-- Published: Thursday, 27 August 2015 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

The global financial system is now getting out of control. While the clowns on the financial networks continue to regurgitate the same bullish propaganda, “that everything will be fine”, quite the opposite is the case. The system is so broken and the leverage propping it up is so extreme, the result will be the largest financial and economic calamity the world has ever seen.

The global financial system is now getting out of control. While the clowns on the financial networks continue to regurgitate the same bullish propaganda, “that everything will be fine”, quite the opposite is the case. The system is so broken and the leverage propping it up is so extreme, the result will be the largest financial and economic calamity the world has ever seen.

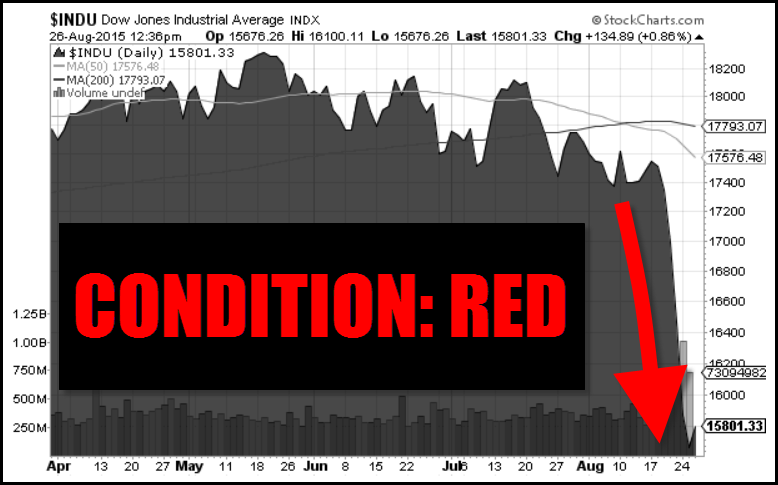

To get an idea just how broken the system has become, here is the Dow Jones chart of Monday’s trading activity from Zerohedge’s article Behold: Insanity:

After the Asian markets received a financial enema Sunday night as the Hang Seng fell more than 1,200 points and the Nikkei nearly 950 points (at their lows), the Dow Jones experienced one of the strangest trading days ever. Of course, the Dow Jones suffered large single-day losses before, but never the sort of volatility as it experienced this Monday, August 24th.

I would imagine this type of volatility can be explained by the HFT – High Frequency Traders that have now taken over the majority of trading in the markets. This type of stock market insanity wouldn’t have taken place 10 years ago as the system still had a great deal of retail traders. Thus, human retail trading activity would move slower and take more time in mulling over information.

The Dow Jones moved over 4,500 points (up & down) on Monday. This should be a warning to investors that serious dislocations in the market are coming.

Beginning Stages Of A Run On The Retail Precious Metal Market??

Ever since the middle of June when Greece threatened to leave the European Union, sales of gold and silver bullion exploded. Investors purchased a record 176,000 oz of Gold Eagles in July. This was the highest monthly sales figures in several years.

Even though the rate of Gold Eagle sales declined in August compared to July, they picked up significantly over the past few days surpassing 30,000+ oz to a total of 68,500 oz for the month.

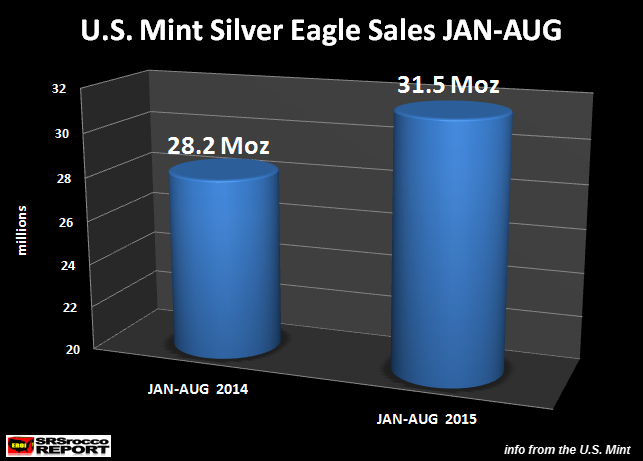

While sales of Gold Eagles have been the strongest in several years, Silver Eagle sales continue to beat all records. Not only are sales of Silver Eagles 12% higher at 31.5 million oz (Moz) compared to 28.2 Moz during the same period last year, total sales for June, July and August are a staggering 14.5 Moz. If the U.S. Mint continued to sell Silver Eagles at the same rate over the past three months, total sales would reach an annual 58 Moz.

