-- Published: Thursday, 31 December 2015 | Print | Disqus

THIS CHART IS REGULARLY IN GORDONTLONG.COM’S MONTHLY MATA REPORT

THE QUESTION TO CONSIDER IS HOW YOU WILL MAKE MONEY WHEN THE CRACK-UP BOOM ARRIVES?

… OR HAS IT ALREADY ARRIVED?

1- VENEZUELA

As Zero Hedge Reports: Consider Venezuela

It’s that time of year again. When hindsight is 20/20 and coulda/woulda/shoulda gives way to reality. With the US equity market barely able to keep its head above green water, a look around the world shows investors could have done a lot better (or not).

In fact, as Handelsblatt shows, the best investment in the world in 2015 would have been – drum roll please – Venezuelan stocks!

Note – these returns are from a EUR-denominated persepctive

So – that proves it – buying stocks during hyperinflation “works” and protects your purchasing power, right?

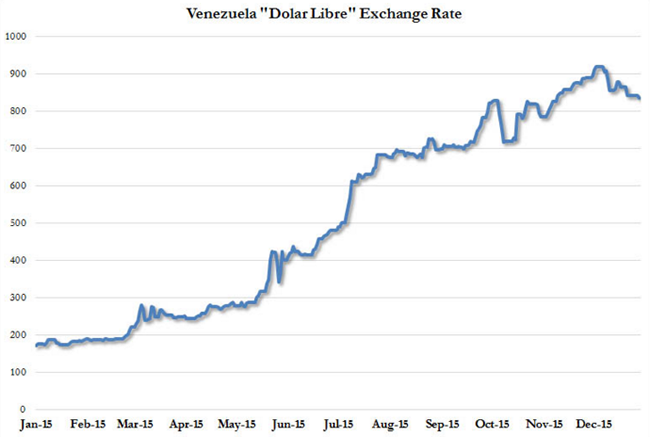

Not so fast! While Venezuela’s official spot Bolivar rate has been flat at 6.2921 all year as Maduro dreaded the admission that his nation is in utter collapse, the “real” exchange rate – or ‘Dolar Libre’ Rate – has been crashing…

Which means, if you wanted to “invest” in Caracas Stocks last year (by moving your USD into Bolivars, buying stock, then moving your “gains” back into USDs to bring home and celebrate), things look a lot different.

From a 287% gain, you would have actually lost 22% of your initial USD stake!

So sorry, hyperinflation does not pay after all!

Still, The Fed, ECB, BoJ, PBOC will keep playing the ‘inflate’ and debase game until they are all proven wrong.

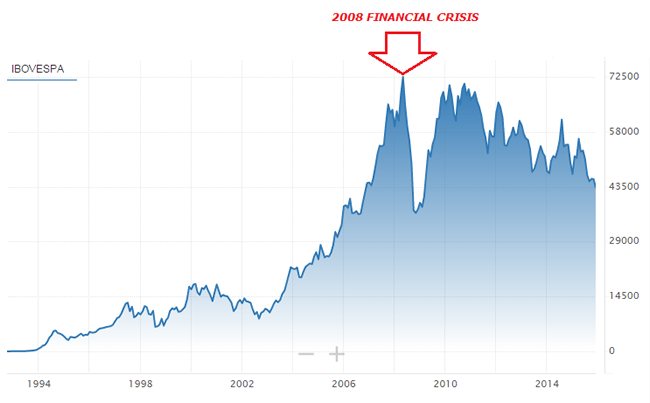

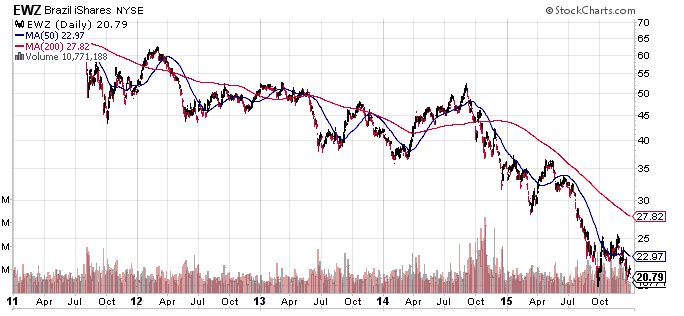

2- BRAZIL

Let’s also consider Brazil. Brazil was an investment darling as hot money flooded into Brazil prior to the 2008 Financial Crisis and the Commodity boom exploded with China’s emergence as a global manufacturing giant.

However, things haven’t been so good since the Financial Crisis and 2010 as China began to slow. Recently things have only gotten worse as government corruption and failed policies surface.

Following recent strength on the heels of hope for a new finance minister, news that Ruosseff has sent the minimum-wage-hike Bill to Congress appears to have crushed the hype of any fiscal rectitude and sent Real tumbling. Down over 4% – the most since September 2011 – BRL is back above 4.00 per USD, giving up all the recent gains.

Broad weakness in EMFX…

Seems to have been exacerbated by:

- *BRAZIL ROUSSEFF SENDS BILLS ON CIVIL SERVANT WAGES TO CONGRESS

A Bill that could cost BRL 4.77 billion, wrecking hopes of any improvment in the fiscal situation. As Bloomberg reports,

Brazil’s bigger-than-estimated minimum wage increase and potential credit expansion make it harder for govt to control around 11% on year inflation and cut budget gap, Marcelo Schmitt, portfolio manager at investment firm Sul America, says in a phone interview.

These initial policy steps after Barbosa replacing Levy as finance minister are concerning, says Schmitt.

And so…

This is the biggest drop in BRL since September 2011.

Charts: Bloomberg

HOW HAVE BRAZILIANS DONE AFTER THE BIG RUN UP WHEN DENOMINATED IN “BOGUS” USD?

THE DEVASTATION – FROM 65 TO 20!

A CASCADING CRACK-UP BOOM

The Crack-Up boom is already underway in many of the peripheal nations of the world. It is more about a cascading series of events. The story in all the peripherals is similar to both Venezuela and Brazil. The only way to make Money in the Crack-up Boom is in the US$, remembering the US Dollar will be the last to fall while globalized Crack-Up Boom is underway. However, the US$ will eventually fall.

It may be subtle but what is happening is Emerging Market Wealth is being pillaged around the world via “Exorbitant Privelege” and a fictitionally valued US$. This is the greatest “Debt for Equity” Swap in history. M& A activity has exploded as overvalued US stocks (due to buybacks and borrowing to pay dividends) is used as “currency” in this M&A binge.

The real question is where is the crack-up boom occurring today and most importantly, how will you keep your wealth after the Cascading Crack-up Boom ends and the US Dollar inevitably collapses?

| Digg This Article

-- Published: Thursday, 31 December 2015 | E-Mail | Print | Source: GoldSeek.com