-- Published: Friday, 22 January 2016 | Print | Disqus

By Frank Holmes

How did you spend your $700?

That’s how much the average American driver saved at the pump in 2015, according to a report from J.P. Morgan Chase. The bank also found that the savings fueled consumer spending on non-gas related purchases, which, based on credit and debit card transactions, were higher than previously thought. For every dollar saved, Americans spent roughly $0.80 on other things—restaurant visits, appliances, new gadgets and more.

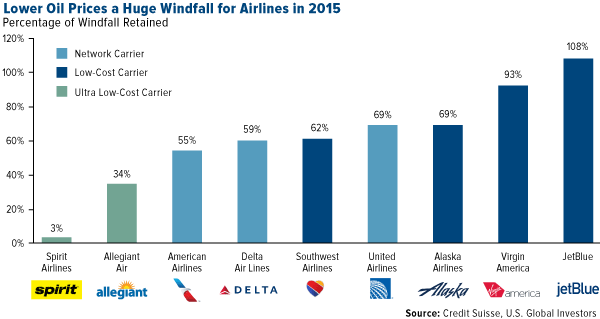

But everyday consumers weren’t the only ones who saved big in 2015. Lower fuel prices represented a huge windfall for the airline industry. Delta Air Lines alone netted $5.1 billion in savings. As a whole, U.S. carriers retained between 50 and 75 percent of fuel cost savings, says Credit Suisse, and with crude oil at 13-year lows, they can expect to hang on to a similar percentage this year.

click to enlarge

As I mentioned in a previous Frank Talk, cheaper fuel helped the domestic airline industry soar to record profits in 2015. According to the International Air Transport Association (IATA), airlines are collectively set to post an annual $33 billion in net profits, up from $17.4 billion in 2014, an increase of almost 90 percent.

Profits could touch $36 billion this year, the IATA says, resulting in record amounts of free cash flow.

click to enlarge

So the question is: What are airlines doing with it all?

Generous Rewards, Attractive Valuations

Besides upgrading their fleets to include more fuel-efficient aircraft, airlines are putting the cash to work by improving balance sheets and rewarding shareholders.

In 2015, more than $10 billion—about 7 percent of U.S. airlines’ market cap—was returned to shareholders in the form of stock buybacks and dividends. That’s double the amount from 2014. Among the carriers expected to raise their dividends this year are Delta, American Airlines, Alaska Air Group and Southwest Airlines, according to a Barron’s article this week. Credit Suisse calls American’s $1.5 billion stock buyback program, more than 12 percent of its market cap in 2015, “a sign of management confidence of what’s to come in 2016.”

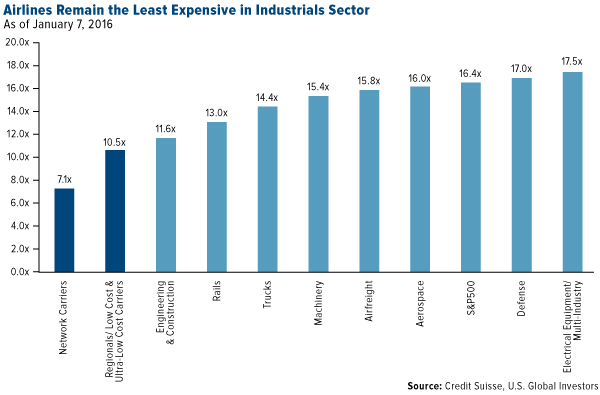

Investors are taking notice. Within the industrials sector, airlines are the least expensive, with network carriers (American, Delta, United Airlines, etc.) at 7.1 times earnings and low-cost carriers (Spirit Airlines, JetBlue, Allegiant Air, etc.) at 10.5 times earnings.

click to enlarge

A concern some investors might have is rising labor costs, which have overtaken fuel as airlines’ top expense. (In its World Airline Profit Outlook 2016, the CAPA Centre for Aviation calculates that the industry’s fuel expenses came down from 30 percent of revenue in 2014 to 25 percent in 2015. This year, they could fall to as low as 19 percent.) There have been reports that pilots, flight attendants, ground crew and other personnel are seeking higher wages and salaries as company profits climb.

These additional costs, if approved, could be offset by not only lower-for-longer fuel prices but also growing ancillary revenue—non-ticket fees for checked-in baggage, priority seating, in-flight meals and the like—and more disciplined capex spending.

Don’t expect airfares to drop dramatically, however. As far as anyone can tell, they’re likely to stay where they currently are. In the second quarter, the average price for a seat fell a slight 2.8 percent year-over-year, from $396 to $385.

That’s a little less than the $700 you saved at the pump.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2015: JPMorgan Chase & Co., American Airlines Group Inc., Delta Air Lines Inc., Allegiant Travel Co., JetBlue Airways Corp., Virgin America Inc., Alaska Air Group Inc., United Continental Holdings Inc., Southwest Airlines Co., Spirit Airlines Inc.

| Digg This Article

-- Published: Friday, 22 January 2016 | E-Mail | Print | Source: GoldSeek.com