-- Published: Wednesday, 9 December 2015 | Print | Disqus

By Justin Smyth

Despite widespread pessimism, apathy, and derision towards the sector, gold and gold stocks present an extremely rare opportunity. Gold stocks are on track to record 5 years of losses starting in 2011 with the $HUI gold bugs index plunging 84% percent from 2011 to 2015. Gold is on pace to put in a 3+ year bear market with 3 years of losses. But the utter destruction in this sector is what has created an awesome opportunity. The only question is the timing of when this can be capitalized on.

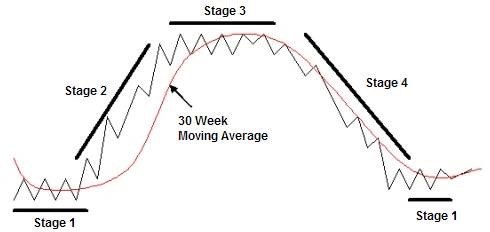

Stage 4 bear markets are what create massive opportunities for upside gains and new Stage 2 bull markets. A bear market causes investors to panic out of a sector. Selling begets more selling until finally the sector bottoms out as sellers become exhausted. After a bear market a Stage 1 base forms which is a period of disinterest in a sector as investors favor other sectors. The sector may remain “cheap” and drift sideways for a long period of time, from months to even years.

When enough investors come back into a sector to force a breakout of the Stage 1 base a new bull market is born. This is the most exciting and profitable time to enter into a position in a sector. At this point the sector is still “cheap” because of investor disinterest, but it is now being bid up in a new and often explosive trend higher. This produces massive gains for those brave enough to enter early. They are usually looked at with skepticism buying into a beaten down asset class early in an uptrend. But this healthy skepticism is what fuels the climbing of the “wall of worry” that is a hallmark characteristic of a new bull market.

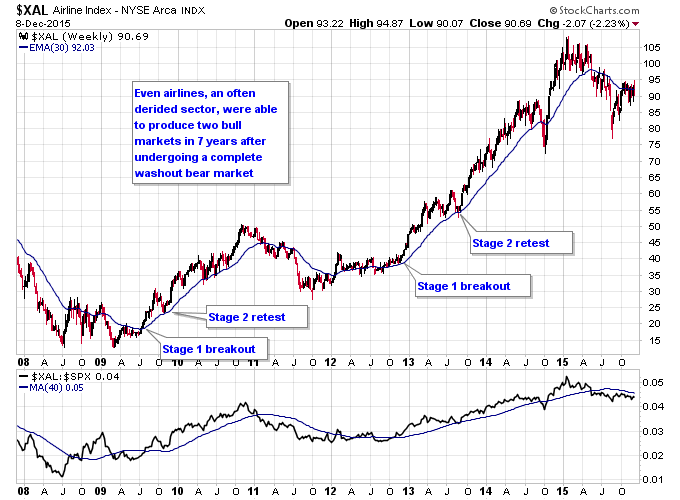

For an offbeat but instructive example of how bear markets produce incredible opportunities consider the airlines sector. From the early 2000s until the depths of the financial crisis in 2009, the airline sector as represented by $XAL declined by roughly 90%. Airlines had been a terrible investment for a long time, and with oil seemingly in a perpetual bull market airlines appeared to never be a good trade. But counter-intuitively the destruction in the airlines sector is exactly what created the massive opportunity airline stocks have been the past 7 years.

As you can see below airlines broke out from a Stage 1 base in 2009 and proceeded to more than double over a year and a half period up until 2011. Then after enduring a mini-bear market from 2011 to 2012 airlines once again broke out into a Stage 2 uptrend in early 2013 and almost tripled over a 2 year period until early 2015. Some airline stocks performed far better, producing 5-fold and even 8-fold returns if purchased early when everyone was ignoring this formerly loathed sector.

One problem with Stage 4 bear markets is they produce false breakout attempts. Every countertrend rally that fails leads to the next downleg in a bear market. Only the last countertrend rally that holds and forms the first higher low is the real breakout attempt that produces the new Stage 2 bull market.

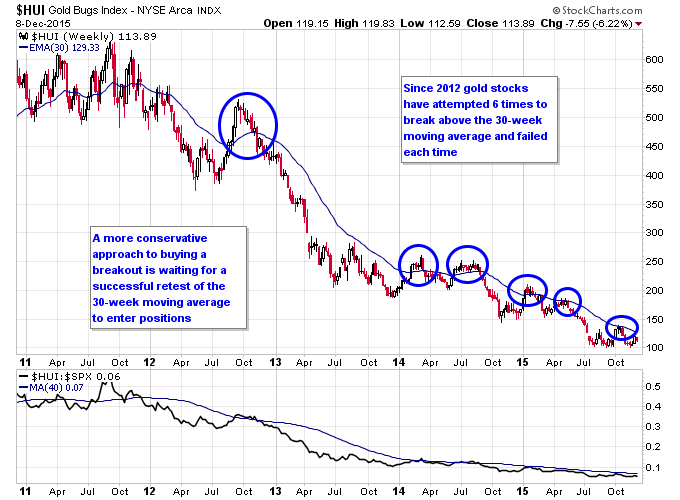

Gold stocks have had many false Stage 2 breakout attempts during their bear market. Most notable were 2 attempts during 2014 where gold stocks traded for multiple weeks above the 30-week moving average before falling back below it. Gold stocks have made 6 attempts since 2012 to move back above the 30-week moving average and each attempt has failed and produced another leg lower in the bear market.

One way to filter out false breakout attempts is to wait for a re-test of the moving average in order to confirm that the breakout higher is real. Waiting for this signal alone would have kept a trader out of the gold market and away from the damage of a Stage 4 bear market for the last few years.

After 5 years of a bear market and 6 failed breakout attempts, gold stocks are perhaps the most loathed they've ever been. But the reality is that a cyclical sector such as gold will never remain out of favor perpetually. Just as many would have believed that airline stocks would never make a good investment, those that shun gold and gold stocks will miss out on the eventual bull market that will be reborn. They key is waiting for the opportunity to occur and being recognizant enough to take advantage of it.

Checkout my new Stage Analysis Screening Tool at: http://screener.nextbigtrade.com

Twitter: @nextbigtrade

The original article and much more can be found at: http://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.

| Digg This Article

-- Published: Wednesday, 9 December 2015 | E-Mail | Print | Source: GoldSeek.com