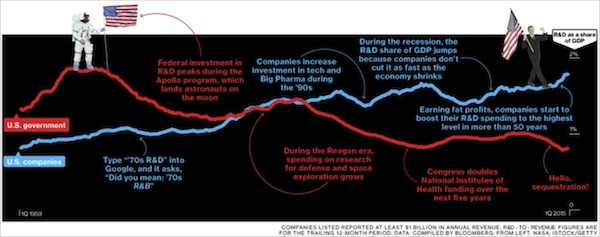

We used to have quite a bit more of it. Expressed as a percentage of GDP, government R&D spending peaked with NASA’s Apollo space program in the late 1960sand early 1970s. It got a little bump from defense spending in the Reagan years and the Human Genome Project launched toward the end of Bill Clinton’s era, but the overall trend is still down.

Source: http://www.bloomberg.com/news/articles/2015-06-04/look-who-s-driving-r-d-now

At the same time, private-sector R&D grew steadily before retreating in the early 2000s. From there it grew at a more moderate pace as businesses spent cash on stock buybacks and higher dividends. Now it’s jumping even more – I think because businesses recognize the need to boost productivity.

Writing for Bloomberg Businessweek in June of this year, Matthew Philips and Peter Coy found this private investment might be just the ticket to boost economic growth.

Companies have been pouring money into research and development at the fastest pace in 50 years. From November through the end of March, U.S. companies funded R&D at an annual rate of $316 billion, or about 1.8 percent of gross domestic product, the largest share ever for the private sector. That’s up from 1.7 percent last year and 1.6 percent from 2007 to 2014. “If secular stagnation is a ‘thing,’ then U.S. companies are investing like crazy to make sure it doesn’t happen,” says Neil Dutta, senior U.S. economist at Renaissance Macro Research.

After years of spending cash on dividend boosts and share buybacks, U.S. companies may finally be realizing they need to start seeding real innovation. To some economists, this marks a turning point as companies make the transition from engineering short-term profits to devising products and more efficient methods of doing business. “In a way, this is what we’ve been waiting for,” says Torsten Slok, chief international economist at Deutsche Bank. “It’s not quite Godot arriving, but it’s close.”

They go on to say this shift is not a sure thing. The time lag between conducting R&D and selling actual products can be years, even decades. And the government labs that hatched big ideas now hatch them more slowly and they don’t move into the private sector as quickly.

Looking at the chart above, economic growth seems to coincide with periods when both private (blue line) and government (red line) R&D spending rose together.

Right now only the blue line points higher. Will federal R&D spending return to growth? Frankly, I don’t see how. No matter how next year’s election turns out, the White House and Congress will have to sustain rising entitlement and military spending with little or no additional revenue. They won’t have much slack, and I doubt they will want to expand projects whose payoff is years in the future (or possibly never).

That means private industry will have to pick up the slack. Can it?

Quarterly Mindset

Some US corporations get this. At Facebook, for example, CEO Mark Zuckerberg told shareholders last year not to expect profit growth because the company would make huge investments in new products. He wasn’t kidding.

Companies like Facebook are the exception. Most CEOs give in to shareholder demands for expanded stock buyback programs or higher dividends. This is perfectly logical from these executives’ personal viewpoints: most of their compensation comes from stock options. Share buybacks are what keep that gravy train moving without diluting other shareholders.

Jerry Grantham took the “stock option culture” to task in his most recent quarterly investment letter:

This near-perfect synergy between Fed policy and the stock option culture has, not surprisingly, resulted in most of the corporate cash flow of public companies being used for stock buybacks – a record $700 billion annualized rate this year at the expense of corporate investments in expansion. Thus, well into the seventh year of economic expansion, we have uniquely had no hint of a surge in capital spending, which remains well below average. And why should we be surprised? For how risky it is to build new factories and shake them down in a world where things can go wrong and corporate raiders lurk. How safe it is to buy your own stock [and how easy to raise debt with which to do so, given the wondrous workings of QE-SLF] and how likely that doing so will push prices higher, thus increasing option values (making it easier for CEOs to go from earning 40 times the average worker in 1965 to over 300 times today) and enlarging the Fed's wealth effect at the same time!

But the downside is less corporate expansion; less GDP growth; lower job creation, and hence lower wages. Pretty soon, Mr. Ford, there will be no one to buy your cars. The economy becomes persistently disappointing for yet one more reason.

Source: http://online.barrons.com/articles/jeremy-grantham-the-10-topics-that-really-matter-1438122157

Sadly, we seem to be at a point where the mindset in the nation’s C-suites is not so different from the mindset on Capitol Hill. Our politicians think ahead no further than the next election, while our business executives think only of the next quarterly and annual reports.

If short-term thinking continues to rule both the public and private sectors, we are going to stay stuck in the mud. The outcome, as Jeremy Grantham says, will be “less corporate expansion; less GDP growth; lower job creation, and hence lower wages.”

A quote came to mind which I believe is attributed to Henry Ford: “If you keep doing what you’ve always done, you’ll keep getting what you’ve always got.”

What we’re doing right now is working well enough to keep the US out of recession. We’re also seeing some mild improvement in employment and consumer spending. If we stay on the present course, we’ll keep getting mild improvement.

The problem is that we’re in a tunnel with a giant debt train chasing us from behind. Doing what we’ve always done will eventually get us run over. Somehow, we have to start running faster.

Fishing for a Candidate

Last night I watched the first Republican primary debate along with much of the group. Our group here at Camp Kotok in Grand Lake Stream, Maine, is very diverse in terms of the political spectrum, so that made for fun watching. Rather than talking about who won and lost, let me offer another thought. The big winner was the process. To everyone's surprise (and certainly if you had asked a year ago), the TV audience was huge. Eight times more people watched than tuned in for the last presidential cycle's first debate. It was the largest cable audience ever for a non-sports event.

Who knew the Republican primary could be a reality show? Sadly, it took The Donald to make that happen, but it is worth suffering through his bloviating to get the audience to listen. What they heard were 4-5 very good potential candidates, although there was some vigorous disagreement in the room here over who made up the top four. I bet you and I might have a different list as well.

That is beside the point. The Republican primary is now Survivor. People will start watching to see who gets voted off the island. I bet this even boosts the ratings for the Dems. Maybe they could get George Clooney to run and then beat the GOP numbers. Just saying.

Your hoping we can learn to make better sausage analyst,

John Mauldin

subscribers@mauldineconomics.com

If you enjoyed John's article, sign up for Thoughts from the Frontline, a free weekly letter, at mauldineconomics.com. You can follow John Mauldin on Twitter @johnfmauldin