The surprises are going to the upside for gold, and that is obviously a change in behavior. The miners are roaring higher and are outside of their Bollinger Bands for multiple days, a sure sign of strength. Up until very recently, the Investor Cycle had showed us relatively little to get excited about. But suddenly, eleven weeks into the Cycle and right where you would have expected it to turn lower, gold has found yet another gear.

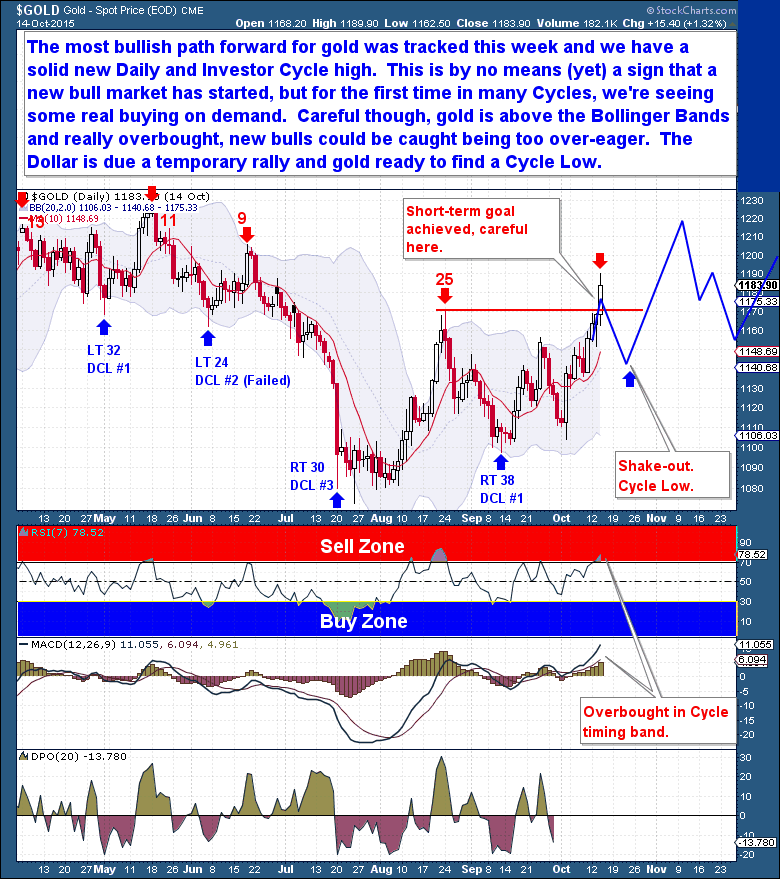

The most bullish path (from a number of possibilities) has resolved itself this week and we have a solid new Daily and Investor Cycle high. This is by no means (yet) a sign that a new bull market has started, that type of conclusion can only be reached with consecutive higher highs at the Investor Cycle timeframe. I like how the sector has performed here, but let’s not forget that all commodities are doing well with a sharply lower dollar. And for those with short term memory issues, let’s not forget that gold has a habit of drawing in the gold bulls before unleashing another wave of selling.

However, we do have a monthly Swing Low in play now. Possibly for the first time in years, we’re seeing some real buying on demand, as opposed to counter-trending and forced short cover buying. The highs this week have come on week 12, the furthest any Investor Cycle has reached since 2011, and there is potential for further gains now that this is likely a Right Translated Investor Cycle.

In the short term though, some caution is warranted. Gold is well above the Bollinger Bands and significantly overbought. From a Daily Cycle timing standpoint, we’re deep into the Cycle and ready to begin a move towards the DCL. Even if the recent October 2nd Low marked a shortened Daily Cycle Low, gold in that case would still be ready to move lower into a Half Cycle Low. The point being, social media is suddenly a buzz over gold and a “new bull market”. Everyone is suddenly jumping back in here after an already extended move higher. This is setup to teach the bulls a little trading lesson and to catch them being a little too over-eager. Beyond a possible shake-out, the gold Cycle look very encouraging and a transition away from a bear market could be developing.