-- Published: Sunday, 13 September 2015 | Print | Disqus

Confluence of events drives renewed investor interest

Reflection #1

Tightness in the gold and silver coin and bullion markets

"My baseline is they [the Chinese] have been buying and the Indians have been buying in enormous quantities. It's virtually impossible to get physical gold in London to ship to those countries. We get permanent requests from Russia, would we please sell our physical gold to India and China. Because there is no physical, only endless promises. And I really worry that the market, that paper market, could be stamped on and people will say 'sorry we'll have a financial close out,' and it's all over."

Peter Hambro, Petropavlovsk, 9/9/2015

Editor's note: For those of you unfamiliar with Peter Hambro, he is the highly respected head of a Russian mining company and one of the world's foremost gold analysts. When you listen to this interview, your gold broker at USAGOLD will no doubt come to mind as his message runs parallel to ours.

Please see Peter Hambro's Bloomberg interview: Is gold still a safe haven asset?

"The cost of borrowing physical gold in London has risen sharply in recent weeks. That has been driven by dealers needing gold to deliver to refineries in Switzerland before it is melted down and sent to places such as India, according to market participants. '[The rise] does indicate there is physical tightness in the market for gold for immediate delivery,' said Jon Butler, analyst at Mitsubishi. The move comes as Indian gold demand picked up in July, with shipments of gold from Switzerland to India more than trebling. Most of that gold is likely to originally come from London before it is melted down into kilobars by Swiss refineries, according to analysts."

Henry Sanderson, Financial Times, 9/2/2015

|

United Kingdom's Queen Elizabeth visits the Bank of England's gold vaults (December, 2012) |

"If the calculations above are correct about the 500,000 Good Delivery bars in the London vaults whittling down to about 130 tonnes of gold that's not accounted for by ETFs and other known gold holders, and that's not accounted for by the Bank of England vault holdings, then there is surely very little available and unencumbered gold right now in the London Gold Market. . .And it begs the question, why do the dealers need to borrow, and who are they borrowing from. And if the gold is being borrowed and sent to Swiss refineries, and then shipped onward to India (and China), then when will the gold lenders get their gold back."

Ronan Manley, Bullion Star, 9/7/2015

Please see R. Manley's How many Good Delivery gold bars are in all the London Vaults?

Editor's Note: The situation we are experiencing at the moment in the gold market is reminiscent of the period around 2002 just before the gold market broke to the upside. At the time, there were shortages in London and the Bank of England was forced into sales, in my view, to cover delivery problems being experienced by the bullion banks. As the BoE selling cleared the market, the price began to rise and developed into the first leg of gold's secular bull market a long bull market I see as still in force today.

If you take the time to read Ronan Manly's lengthy article, you will see that he features the large tonnages being turned over at the refineries primarily in Switzerland. Some of that big number is probably from double counting the result of 400-troy ounce London good delivery bars being converted to kilo bars for sale principally to China, but also to India. The important point to understand is that the double counting reflects how quickly the bars are being turned over - further reflection of the super-charged velocity at work. China and India are saying, "At these prices, we will take all you've got as quickly as you can get it to us." One should not overlook the effects of stymied production, particularly in South Africa, as further complicating the physical supply-demand picture and something with which the market will have to contend in the months ahead.

Client demand at USAGOLD:

I should emphasize that, with the exception of silver Canadian Maple Leafs and a few other products, USAGOLD is not experiencing the same delivery problems often cited by other bullion firms. Due to our experience dealing with tight market conditions in the past, we stockpiled, and continue to stockpile, significant inventory in most of these items and have, for the time being, continued to operate as normal - albeit at increased premiums. Our delivery times have not changed on most products at least not as of this writing. Our position, however, could change overnight particularly when you blend into the equation the strong, industry-wide demand we are experiencing.

