-- Published: Thursday, 29 October 2015 | Print | Disqus

By Daniel R. Amerman, CFA

With comparatively little fanfare, Fidelity Investments has announced that 100% of their $115 billion Cash Reserves fund, the world's largest money fund, will be invested in US government debt by December 1st of 2015. It is expected that many other money fund companies will also change their policies and invest only in US government and agency securities, because of a change in regulations that will occur in 2016.

Since 2010 the US government has been implementing a textbook example of Financial Repression, when it comes to using private savings to control and even effectively pay down the size of the national debt. Far from slowing down or ending this process, these new policies will expand by many millions the number of people who will effectively be forced to fund the purchase of government debt at artificially low interest rates.

Tightening The Controls On Savers While Lowering Their Returns

As explored in the tutorial "Is There A 'Back Door' Method For The Government To Pay Down The Federal Debt Using Private Savings?" (link here), Financial Repression is an economic process that has been used by many nations around the world to quite successfully reduce the effective size of their national debts relative to their economies, in a manner which the average saver/voter never has understood and likely never will.

The core of financial repression is to create a "negative real interest rate" where interest rates paid are below the real rate of inflation. Over time, savers then lose real wealth as financially modeled here.

While this is highly effective, it does require the public being forced to participate. Whether they realize what is happening or not, if given a choice, any rational person would of course choose to try to avoid these very low interest rates that do not keep up with the rate of inflation and which steadily erode the purchasing power of savings. In other words, not only does an uneven playing field need to be created, but a series of fences need to be put around the field, to keep the savers from escaping.

There are several traditional types of fences that were common in the economies of the West between the end of World War II and the early 1970s, and that have reappeared since 2010. The first of these fences is to encourage or mandate participation by financial institutions.

Most people do not directly own US government debt. But they do keep their money at banks and other financial institutions. The goal for a national government is that if the financial companies can be made to invest the public's money in government debts, then the public has effectively funded the government, even though they do not realize this is happening.

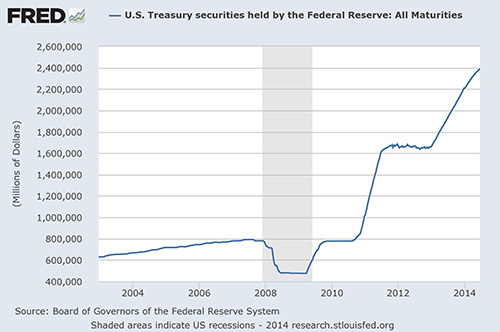

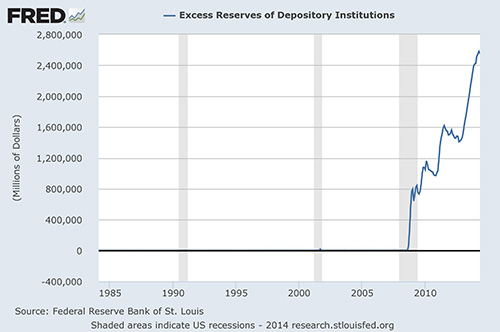

When we look at quantitative easing and the approximately $2.4 trillion dollars in US treasuries that are being held by the Federal Reserve – and are funded by excess asset reserves from the banking system – we have a classic example of the public unknowingly funding the government at extremely low or even zero percent rates.

What happens is that anyone who has a savings account or interest-bearing checking account at a financial institution receives almost no money from their savings, because the financial institution uses their money to make loans to the Fed (in the form of excess asset reserves), for which it receives almost no income, and the Fed uses that borrowed money to buy US government debt, for which it receives very little income.

Effectively the saver lends to the bank, which then lends to the Fed, which then lends to the US government at an extremely low interest rate. As the financial institution and the Federal Reserve are each only intermediaries, they can be netted out, and it is the US savers who provide $2.4 trillion worth of extremely low rate funding to the US government.

The savers have no idea they are doing this, but the overall situation is a matter of quite deliberate design. Indeed, creating that exact relationship is one of the main objectives of Financial Repression.

However, up until now investors were able to partially "escape" the state of Financial Repression by not saving in government insured banks, and instead placing their savings in money funds. This was only a partial escape, because the money funds are generally mostly invested in government debts. But not entirely invested. Instead there is a good possibility that the fund manager was picking up just a little bit of yield by partially investing in high quality, short term, non-governmental debts.

In other words, the fence was mostly complete - but not entirely complete. Per the Wall Street Journal article linked below, about $1 trillion out of the $2.7 trillion in money fund industry assets was still able to leak out and go to places besides the federal government. That loophole will be closed during 2015, and another trillion dollars of the US national debt will be funded at almost no expense - which will also just happen to cover those inconvenient sales of US Treasuries by China.

Part II: Mandated "Safety" Raises The Fence

Part II of this article explores the other classic, textbook feature of Financial Repression which can be found in the upcoming change of regulations for the money fund industry - asserting that safety is the reason for the change, and that the forced use of private savings to fund the national debt at essentially no cost is the protective act of a caring government which is being done for the saver's own good.

Continue Reading The Article

Contact Information:

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: dan@danielamerman.com

This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

| Digg This Article

-- Published: Thursday, 29 October 2015 | E-Mail | Print | Source: GoldSeek.com