-- Published: Friday, 8 January 2016 | Print | Disqus

By Gary Tanashian

It is important to distinguish the ‘back end’ from the ‘front end’ of the economy or else all you end up with hype emanating from the financial sphere every time an economic data release comes out. For example, I was critical of Martin Armstrong’s post, Is the recession Starting? in a rebuttal post, Armstrong 3+ Decades Late on Manufacturing because Marty’s post not only brought back some jaw droppingly old fashioned concepts about US manufacturing (JiT and automation replacing labor) but it focused only on the ‘front end’ of the economy, affirming the “ECM” in a short info-blurb.

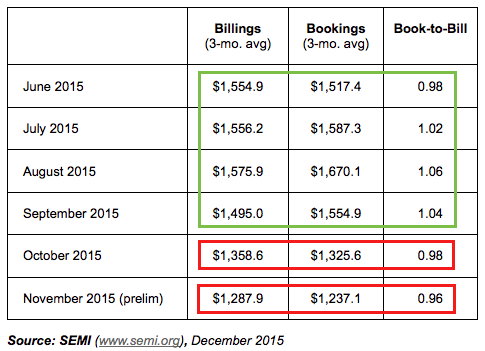

While we caught the downturn in manufacturing ahead of time (July) and also have been on the sharp deceleration in Semiconductor bookings and billings (a two month trend now), these Canaries in the Economic Coal Mine are just front end clues. Meanwhile, as we have been noting for months in NFTRH, the back end, with a strong US dollar at its back, has been doing just fine.

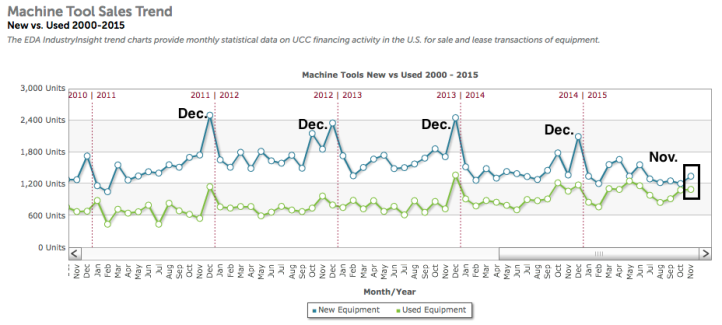

Before proceeding to the BLS Payrolls report, let’s shoe horn in a little extra data from the manufacturing sector. Machine Tool unit sales have been very bad for most of 2015. In November a little up turn happened. Call it a foothill to a would-be mountain that, like clockwork, happens in December. So economic bears, do not fret if it comes about. It is simply would-be buyers waiting until the last minute before deploying Cap/Ex for ‘tax incentive’ purposes. From EDA (markups mine).

This Machine Tool sales data had better bump in December or else things would be indicated to be going the way of, well, just ask the miners and energy extractors circa 2014.

Finally for this interlude to what was going to be a simple ‘Payrolls’ post, for related reasons I would not be surprised to see the December SEMI Book-to-Bill data get a little bump in December. But that is not nearly the ‘like clockwork’ thing that Machine Tool sales are. Here again for review, is the latest reading from SEMI (markups mine).

Back on message, from the BLS release, here is really all you need to know about the report.

Total nonfarm payroll employment increased by 292,000 in December. Employment rose in several industries, including professional and business services, construction, health care, and food services and drinking places. Mining employment continued to decline. In 2015, payroll employment growth totaled 2.7 million, compared with 3.1 million in 2014.

The economy continues to service itself quite nicely. I really hope FloatingPath will get itself back up and rolling because I miss Nick’s handy employment graphics, which we had shown for many consecutive months in NFTRH to have been in unbroken trends. That would be services (in which I include construction, as it is a product of the service economy) up and manufacturing and mining flat or down.

If however, the Canaries in the Coal Mine work in reverse fashion to their late 2012/early 2013 status as early economic indicators, the clock is ticking; for most employer categories but perhaps “drinking places”. With a dawning bear phase in the markets, they should hold up just fine.

NFTRH.com and Biiwii.com

| Digg This Article

-- Published: Friday, 8 January 2016 | E-Mail | Print | Source: GoldSeek.com