-- Published: Friday, 5 February 2016 | Print | Disqus

China May well Change the Game

- China lifts reading of cenbank gold holdings by 57 pct

- Gold now accounts for 1.65 pct of total forex reserves

According to Central Bank Data, China's gold reserves stood at 1,658 tonnes at the end of June of last year. This was up 57 percent from the last time reserve were adjusted more than six years ago.

Despite the tonnage increase, gold now accounts for 1.65 percent of China's total forex reserves, against 1.8 percent in June 2009. The United States, the biggest official sector gold holder, holds nearly 73 percent of its reserves in gold.

The figures make China the world's sixth largest official sector gold holder after the United States, Germany, the International Monetary Fund (IMF), Italy and France.

Speculation in the gold market has been rife in recent years over the size of official sector reserves in China, which is the world's biggest producer of the precious metal and vies with India for the title of number one consumer.

China considers its gold holdings a state secret and does not report its holdings on a monthly basis to the International Monetary Fund as most other countries do.

It last adjusted its reserve figures in April 2009, when the level was lifted to 1,054.1 tonnes from 600 tonnes. In a statement, the People's Bank of China said investment in gold would be beneficial for risk management.

"On the basis of our assessment of the value of gold assets and our analysis of price changes, and on the premise of not creating disturbances in the market, we steadily accumulated gold reserves through a number of international and domestic channels," it said.

The increase, which amounts to 604 tonnes, worth $21.964 billion at today's prices, would help guarantee the security, liquidity and value of China's international reserves, it said. It said it would remain flexible when deciding whether or not to adjust gold reserves in the future.

Game Changer: China Set To Start Yuan-Based Gold Price Fix In April 2016

It has emerged that the People’s Republic of China is set to launch a historic Yuan-based gold price fix this April to boost the country’s status as the new emerging leader in the international financial market.

Vice president for Shanghai Gold Exchange (SGE), Shen Gang had admitted publicly: “We will be introducing a renminbi-denominated fix at the right moment, we are hoping to introduce by the end of the year.”

The Chinese are believed to have taken these measures in collaboration with their close ally, Russia. Commentators say the two countries are keen on breaking the metal free from the price manipulation undertaken by the banks and governments in the US and the UK. And once price discovery moves from West to East, the two countries will allow the price to float to free-market levels, and the value of all the gold they have been accumulating will skyrocket.

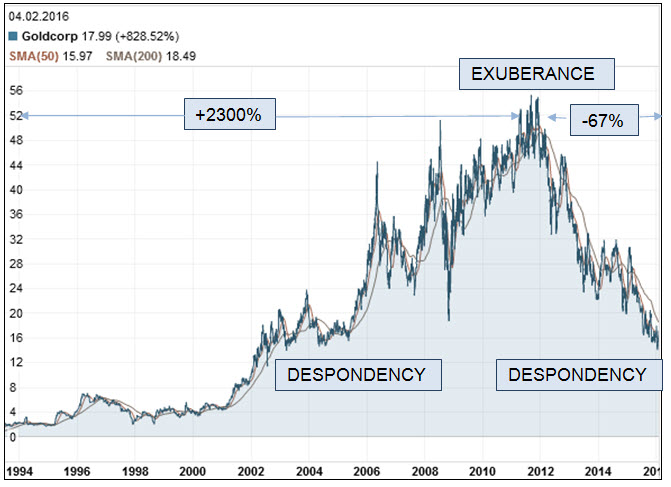

On August 24, 2000, we recommended a company called Compania de Minas Buenaventura at USD 4. The stock peaked at USD 56 in 2010 for a gain of 1,300%. At the end of January of this year, the stock traded again at USD 4.

We are presented today with the same opportunity for extraordinary gains as the general attitude towards precious metal are similar to those experienced fifteen years ago.

For opportunities to invest into a precious metal fund, go to www.timeless-funds.com

Licence Holder Type: Alternative Investment Fund Manager - De Minimis AIFM

Status: Licence Authorised

ROC Company ID: C 61250

Identification: TIME

Registered Address:

168 ST. CHRISTOPHER STREET

VALLETTA VLT 1467

MALTA

6, THIRD FLOOR, SUITE 1

MARKET STREET

FLORIANA FRN 1082

MALTA