-- Published: Wednesday, 16 December 2015 | Print | Disqus

By Gary Tanashian

We have noted anecdotally that there is a creeping inflation in the system. It does not show up in commodities, which are in a post-bubble (ah, the good old ‘China story’ that was so vigorously promoted to a degree that would make a gold bug promoter blush) melt down. Crashing costs like that are providing the Goldilocks-like balance to rising costs within the economy.

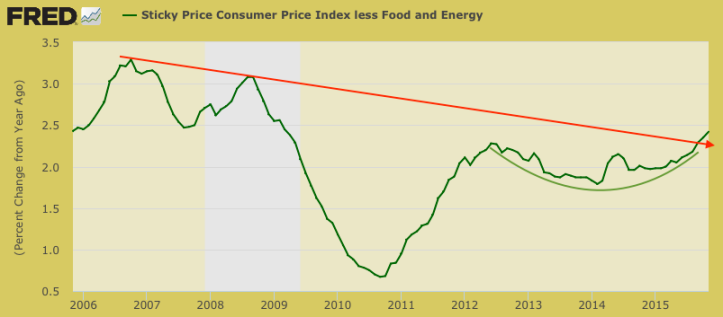

This morning, the highly recommended Daily Shot had among its macro graphs a look at the “sticky” consumer price index. That got me to go over to the St. Louis Fed website and pull a couple different views of it. First, here is SLF’s description of the sticky index…

“The Sticky Price Consumer Price Index (CPI) is calculated from a subset of goods and services included in the CPI that change price relatively infrequently. Because these goods and services change price relatively infrequently, they are thought to incorporate expectations about future inflation to a greater degree than prices that change on a more frequent basis. One possible explanation for sticky prices could be the costs firms incur when changing price.”

These could be considered the embedded costs within the economy, like the steady upward march in healthcare or my trash collector’s price increases due to administrative and regulatory issues built into this particular service (despite dropping fuel costs).

Is this one of the graphs the Fed is eyeing as it prepares to initiate a rate hike regimen? That’s a bullish looking breakout in sticky costs. How long can the commodity crash and associated Goldilocks be ridden? I think the Fed is rightly in anticipation mode.

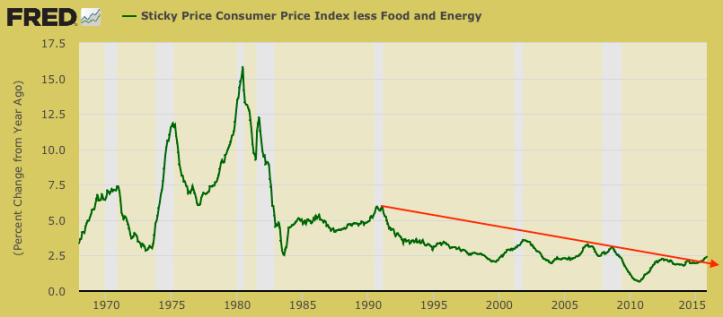

Here’s the longer-term view…

The meltdown in 2008/2009 dropped prices throughout the economy. Certain costs have been on an incline since then and these graphs show the potential for much higher levels. And then what if commodities actually bottom for a big bounce or cyclical rise? The Fed is right to be preemptive* about the possibilities of the inflation that they have tried so hard for years to promote.

Cue the roosting chickens.

* Sticking with the barnyard theme, one might argue that the horse is already out of the barn.

NFTRH.com and Biiwii.com

| Digg This Article

-- Published: Wednesday, 16 December 2015 | E-Mail | Print | Source: GoldSeek.com