One of two things must happen to level this market. Either premiums to spot for both gold and silver will continue to push higher as the physical markets try to normalize the imbalance between supply and demand by setting their own prices, or the paper price will be forced rapidly higher to achieve the same end. Either way, such extreme imbalances between supply and demand cannot persist into perpetuity and will translate to the price one way or another.

I have been asked on many occasions how I would distinguish the contemporary gold market from earlier versions. The biggest change, in my view, has been the widespread, in fact, global acceptance of gold (and now silver) as viable alternatives to other forms of investment and savings. That acceptance in many instances is well-entrenched and difficult to undermine. The other change I consider to be crcuial has been the invention and growth of the world wide web as a source of information. Through it, the ordinary investor has been able to get the other side of the story on gold and for many that message is compelling. Generally speaking, the individual who buys gold and silver is not puzzled, for example, by the popularity of presidential candidates completely detached from the professional political class. This group, global in scope, simply sees declining prices as a buying opportunity an opportunity to hedge the portfolio at less of a cost. That is the psychology stubbornly and efficiently at work in the gold market today even now as you read this issue of our newsletter.

I would like to thank Koos Jansen at Bullion Star whose article, "It's virtually impossible to get physical gold in London", served as a source for much of the material republished above.

Reflection #2

Traditional IRAs, 401Ks in digital warfare's line of fire (Conversations with a spy)

"Only one person has ever been director of both the National Security Agency and the Central Intelligence Agency. That person is retired Four-Star General Michael Hayden. Recently I had the chance to talk to Mike Hayden on Capitol Hill. We were both there as part of a conclave to discuss the status of Iran-U.S. negotiations on uranium enrichment. We had a chance to talk one-on-one about my specialty, which is financial warfare, and the potential impact on investors. . . For investors, the implications of this new age of financial warfare are profound. Stock and bond markets have always been affected by wars. But the wars were fought elsewhere stocks and bonds merely adjusted in price to the new state of the world. Today, markets are not bystanders; they are ground zero. It's fascinating to meet brilliant military and intelligence officials like General Hayden who are rapidly absorbing the fact that wars are now fought in financial markets rather than on physical air, sea and land.

The military and intelligence communities are absorbing the new reality, but most investors are still behind the curve. Traditional stocks and bonds are digital assets that can be hacked, wiped-out or frozen with a few keystrokes. It's important to allocated part of your portfolio to physical assets that cannot be wiped out in financial warfare. These assets include silver, gold, fine art, land, rare stamps, cash (in banknote form, not bank deposits) and other physical stores of value. For the portion of your portfolio that is in stocks, it is helpful to consider venture capital and start-up companies where your ownership is in the form of a written contract, not a digital account. My conversation with General Hayden reinforced my already strong view that financial warfare is here and digital assets such as brokerage accounts and 401(k)s are in the line of fire."

James G. Rickards, Darien Times, 2/7/2015

Editor's note: Global economic instability is encouraging retirement planners to hedge their IRAs, 401k's, etc. with gold and silver coins and bullions. We have helped a large number of investors with their rollovers over the past several weeks and we can help you. There are two immediate considerations that I should pass along to those in the vetting process. First, make sure you select a reputable company to help you with your retirement plan. There are a good many firms out there out that push their own agenda, but usually at your expense. Second, avoid slabbed, graded contemporary gold and silver American Eagles at all costs. Most firms push these items because of the high mark-ups pricing that puts you at an immediate disadvantage. There are better, more cost-effective ways to go.

Please see: What you need to know before you launch your gold and silver IRA

Reflection #3

Key trade in gold market signals China's intentions

"In recent years, China has come to shape the very way in which commodities are bought and sold, traditionally the preserve of financial centers such as London and New York. Late last month, the price of gold fell sharply, to a five-year low, within minutes of Asian markets opening. That came after almost five metric tons of goldclose to $200 million of the metalwas sold on the Shanghai Gold Exchange, according to ANZ Bank. The trade was seen by market participants as a key moment reflecting how China had moved Asian commodity markets away from just following the overnight pattern of U.S. and European trading."

