-- Published: Thursday, 10 September 2015 | Print | Disqus

US-Iranian Deal will pass

China has replaced Greece in terms financial market unsettling news maker

Gold prices continue waffling

Janet Yellen gets another chance at raising interest rates at the September 17th FOMC meeting, but will likely not do so

Even Chinaís mess isnít supporting gold prices

China

It seems that todayís financial markets are being overwhelmed by wave after wave of news coming out China.

In large part itís because of the impact any slowdown or acceleration of Chinaís economy has on the business climate of those who do business with China. For example, China is the worldís largest consumer of copper. Copper prices have been in a bear market for a very long time, with prices finally finding its footing in the low $2.20s.

Glencore, a giant Swiss multinational commodity trading and mining company headquartered in Baar Switzerland, is the goliath in the room when you talk about copper, one of its main businesses.

After five or so years of takeovers, buyouts and the like to create this behemoth, Glencore now finds itself struggling due to its largest customer, China, cutting back on the goods Glencore sells it.

This past Tuesday all it took was for Glencore to announce it was cutting back production of copper for copper prices to stage a 13-cent rally better yet, hold onto it. Helping the rally was China reporting that it had imported around 350,000 tons of copper in August, which admittedly was a surprise as it represented a year-on-year increase of 4%, according to Commerzbank. However, what got little attention was that China only imported 2.94 million tons of copper since the beginning of 2014, which is approximately 8% lower than what it imported in the comparative period in 2014. Fast forward to today and the fundamentals donít warrant getting overly bullish, certainly not 13-cents worth given Chinaís economy is struggling. As I see it, unless the government plays with its numbers, I donít see China even hitting its reduced goal of a + 6% GDP this year.

I make mention of this simply because what Glencoreís doing is logical and likely going to take place in the gold mining industry. In other words, when you canít increase demand, you cut back on supply if as a supplier you arenít getting the return you need on your investment. Scale of course matters as small players donít have the clout to impact prices like a Glencore does, but the larger gold mining companies have that clout and down the road, theyíll have to be considering moves similar to that of Glencoreís.

South African unions continue with their strike threats against gold, platinum and palladium mining companies. Their goal is to get better working conditions and better pay for their members. Unfortunately for the unions, a strike plays into the mine owners hands as it reduces inventories, which provides sellers with higher prices for metals and metal ores already mined and stored above ground. A strike wonít move the miner owners to pay more if the mine itself is receiving less and its profitability is in doubt. Over time, as supplies get reduced and demand comes back the unions will be in a better position to get parts of their demands met, but that time is likely not now.

My point is that Glencore is but the tip of an iceberg. Gold companies will likely take a page from Glencoreís playbook and use it. A likely scenario is seeing some long lasting mining strikes, cutbacks in production by mines that stay open and closing of some mines. Demand is not something mine owners can control, nor do they control inflation, world politics, or other things needed to prop up gold prices. What they can control, are their costs, which they are already closely watching if they want to stay in business.

In other words, look for disruptions to show up in the gold mining fields of the world, with special emphasis on Africa especially if prices get under $1050 an ounce, the last round of break lows. Keep your eye on the names of Barrick Gold, Newmont Mining, AngeloGold Ashanti, Goldcorp, Kinross Gold, Newcrest Mining, Gold Fields, Polyus Gold and other major players to see if articles about them mention pay issues their workers. If so, think Glencore.

Update on India

With all the talk about the great giant India is in the gold world, I thought it time to offer up a bit of current events in India.

In June, 2013 the Indian government decided to raise the import duty on gold from 4 % to 8 % and in August 2013 raise it again from 8 % to 10 %. At the same time it imposed an 80/20 rule which forced traders to export 20 % of all imported gold. The 80/20 rule never made sense and as a result gold imports dropped from an all-time high in of May 2013 which say 165 tons imported to a just 16 tons imported in September 2013. In 2014 the 80/20 rule was revoked.

Fast forward to today. India is now looking for ways to monetize gold by having Indians deposit their gold in Indian banks. In return, depositors would receive interest on the gold and the banks would be allowed to use the gold to lend out. The depositor would still legally own the gold, but the gold would flow between the bank as custodian and whoever the lent it to. This plan has as much thought and chance of working as the 80/20 plan did in my opinion.

Without doubt, India is a key player in the world gold market. However, ideas of increased imports into India resulting from customers buying gold and depositing that gold into banks to receive interest on it seems highly unlikely. This is clearly a plan by the Indian government to monetize gold, but one doomed to fail. Therefore, this is neither a catalyst for increased gold imports into India nor a way for the Indian government to pry gold already being horded into its banks.

The impact of the upcoming FOMC Meeting is an unknown. I am in the camp that believes the Fed will not raise interest rates at this meeting; which might cause a gold pop to the upside. Higher interest rates go hand in hand with a higher US Dollar. No interest rate hike in theory at least is neutral to bearish the US Dollar. I say neutral since no hike at this time doesnít mean October, December or whenever wonít be mentioned by analysts as the next time for hike. The hike is coming sooner rather than later and will continue to keep the Dollar off balance until it comes.