We also must remember, there is still another U.S. Mint update on August 31st. Most of the time, the U.S. Mint updates its sales figures on Monday, but this week they waited until Tuesday. If they update their sales figures on Monday, we could see total sales for August at 4.8-5 Moz.

I contacted a few dealers to see what was going on in the retail end of the market. Here was their reply:

Money Metals Exchange:

Demand for silver is outstripping the ability of Mints and refiners ability to supply, and unfortunately the recent sell-off in stock markets is compounding the problem. Demand spiked in late June when investors began worrying about events in Greece and the collapse in Chinese equities began. Now we’re seeing another wave of buying based on the turmoil here at home. On top of it all has been additional demand from bargain hunters taking advantage of lower spot prices.

The Royal Canadian Mint iscurrently furthest behind. They announced significant production issues a couple of weeks ago and we stopped taking new orders for Maple Leafs, given we won’t make delivery promises to customers we aren’t confident we can keep. Supply of silver American Eagles isn’t in much better shape. This week’s dealer allocations came in way below whatwas anticipated based on theprior week so lead times for delivery moved out once again.

Given the higher premiums and delays on sovereign coins, pressure is ramping on private mints and refiners who produce rounds and bars. It is going to be very interesting to see how this plays out over the next few months.

its turning into a mad dash for any type of any type of physical anyone can get their hands on (wholesalers, retailers, and investors)…

Seenquite a jump in the past 24-48 hours on premiums on everything. Silver Eagles have jumped .60-.75/oz, and maples about the same.

I still think we’re looking at the potential for 2008 style premiums if we get any further price weakness below $14. Theres just no supply out there. New orders for sunshine products are now shipping end October/early November!

Indian Silver Imports in 2015 May Easily Surpass 9,000 Metric Tons

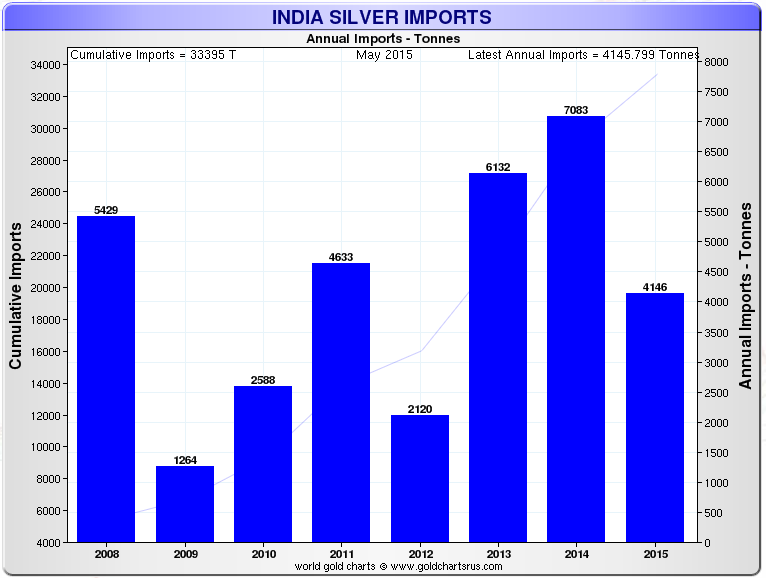

According to the data put out by Sharelynx.com, total Indian silver imports from Jan to May reached a staggering 4,146 metric tons (134 Moz):

According to ETF Securities May 2015 Precious Metals Monthly Report:

Demand from India continues to impress. From 2005 through 2013 India silver imports averaged just under 100 million (mn) ounces per year. In 2014, on the back of substantial restrictions put on gold use and the sharp drop in the silver price, India silver imports jumped to 230 mn ounces. With the election of Mr. Modi and some easing of the gold restrictions, silver use in India was generally expected to decline in 2015. But this has not been the case, as of the end of May. The latest data through April show India silver imports running about 30% above the 2014 record pace, on track for about 300 mn ounces of imports in 2015. India imports alone are on pace to consume about 1/3 of total global silver supply available in 2015. The rapid pace of India imports is likely to subside but indications of strong demand for silver are clear.

Two important points from the ETF Securities analysis on Indian silver demand:

1) Annual silver imports averaged less than 100 Moz from 2005-2013. This increased significantly in 2014 (230 Moz) and 2015 (300-320 Moz). Basically, Indian silver imports in 2015 are on track to be three times their 2005-2013 rate.

2) Most analysts forecasted a decline of Indian silver use due to new election of Mr. Modi and his easing of gold restrictions in 2015. However, the opposite is the case and Indian silver imports Jan-May are 62% higher than the same period last year.

Investors need to realize this huge increase of Indian silver imports is just another sign that ALL IS NOT WELL in the system. If things get out of control with the broader stock markets in September-October, Indian silver demand could actually push their total imports to 10,000 metric tons (320 Moz).

Don’t Be Fooled By The Dow Jones Dead Cat Bounce

Today the Dow Jones closed up 619 points. I would imagine the nitwits on CNBC are smacking each other on the back stating, “A Victory is Near.” How can the Dow Jones be up 619 points, while oil is down in the $38 range and most commodities are in the red?? Shouldn’t stocks be indicative of the health of the overall economy? LOL… not anymore.

This is nothing more than the typical Dead Cat Bounce. Why? Markets never go down in a straight line and I imagine the Dow Jones needed to take a breather after suffering a total 1,842 point loss since the declines started last Wednesday. If there are any folks out there who are still playing a game of “CHICKEN” by trying to time the markets, you may be in for a rude awakening.

The Degree Of Stupidity In The Financial Media Is Off The Charts

Recently, John Mauldin (a regular guest on King World News) put out one of the most ludicrous articles on energy that I have seen in quite some time. Now, of course I’ve read some lousy ones by the MSM, but Mauldin is an analyst with a foot in the alternative media camp… which makes it even worse.

His article, Riding The Energy Wave To The Future was so awful, it invoked a reply from energy perma-bear James Howard Kunstler: As Fracking Implodes, The Clowns Deny Reality. Even though I enjoyed Kunstler’s reply by posting it on my site, I wanted to include a rebuttal from one of the best energy analysts that I follow.

I sent Mauldin’s article to Art Berman who has his own energy blog called ArtBerman.com. I suggest those interesting in knowing what’s really going on in the energy industry, to check out his blog. Art replied to Mauldin’s nonsense with the following:

John Mauldin Defends Faith, Fails Economics 101

Mauldin says he is an economist and yet there is no economic data in his monologue. It is fascinating that production efficiency has become the new justification for the continued inefficient use of energy. For him, growing production volume equals commercial success.

He worships at the alter of technology but fails to grasp its cost and its limits. He blindly accepts the self-promoting proclamations of oil company executives without testing whether their claims are supported by economic facts.

For example, he cites EOG’s claim that they are more profitable at low oil prices than they were a few years ago at high oil prices. All that is necessary is to compare EOG’s cash flow now vs. a year ago to see that is a false statement.

Source: Company 10-Qs and Google Finance.

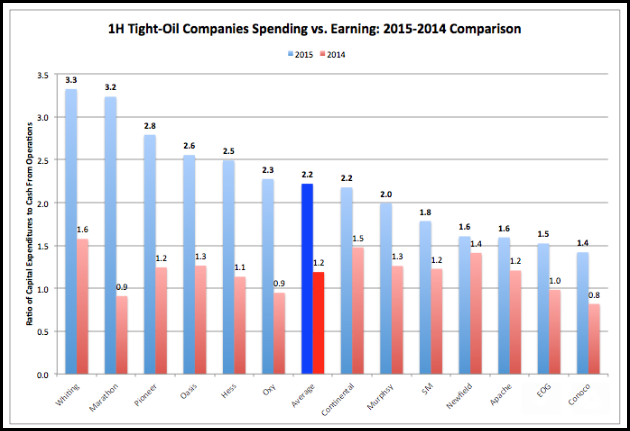

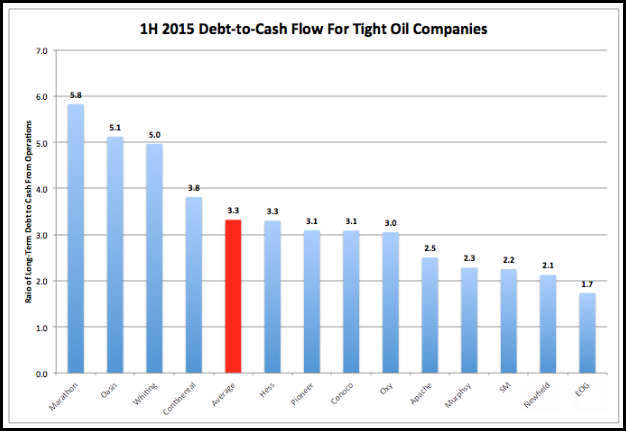

Although EOG is one of the best of a bad lot when it comes to tight oil producers (and I own EOG stock), they were cash-flow neutral in 1H 2014 when oil prices averaged $101/barrel and they were cash-flow negative in 1H 2015 when oil prices averaged $53/barrel, spending $1.50 for every $1 they earn from operations.

EOG’s statement that he takes as true is easy to test and it proves to be false. But he is too much of a true believer or too lazy to run the simple test using Google Finance and taking less than 5 minutes.

Most of the claims of continued profits at lower oil prices are based on incorrect reserve assumption and the exclusion of significant costs of doing business like G&A and interest expense.

I recently completed an evaluation of key company average well reserves in the Bone Spring play in the Permian basin. My reserve estimates based on solid history matches suggest an average well EUR of 205 kboe using the top 6 operators in the play. Simmons & Company International published a report on break-even prices last week that uses 676 kboe per well. A more than 3-fold exaggeration in reserves will get you more favorable economics every day of the week, and they acknowledge no G&A, interest expense, geologic and geophysical costs, etc.

The 1H 2015 tight oil debt-to-cash from operations ratio is chilling.

Source: Company 10-Qs and Google Finance.

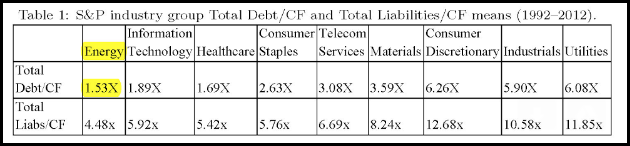

If the companies are truly making a profit at low oil prices why are they all above any reasonable debt covenant threshold (the 20-year E&P average is 1.53).

Source: Bank of Finland Research Discussion Papers 11-2014.

Please see the second half of my blog from Wednesday on 1H financial results: http://www.artberman.com/world-oil-supply-decreased-demand-increased-in-july-eia/

These are a few of my thoughts and observations about Mauldin’s piece.

Art does a great job cutting through all the BS, by stating some simple facts. I am surprised that Mauldin believes the garbage he wrote in that article. This is an ongoing phenomenon in the financial media.

This U.S. Shale Oil Industry is in serious trouble. Watch for serious declines in U.S. oil production over the next 6-12 months. As I stated several times, I believe U.S. oil production will fall 33% by 2020 and 60-70% by 2025. The KING DOLLAR gets its strength from controlling global energy markets. When U.S. oil production declines to less than 5 million barrels a day, and oil exporters will no longer take worthless Dollars for oil…. Americans will be in a world of hurt.

This is precisely the reason to own physical gold and silver. The U.S. and Global Markets are now entering CONDITION RED. Best to have your precious metal insurance while you can still get them.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: