-- Published: Friday, 15 January 2016 | Print | Disqus

By Steve Saville, The Speculative Investor

I consider the gold/GYX ratio (the price of gold relative to the price of a basket of industrial metals) to be the ultimate boom-bust indicator. With monotonous regularity, the gold price trends downward relative to the prices of industrial metals during the boom periods and upward relative to the prices of industrial metals during the ensuing busts. Not surprisingly, given economic reality, in addition to being an excellent boom-bust indicator the relative performances of gold and the industrial metals is also an excellent indicator of general (societal) time preference.

Time preference is the value placed on consumption in the present relative to future consumption. In particular, rising time preference involves an increase in the desire to buy consumer goods in the present and, by extension, a decrease in the desire to save or make long-term investments, while falling time preference involves a growing desire to put-off current consumption in order to save or make long-term investments. As an aside, interest rates naturally stem from time preference in that all else being equal — which it often isn’t — people will prefer getting an item now to getting the same item at some future time. For example, even if there is no credit risk, a dollar in the hand today will always have a higher value than the promise of a dollar in the future. The greater perceived value of the present good relative to the future good can be expressed as an interest rate.

Major trends in time preference go hand-in-hand with the boom-bust cycle. During booms fueled by monetary inflation people temporarily feel richer and spend more freely, largely because debt is cheap and easy to come by. This means that booms are accompanied by rising time preference (a greater eagerness to consume). During the ensuing busts, the mistakes and recklessness of the preceding boom come to light. There is a general “pulling in of horns” as the focus turns to the repairing of balance sheets and the building-up of cash reserves. This means that busts are accompanied by falling time preference (a greater desire to save).

Gold is no longer money, in that it is no longer commonly used as a medium of exchange. However, it is widely viewed as a safe and liquid financial asset, rather than a commodity to be consumed. This causes it to perform similarly, relative to other metals, to how it would perform if it were money. In particular, during a period when there’s a general increase in the desire to immediately consume and a concomitant reduction in the desire to hold cash in reserve (a period of rising time preference), the gold price will trend downward relative to the prices of most other metals. And during a period when there’s a general increase in the desire to hold cash in reserve (a period of falling time preference), the gold price will trend upward relative to the prices of most other metals.

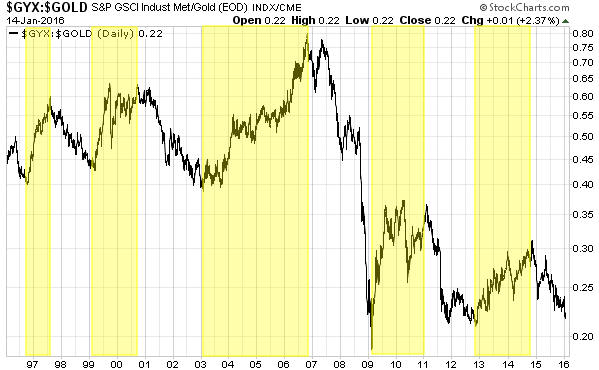

In other words, periods of rising time preference are indicated by rising trends in the GYX/gold ratio and periods of falling time preference are indicated by falling trends in the GYX/gold ratio.

On the following chart of the GYX/gold ratio, the periods when the ratio was in a rising trend are shaded in yellow. If you think back to what was happening during these periods you should (hopefully) realise that they were, indeed, periods when societal time preference was rising. Recall how caution was ‘thrown to the wind’ during the NASDAQ bubble of 1999-2000, the real-estate bubble of 2003-2006, the emerging-markets and commodity bubbles of 2009-2010, and the QE-promoted debt bubbles of 2013-2014.

Also, if you think back to what was happening during the unshaded parts of the chart you should realise that these were periods when societal time preference was falling — when investments were revealed as ill-conceived, debts were revealed as unsupportable, and people throughout the economy were collectively spending less in an effort to save more.

The most recent downturn in societal time preference appears to have been set in motion by the bursting of the shale-oil investment bubble. Many people (not including me) thought that the large decline in the oil price would turn out to be a major plus for the US economy. Just like a tax cut, they claimed. It was actually a negative, though, because substantial debt-funded investments had been predicated on the oil price remaining high.

As to how long the current trend will continue, a lot will depend on whether or not the stock market’s cyclical bullish trend is over. If it is over, which it probably is, then the GYX/gold ratio will continue to fall for at least another 12 months.

The final point I’ll make is that in a free economy that didn’t have a central bank, trends in societal time preference would tend to be more gradual and neither a rising nor a falling time preference would be a problem to be reckoned with. Instead, trends in time preference would influence interest rates throughout the economy in such a way as to provide valid and useful signals to businesses and investors.

http://tsi-blog.com/

| Digg This Article

-- Published: Friday, 15 January 2016 | E-Mail | Print | Source: GoldSeek.com