Ese Dheriene and Biman Mukherji, Wall Street Journal, 8/25/2015

Editor's note: The premise of this article is that China will continue to play a key role in shaping commodities' markets in the years to come, despite the current slowdown, based on its sheer scale. If you regularly read this newsletter, you already know of the infrastructure China is putting in place to influence the gold trade and insert itself as a third gold trading center along with London and New York. We should note that the five tonne trade cited above came after the price had dropped. Keep in mind that Shanghai is a physical market exchange. In other words, someone in China took advantage of the price drop to force the market into a delivery of five metric tonnes of the metal. You might recall too that there have been reports in the background of Goldman Sachs and HSBC looking to purchase significant amounts of physical metal for delivery around the time of the five tonne trade. Are the two events related? They very well might be. And this might be the very first signs of China flexing its muscle in the gold market in the way we outlined in our July Special Report titled, The Shanghai stock crash and China gold demand.

FYI - If you appreciate the kind of gold-based analysis you are now reading, you would probably find value in subscribing to News & Views and receiving regular issues and special reports promptly by e-mail. It comes free of charge and you can opt out of the service at anytime. Last, we will not deluge you with e-mails. Over 20,000 subscribe to this newsletter one of the best and most widely read in the field. Never miss another issue. . . Please register here.

Reflection #4

China Shanghai gold deliveries phenomenal

"August is always a weak month for physical gold moving through China's Shanghai Gold Exchange or rather it has been up until now. The big months for SGE withdrawals are normally at the beginning and the end of the year ahead of The Chinese New Year holidays, while trading in the summer months is usually thin.

But not this year! Gold moving through the Exchange this August has totalled a phenomenal 301.96 tonnes bringing the year to date total to 1,718.2 tonnes, some 219 tonnes more at the same time of year than in 2013 when China consumed a record amount of gold by even according to the consistently much lower consumption estimates by the major precious metals analytical consultancies. . .

If SGE withdrawals continue at the average rate recorded so far this year, full year deliveries though the Exchange would come to around 2,580 tonnes and this is certainly not an impossibility given that demand during the final quarter of the year usually runs strong. This figure is equivalent on its own to around 80% of global annual new mined supply at present."

Lawrie Williams, Sharps Pixley, 9/6/2015

Editor's note: The impressive China gold saga continues. The spike in demand has come, as we predicted in the Special Report back linked above, the result of the Shanghai stock market meltdown.

Reflection #5

The troubling truth revealed by the stock market's nosedive

"A recent working paper by the vice president of the St. Louis Federal Reserve Bank finds that after six years of quantitative easing that swelled the Fed's balance sheet to $4.5 trillion, 'casual evidence suggests that QE has been ineffective in increasing inflation' and only seems to have boosted stock prices. Complaints once in the realm of conspiracy theorists wearing tin foil hats are now being embraced by the Wall Street establishment. In a note to clients, Deutsche Bank analysts warned that 'the fragility of this artificially manipulated financial system was exposed' and that 'the only thing preventing another financial crisis has been extraordinary central bank liquidity and general interventions from the global authorities.'"

Fiscal Times/Anthony Mirhaydari/8-24-2015

|

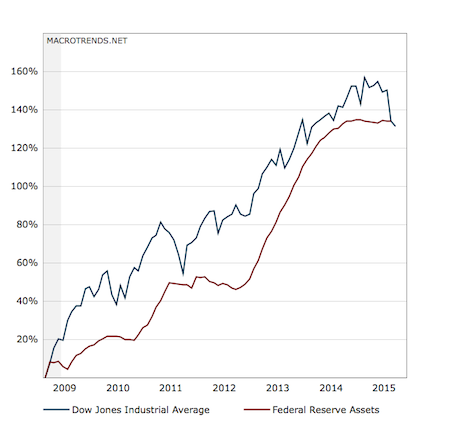

This chart courtesy of Macrotrends.net compares the percentage growth of the Dow Jones Industrial Average against the increase in size of the Federal Reserve balance sheet through multiple phases of quantitative easing (QE).

|

"Policymakers responded to the financial crisis with easy monetary policy and low interest rates. The critics including us argued against 'solving a debt crisis with more debt.' Put differently, we said that QE was necessary, but not sufficient for a recovery. We are now coming to the moment of reckoning: central bankers look naked, and markets have nothing else to believe in."

Alberto Gallo, head of credit research, Royal Bank of Scotland

"We shouldn't pass on the bill for the tasks that are facing us now to future generations. . .Being in favor of more debt and a further flooding of the markets with central bank money is neither original nor serious. Too much growth in credit does not solve any structural problems but leads to financial and debt crises."

Wolfgang Schaeuble, Germany's finance minister

"Over the past few months we have detailed the systematic deterioration in the internals of the stock market. This trend recently reached depths historically seen only near major market tops."

Dana Lyons, J. Lyons Fund Management

"One thing I learned from Dow Theory is that once the primary trend starts its course, nothing will stop it. The primary trend of China and the world economy has turned negative, much to my disappointment. I believe the primary trend of the stock market and the economy has also turned down."

Richard Russell, Dow Theory Letters

"The printing of money has a very limited impact on creating wealth."

Marc Faber, The Gloom, Doom and Boom Report, 9/2/2015

"Uncertainty should not bother you. We may not be able to forecast when a bridge will break, but we can identify which ones are faulty and poorly built. We can assess vulnerability. And today the financial bridges across the world are very vulnerable. Politicians prescribe ever larger doses of pain killer in the form of financial bailouts, which consists in curing debt with debt, like curing an addiction with an addiction, that is to say it is not a cure. This cycle will end, like it always does, spectacularly."

Nassim Nicholas Taleb, Absolute Return, 8/11/2015

For details:

The troubling truth revealed by the stock market's dive by Anthony Mirhaydari, The Fiscal Times (8/24/2015)

Internal combustion: Anatomy of a market top by Dana Lyons, J. Lyons Fund Management (9/4/2015)

Current Federal Reserve policy under the lens of economic history by Stephen D. Williamson, St. Louis Federal Reserve (July, 2015)

Editor's note: Stock bourses around the world are falling because business conditions and prospects are worsening everywhere a situation alarmingly more like the 1930s than 2008. Compared to what is happening in the world economy and financial markets today, 2008 was a provincial crisis a second rate breakdown. Combine that scenario with concerns that the Federal Reserve might have hit a wall with respect to policies to alleviate the situation and there is little left to persuade nervous investors that things are going to get better anytime soon. If the Fed were to raise interest rates under these circumstances, it could turn out to be its greatest blunder since it tightened money and credit in 1928 and 1929.

Reflection #6

Vanishing Act: U.S. banks moved billions in trades beyond Washington's reach

"The lobbying blitz helped win a ruling from the CFTC that left U.S. banks' overseas operations largely outside the jurisdiction of U.S. regulators. After that rule passed, U.S. banks simply shipped more trades overseas. By December of 2014, certain U.S. swaps markets had seen 95 percent of their trading volume disappear in less than two years. While many swaps trades are now booked abroad, some people in the markets believe the risk remains firmly on U.S. shores. They say the big American banks are still on the hook for swaps they're parking offshore with subsidiaries."

Charles Levinson, Reuters, 8/21/2015

Editor's note: As noted, the derivatives positions moved offshore, but the systemic risk remains in the United States. In the event of another meltdown, the "big five" banks will be directly affected and the federal government and Federal Reserve will be called upon once again to socialize both the risks and their effect. Too, the very same specific instruments at the root of the 2007-2008 financial breakdown are alive and well in banking subsidiaries situated offshore and out of the reach of regulators. The Bank for International Settlements puts the outstanding amount of over-the-counter (private contract) derivatives at notional $630 trillion as of December, 2014 down from $710 trillion in 2013. (Yes, you are reading that correctly.) Of that total, interest rate derivatives were the largest component at $505 trillion. In other words there is plenty of exposure to stoke the concerns of central bankers. For the individual wondering whether or not the present systemic risks are something to worry about, this Reuters article will serve as a functional tutorial. Warren Buffett once referred to derivatives as "timebombs" and "financial weapons of mass destruction."

The story of how Wall Street's giants got around the derivatives rules

Reflection #7

How Washington will try to rig the stock market

"One of these mornings or overnight some mysterious buyer will suddenly start purchasing an abnormal amount of Standard & Poor's 500 stock index futures. So we get down to direct intervention just like China did. Only Washington, with Wall Street as its co-conspirator, won't be as sloppy as Beijing was. That'll get the stock market moving higher and everyone will pretend that the buyers are just ordinary people who suddenly think Wall Street is oversold."

John Crudele, New York Post

Editor's note: Since China launched its "patriotic fight" to save its stock market in early July, the Shanghai Exchange has dropped an additional 20%. If the inclination of the market is to correct, no amount of artificial propping is going to turn it around. Sooner or later the real market asserts itself.

Reflection #8

Quantitative tightening

"It is neither the sell-off in Chinese stocks nor weakness in the currency that matters most. It is what is happening to China's FX reserves and what this means for global liquidity. China's actions are equivalent to an unwind of QE or, in other words, Quantitative Tightenting."

George Saravelos, currency strategist at Deutsche Bank

Editor's note: This quote accompanies news that China unloaded $93.9 billion in currency reserves in August, a record. One wonders how much of its reserves China is willing to surrender in order to boost the yuan and stem outflows, particularly when market forces seem caught up in enforcing the currency's downtrend. Might be best to simply step out of the way and let the market sort this out on its own. Remember, it was China's devaluation of the yuan that drove gold higher a couple of weeks ago. Quantitative tightening is a new term in the financial lexicon and something few analysts considered until the release of Saravelos' work at Deutsche Bank. The net effect in an already illiquid bond market would be to drive the 10-year Treasury rate higher a disinflationary outcome and another reason to be cautious about raising rates at this time.

Reflection #9

Cramer says gold is the best insurance policy for your portfolio

"'I think that 10 percent is the upper limit because I consider gold as an insurance policy, and no worthwhile insurance policy should be 20 percent of the money you have invested,' the 'Mad Money' host said. Cramer recommends gold because it tends to go up when everything else is going down. It is the investors' insurance against geopolitical events, uncertainty and inflation. Granted, this may sound like a terrible idea since gold has not done anything spectacular in a few years. However just as you wouldn't own a home or car without insurance, you shouldn't have a portfolio without gold."

James Cramer, CNBC, 9-3-15

Editor's note: OK. Cramer's on board. All's well. At USAGOLD, we recommend 10% to 30% gold diversification depending on your level of concern about the economy, the current state of the equity markets, financial system, etc. Also, we would extend the hedging capability beyond inflation only to cover deflation, disinflation and stagflation as well. Gold protects against any and all and no matter in which order they arrive. Cramer is right about one thing. There were a good many among our clientele who found themselves in a peculiar position post-Lehman Brothers collapse. The gold portion of their portfolio had come to represent 50% or more of the total due to the decline in other markets and the gold's strong price performance. We had a number of clients call to say that they were liquid enough to buy more gold but were having difficulty pulling the trigger because it already represented such a large proportion of their investment portfolios.

______________________________

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of News & Views, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion.

Disclaimer - Opinions expressed do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

| Digg This Article

-- Published: Sunday, 13 September 2015 | E-Mail | Print | Source: GoldSeek.com