-- Published: Friday, 12 February 2016 | Print | Disqus

By: Arkadiusz Sieron

One of the main arguments for the systematic suppression of the gold price says that governments and central banks try to stop gold being the canary in the inflationary mine. We have problems with this view.

First, there are many other indicators of inflation, like official indices (CPI, PPI, and PCEPI), inflation premiums embedded in Treasury prices, or oil and other commodity prices. Do central banks also suppress oil, copper and practically all commodities? We do not think so. The current bear market in gold and base metals is more connected with the strong U.S. dollar than with diligent manipulation.

Second, inflation is currently running below the Fed’s target. The U.S. central bank wants more inflation, not less. So why would it want to smash the price of gold?

Third, gold is not a perfect inflation hedge. As we pointed out in the August edition of the Market Overview, gold secured against inflation only when the inflation rate was high and accelerating. