-- Published: Monday, 11 January 2016 | Print | Disqus

By Bob Loukas

This blog post is a continuation of the bearish theme I highlighted and posted for you back in December, titled: Game Changing Action

Maybe 2016 will be the year when equity bears finally get to celebrate. Although I wouldn’t call an end to the “buy the dip” era quite yet, the current market has a different type of feel and vibe to it. Many people believe – and there is supporting historical evidence – that as January goes for equities, so goes the year. Bulls should hope this axiom doesn’t hold in 2016. The month is still young, but the first week of January ushered in the worst 5-day start to a year in the S&P 500’s history. The last time the market started a year this poorly was 2008, and we know how that turned out.

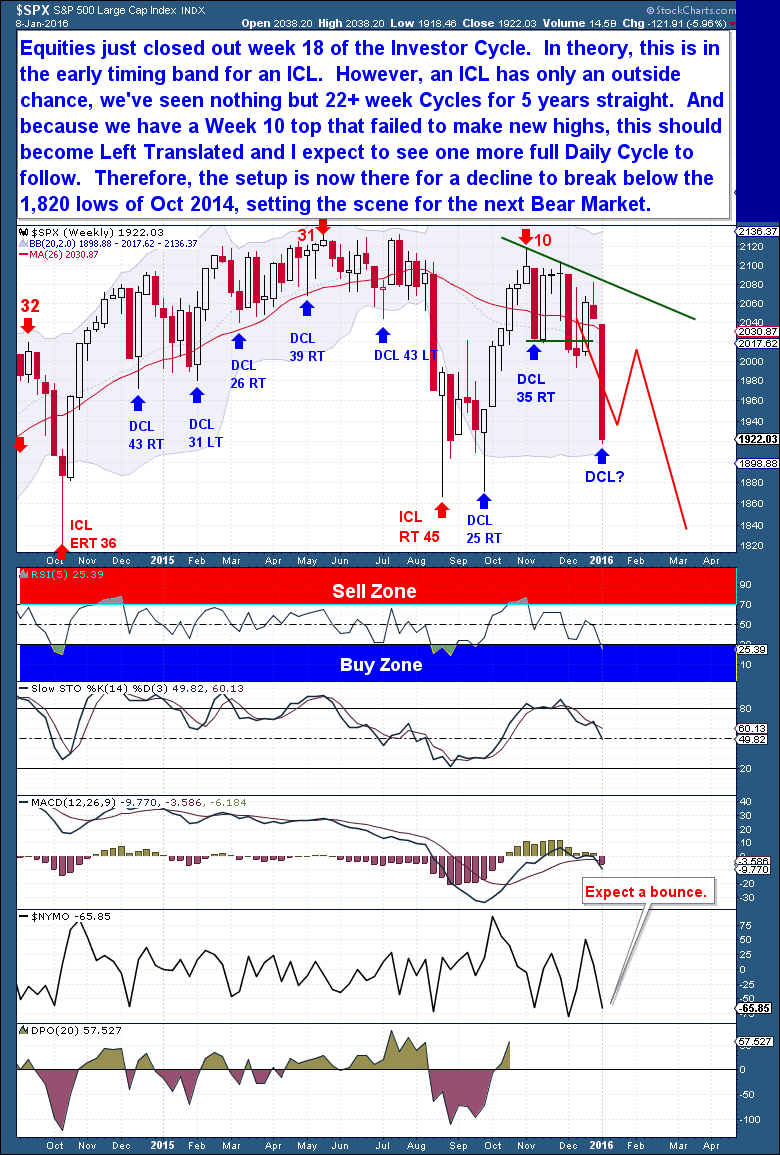

I am not projecting that 2016 will end up like 2008, but it could. As the bull market enters its seventh year, it’s clear that the cyclical advance is on borrowed time. With valuations at historical highs and the economy moving well below optimal levels, unless equities serve up a blow-off top, it’s difficult to see how the current bull advance can continue. I’ve been relatively bullish on the market for two years, but with the current Investor Cycle looking as if it’s topped, I’m thinking that it might be the bulls’ turn to be fooled by equities.

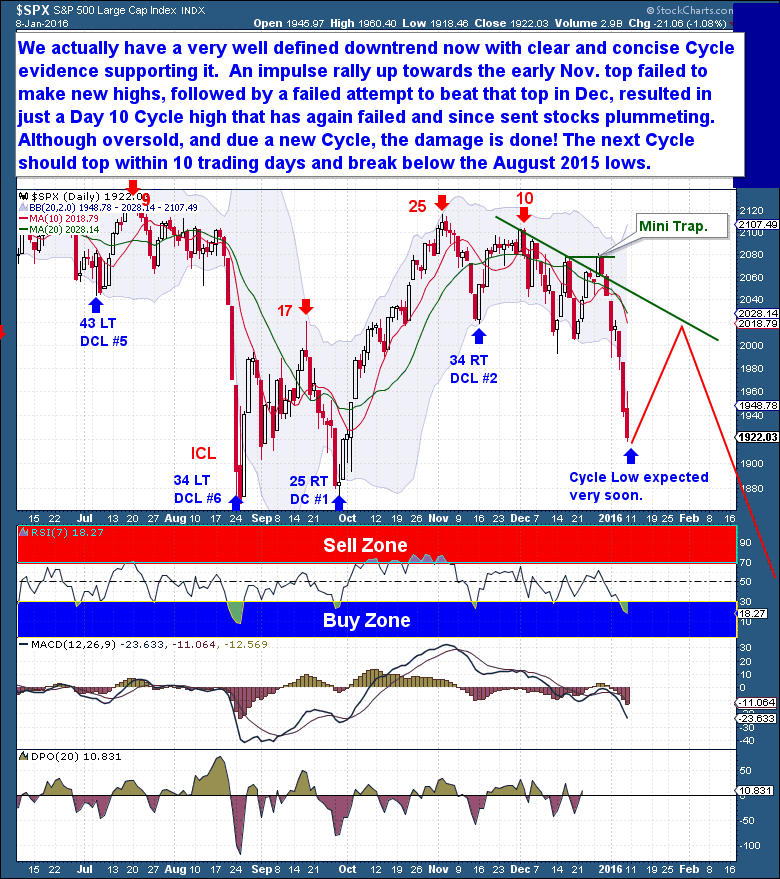

On a daily timeframe, a very well defined downtrend is in motion with clear Cycle evidence supporting it. If we look back over the past few Daily Cycles, we see an impulse rally into an early November top that failed to make a new high, followed in December by a new Daily Cycle that failed to exceed the November peak, resulting in a day 10 DC high. Since then, the current Daily Cycle has failed, and stocks are plummeting.

In the world of Cycles, equities are showing a classic topping pattern. With Daily Cycles in a declining pattern, we have very clear evidence that the Investor Cycle (IC) has topped. Although the equity markets are now oversold and a new DC is due, the damage is already done! The next Daily Cycle (DC)should top within 10 trading days, and then turn lower to break below the August 2015 Investor Cycle Low (ICL).

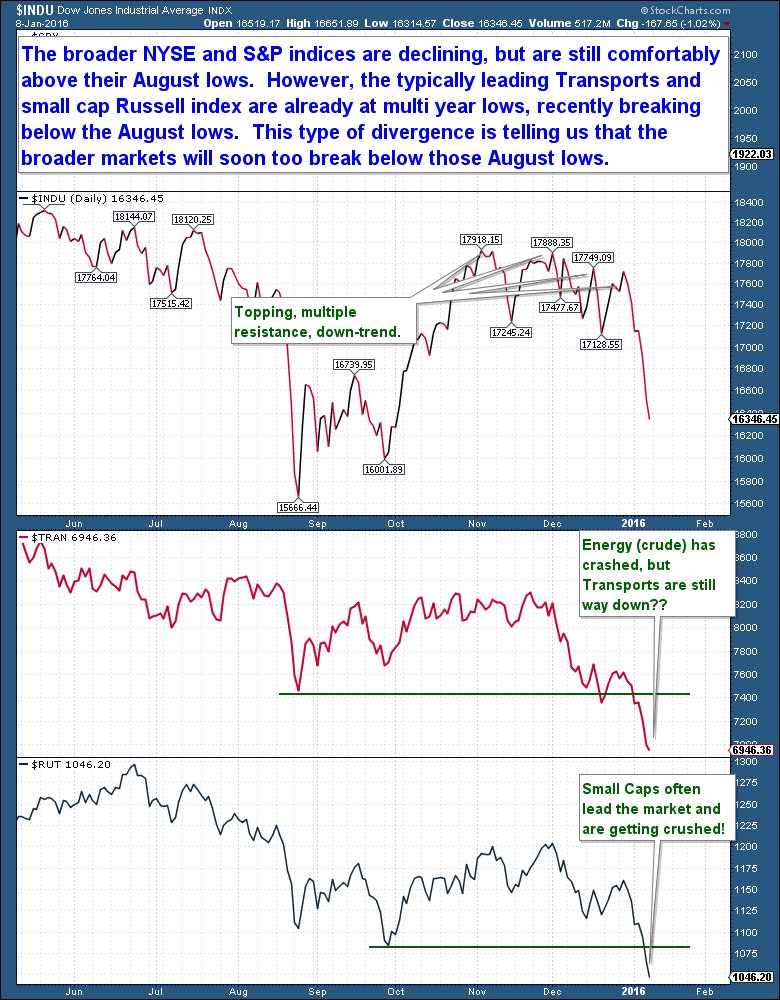

Even though the broader NYSE and S&P indices show failed Daily Cycles and are in clear decline, they remain comfortably above their August lows. These markets, however, are typically led by the Transports and small caps, and these indices – the Dow Transportation index and the Russell 2000 – have broken below the August lows and now rest at multi-year lows. This type of divergence is shouting that the broader markets will also soon break below their August lows.

The Russell 2000 small cap index, in particular, has been suggesting for some time that the current IC is fundamentally weak. In December, the Russell was rejected at the 200-day moving average, and has since moved well below the October 2015 low. After leading the broader indices higher during much of the bull market, the Russell 2000 is again leading, only this time to the downside.

Bulls will suggest that the market is oversold, with technical levels that now favor a Cycle low. That has been the hallmark of the bull market and is why so many traders are confident that the current drop will eventually go down as yet another buy-the-dip opportunity. But for the first time since 2013, I suspect the bulls are going to be wrong. Until we have stronger confirmation, however, it doesn’t make sense to call the end of the bull market.

Equities just finished week 19 of the Investor Cycle, and that’s too early in the timing band for an ICL. And with a 5 year history of 24+ week Cycles behind us, an ICL in the coming days has only an outside chance of occurring . In addition, the current IC has an early, week 10 top that failed to make a new IC high, so I expect the IC to become Left Translated and to fail by falling below the August low. That implies that we should have an IC of at least 22 weeks, supporting the need for at least one more Daily Cycle lower before an ICL.

The setup is in place for a further decline, but I expect we’ll have a counter trend move higher first. I suspect that traders will step in after an initial drop on Monday, and could bid the market higher over the following two weeks. Look for the counter-trend move to approach 1,980 before turning lower into a rather fast, steep collapse below the Oct 2014 low at 1,820. That will set the stage for a potential 2016 bear market.

Trading Strategy Ideas

As always, you must understand the time-frame within which you wish to trade and structure your positions and risk levels accordingly.

In the very short-term, going Long equities now with a stop under Friday’s lows offers a good risk/reward opportunity on a counter-trend rally. I can see a move back to 1,980, where partial profits should be taken, followed by a test of the 2,000 level over the next two weeks. At that point, profits should be taken or at least a rising trailing stop strategy used.

I will be personally looking to renter short positions again around the 1,980- 2,000 level, to once more be in a position to capture significant gains from a Failed Daily Cycle.

https://thefinancialtap.com/

| Digg This Article

-- Published: Monday, 11 January 2016 | E-Mail | Print | Source: GoldSeek.com