Speaking of the Dollar, the Dollar Index has not been rising as the press would have you believe. If anything, the Eurocurrency has risen from 1.04 to a high of 1.17 in recent months. Therefore, gold has benefited from a ďsoftĒ Dollar in relative terms, which is another bullish factor that hasnít produced price appreciation.

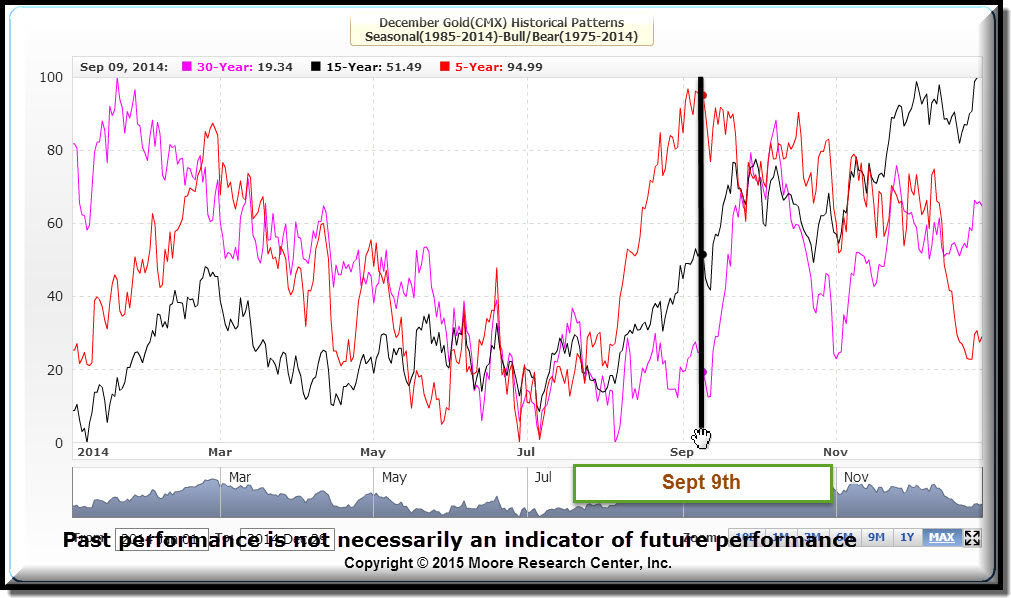

Seasonal Chart

In terms of seasonal movements, Iíve marked off where we are in calendar terms on the above chart.

Gold often, clearly not always rallies from mid-month into late September and from there has shown a tendency to drift around, rallying once again in late December to year end. The big surge, from early August into September has already come and gone. I doubt you took much notice of it since it was under a $100 an ounce in size and clearly disappointing to gold bulls.

From all I see this point in time, Iím not looking for gold to stage a rally that will make your hair stand on end. Rather, hit and run type trade is what I expect, without a major move to the upside unless some world events, such as China providing a major market scare to the financial markets.

Given Chinaís deflationary look, I donít see gold rallying anytime soon off of inflationary fears. That leaves an outbreak of war of threat to economies as a potential catalyst and that hasnít proven a benefit to gold. Think Greece if you need a refresher on that idea.

Weekly Chart

The Downtrend line continues to drop and prices with prices failing to go over and stay over it since this past March when I connected two points shown with the  figures to label them.

figures to label them.

On the above chart the resistance line has dropped down to just over 1152. The 100-Day Moving Average of Closes is way higher, up at 1234.8 at this time. Due to it being so far away from current prices, I donít think it offers much more right now than providing you with an idea of where an upside thrust, if one developed, might run into longer term resistance.

Unlike the Daily Chart, which did hit a major chart point, its 100-Day Moving Average of Closes, the weekly chart hasnít recently done so. What the last rally did was provide us with a third price point to connect to the downtrend line to, which makes the line more valid that if it had but two connected points.

If a surprise develops, it will likely come to the downside, not the upside. As I see it, the seasonal influences to the upside will be out the window if prices take out 1078.6. On the other hand, a close over 1155 will put the seasonality into play, and might mean the 100-Day Moving Average of Closes will become a more important chart point.

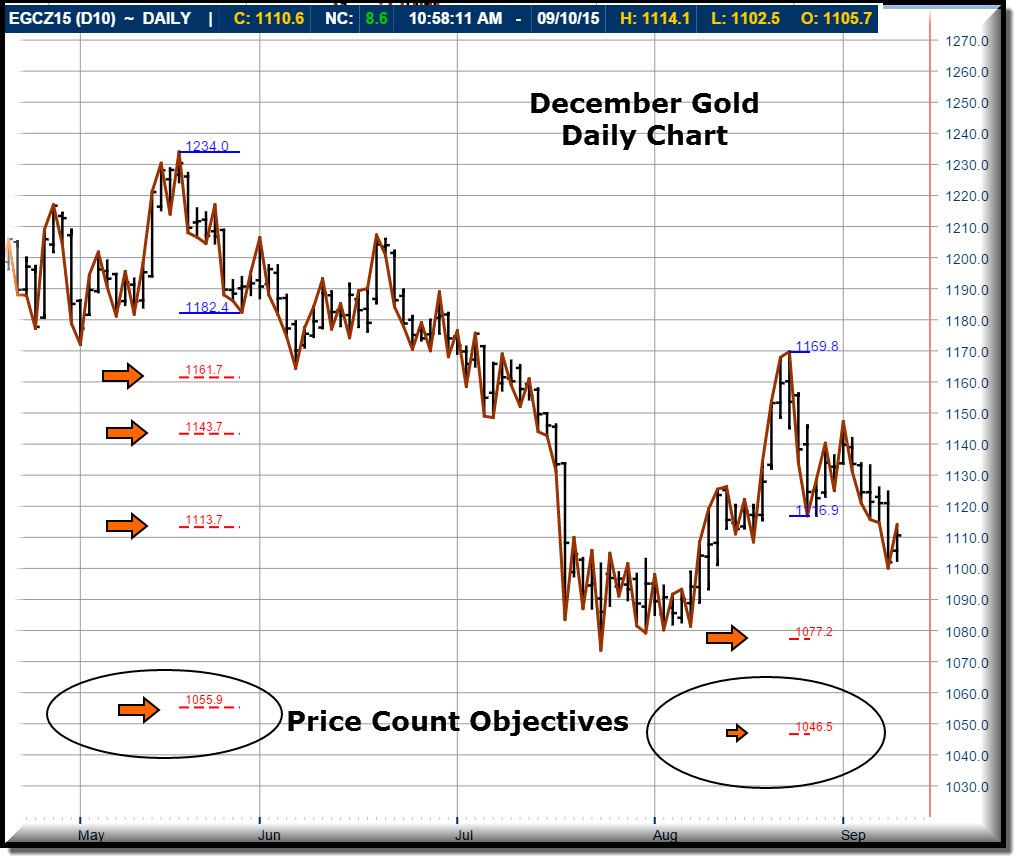

Daily Gold Chart

As I see it, the big question is whether or not gold makes a run on this chart for a rare fourth Price Count, down at 1055.9 or not. There was a small up-leg that was violated with the current price break.

Iíve also plotted in dark brown the Swingline Study. There is no trend as the Swingline pattern is one of a higher high and lower low, which I define as trendless. More important, it will take days of unknown at this time price action to setup a trend.

Gold ETFÖGLD

The chart of the ETF GLD is much cleaner in terms of a techincal story than that of the futures contract.

First, the Swingline is clearly in a bearish trend as seen by it having lower highs and lower lows. Iíve marked the the highs with red down arrows for you to see. The lows speak for themselves.

Second, prices have hit the lower Bollinger Band, the dashed black line. This is an initial objective where those short should look for support. The market has bounced off this number.

Last, as the market got down to the lower Bollinger Band, the market became ovesold as measured by the Slow Stochastic Study. I consider a ready in this osciallator under 30 as being oversold, which this clearly has. Therefore, if one were short at a bare minimum, the market hit a downside target and became oversold.

Conclusion

Gold is likely to drift a bit, not proving much in terms of a trend until we get past the September 17th FOMC Meeting.

Seasonally speaking, thereís often an attempt to rally in late September for prices to move up.

More important to me is that prices are close enough to the most recent lows to say that if it they are taken out, the odds favor the seasonal play is out the window and more downside can be expected. In other words, prices most hold and move higher from here to prevent a slide down toward $1000 an ounce.

Contra to what you hear on TV, the Dollar is weak, not strong. Just look at the Dollar Index chart if you need proof of that. Of course this could all change on a dime if the US Federal Reserve were to say something in the upcoming FOMC Meeting that takes the market by surprise.

I am in the camp that thinks the Fed will stand pat. I donít think the Fed has to raise rates in order to have ammunition as some fellow analystsí think theyíll need to lower them again if poor economic conditions so warrant. If anything, I think the Fed would lose considerable prestige and respectability by raising rates only to shortly afterwards have to lower them again.

If the Fedís waited this many years to move monetary policy back to a more normal track, I see nothing wrong with and frankly expect the Fed to wait until theyíre sure that events like a Chinaís slowdown, our lack of meaningful wage inflation, and other factors line up as they want them to before embarking on raising interest rates. Its nonsense to think an interest rate hike is a one off event. It rarely if ever is. Yes, the timing between hikes can be long, but in the past once the Fed made a move in one direction, it was followed by other moves in the same direction. It hasnít gone from hike to reduction.

As for gold, once the hikes begin, it might be interpreted as inflation is around the corner. Given that the Fed has met the unemployment mandate it operates under, the only other mandate open is inflation. When the Fed raises our interest rates, it should be done because inflation has arrived on our doorstep, which is the only story gold hasnít dealt with in nearly a decade. Maybe thatís the story gold needs to start moving higher.

In the meantime, why get involved until we see what the Fed does. It makes no sense given the current scenario and chart picture.

Ira Epstein

Ira Epstein Division of Linn & Associates

Local: 312 264 2805

Toll Free: 866 973 2081

Website: www.iraepstein.com