-- Published: Friday, 4 December 2015 | Print | Disqus

By Gary Tanashian

Euro 50 Flips Draghi the Bird, S&P 500 Fails at a Key Parameter, Semi’s are Fundamentally Bearish and Gold Has a Sentiment Washout Within its Bear Market

Markets Had Been Obedient, Until Today

Despite Janet Yellen’s protests to the contrary, the 7 year long asset market bailout (ZIRP + QE’s 1, 2 & 3 with a side of Operation Twist) has served to further enrich formerly troubled asset holders and provide a handy wealth effect for regular 401k holders to boot.

It’s great as long as things stay so symmetrical that even a linear-thinking, professionally trained economist can understand it. Indeed, Mario Draghi has been implementing a ‘me too!’ QE plan in Europe in order to more or less ape the success that is the US bond market err, management program. Fed Funds interest rates at zero, pinning T bill yields to the mat and encouraging banks to borrow for free and lend at interest, Quantitative Easing in various forms sanitizing inflation signals and literally painting the macro backdrop as desired. It all seemed so easy, so unquestioned by the market.

There have been no obvious repercussions… until today. The Fed had previously been able to print US dollars aplenty to buy distressed MBA and Treasury bonds (before finally terminating the operation) and hold interest rates at ZERO, years into an economic expansion ostensibly to bail out regular people. Get this, it was institutions from Wall Street banks to mortgage companies to asset speculators to the Fed itself, that created the edifice of debt and leverage that fomented the “Great Recession” (a nice nickname, implying it is safely in the past) and now Janet Yellen argues that the Fed was acting to protect regular people by denying them their interest on savings? That’s a good one.

Moving on, I listened to her speak today and as I thought about Ben Bernanke, I think she comes off as a decent sort. But the all-knowing, all-powerful status that market participants (including the black boxes, which I assume are programmed not to question) have assigned to these people is incredible. In my opinion, official policy makers are the same dullards they have always been, but a hallmark of the post-2011 phase has been ironclad confidence in the Federal Reserve. It can’t all be black boxes, can it? Let’s call it a financial fascism, which has gripped the markets and served the Fed’s agenda very well.

Until today. Today the Euro STOXX 50 flipped Mario Draghi the bird, the Euro launched and the US dollar, despite the well-telegraphed US rate hike set for December 16, got harpooned. Maybe it was just a contrary play in the markets, putting the now-bloated deflation/dollar bull camp off sides (USD is in a cyclical bull market, after all) in a massive display of Euro short covering and corresponding USD selling.

But then again, maybe it was something more. Maybe it was something impulsive. The Fed may be a collection of linear-thinking economists, but they are not stupid. Indeed, Ms. Yellen talked today about not getting too far behind inflation signals that may be beneath the surface. Today may have ripped the face off of the deflationary facade that has served Goldilocks (here in the US) so well.

The markets were ostensibly underwhelmed by the scope of Draghi’s move and this was probably a ‘sell the news’ event. We had projected a likely reaction or correction in the USD in an NFTRH update earlier in the week and now here it is. We have set chart support parameters and will simply do what we always do in markets, tune down the noise (like that above) and simply manage. So let’s do a little bit of that now.

Market Talk

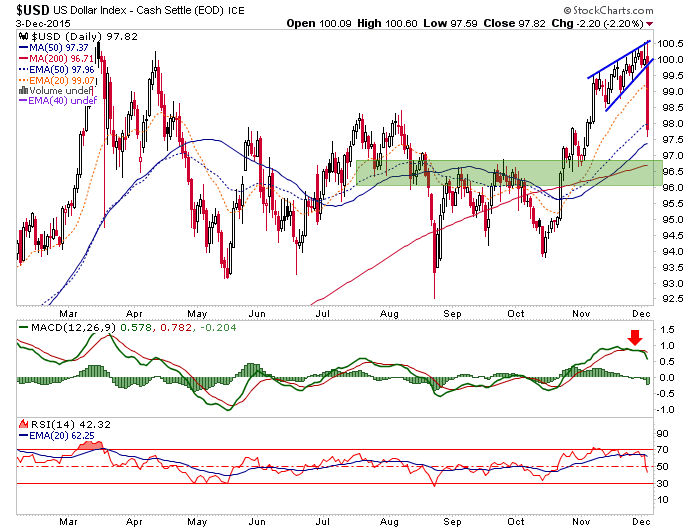

While USD was still in its wedge, we projected initial support at 96.50 to 97. Here is the chart from that update with support now drawn in, expanding the range a bit. The Euro is of course, doing something completely opposite.

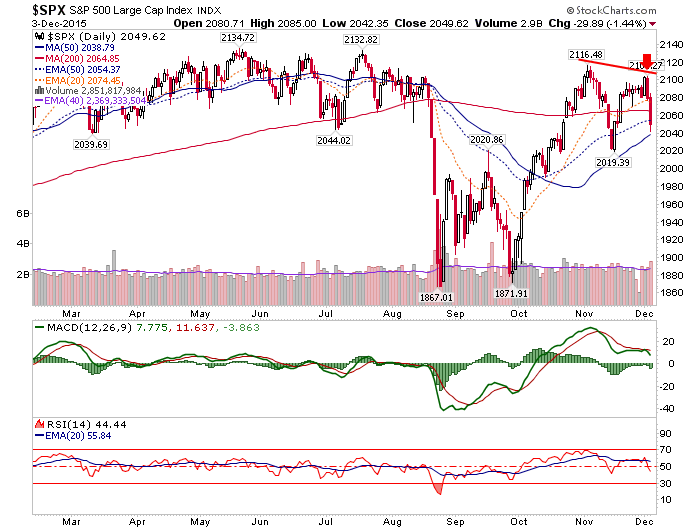

Despite this being Draghi day, what I found really interesting is what the US stock market did. From the same NFTRH update yesterday…

“SPX should not make a higher high to the late October high of 2116.48 and close the week above it, or the bear case takes a big step backwards, in the short-term at least.”

When the stock market was up fairly large in pre-market (pre-Draghi) this morning I though “hmmm, really?” Well no, not really. NFTRH subscribers have been consistently advised that the favored plan is bearish on the US stock market, with the less favored but viable ‘manic up’ if SPX made a higher high to November. Well boyz, close but no cigar. A rise and weekly close above 2116.48 was the parameter and the bull case got hammered before it could be registered.

Maybe this was not so surprising given the dominance of bull stories (from the official start of Santa rally season to the November-April bull seasonal to an old chestnut, a bullish Coppock Curve signal) in the media. The media it seemed, was loving to be bullish and that is not a good thing if you are a bull. Still, the failure at or below 2116.48 was needed to keep these bull spirits at bay. So far so good.

Indeed, I took a bull trade (GILD, stopped out for limited loss) and a bear trade (LRCX, ongoing) last week per ideas highlighted by NFTRH+. Well, out of the gate they made me look pretty dumb as my bull, GILD was the subject of political muck raking and dropped, and my bear, LRCX (short) of course went up. You’ve got to love the markets for their ability to humble every one of us.

We highlighted some bad Semiconductor sector fundamental news in NFTRH updates and the weekend report. This ranged from Semi equipment (as supplied by LRCX, AMAT, etc.) book-to-bill data that showed a big drop off in bookings to decelerating world-wide shipments of Semiconductors to best of all, proprietary information from my former associate that things were quite bad. Why did I give his input such weight? Well, he was the source of our critical information in January of 2013, indicating that the sector was ramping up and compelling me to get NFTRH promptly into the economic growth camp. Manufacturing in general soon followed and finally, the economy and ‘jobs’. Why, even those conventional, linear, mainstream economists eventually caught on to the trend they now tout so vehemently.

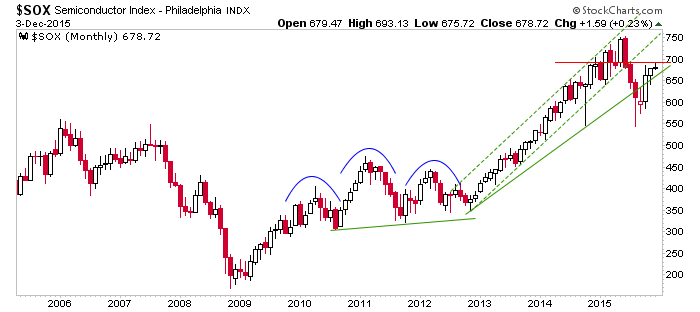

I am all too human, so when I see TA website after TA website guiding us bullish on the Semi’s I second guess myself; in a healthy way I think. I am a TA after all. But I am also a macro funda and what the TA fly boyz don’t understand is that you cannot fly by charts alone. No way, not in this market. That is why we set parameters and probabilities, as with SPX above. As for the SOX, this is how I viewed it per yesterday’s update…

“I continue to believe the semiconductor sector is setting up to disappoint those who buy it as a momentum-based market leader. That is due to fundamentals we discussed previously. As also discussed, the technicals have been indicating otherwise, with a measured recovery target of 700 to 710 still in play. SOX has taken out the October high and can continue higher to the target, the June gap around 720 or even a test of the highs. This continues to look like a setup for a shorting opportunity, but it is important to realize that you can be right for extended periods before the market votes that way in its pricing. I am trying to exercise extreme patience here. I still hold an initial short on LRCX and have not decided yet whether to obey stops or hold in a gung ho longer-term bearish manner. For the purposes of our updates, let’s just generally consider the funda vs. the technicals for the sector itself.”

The recovery target has been in play since September. Today SOX hit 693.

I not only held short on LRCX, I initiated short against AMAT (which NFTRH+ had successfully called long on October 22) and MKSI while they were both green yesterday. This with the idea that things could be rough on those positions if the market chose ‘manic up’ for the short-term, as would have been indicated by a weekly close above SPX 2116.48.

Of course, the bear case is not yet proven in the markets. Today markets sold the news in European stocks and bought the news in the Euro, sold the news in USD and just sold US stocks, keeping the bear case in play as the favored scenario, by a whisker. I am not declaring victory in my Semi equipment shorts but I’ve got time, because I’ve got macro fundamentals on my side, not just a bunch of squiggly lines called stock charts.

We talk so much about the Semi’s because they led this cycle. More specifically, their fundamentals led this bull cycle while the chart was still looking highly suspect, just beginning to negate a bearish pattern. Here look at what was going on in late 2012 and early 2013 per this monthly chart we used in another NFTRH update, which has been unlocked if you’d like to review it.

“Until proven otherwise, I am going to assume that today’s bullish activity in the Semi’s and elsewhere is just Wall Street being what it is, a trend follower. Here I am using our own correct view that 3D Printing was a scam in 2014 and indeed, that Semis were bullish 3 years ago as guides. Those views used fundamental analysis, not technicals. The same goes for a developing bear view on the Semis now.

As to the chart of the SOX, 700, which was the rough target of the bottoming pattern (by daily chart) that formed off of the summer’s bear hysteria, is the measured target and also very key resistance. I’ll respect technicals, but fundamentally (again, putting the Fed to the side for a moment) there seem to be some fundamental bear themes cropping up in the US economy and markets.”

This post intended to cover the gold sector as well, but folks, I am beat. Gold is in a bear market and gold is also in a bounce setup per this post a couple days ago: Gold Contrarian Indicators Very Bullish Now. Also, this most hated sector is going to come ripe for a long trend trade at some point. The fate of stock markets and economies will play directly into the prospects for this.

Let’s get through jobs tomorrow and proceed to simply manage the markets in a rational way. For me, when it becomes less manageable for a majority it seems more manageable. Until today, things had been all too manageable for the linear, conventional contingent.

NFTRH.com and Biiwii.com.

| Digg This Article

-- Published: Friday, 4 December 2015 | E-Mail | Print | Source: GoldSeek.com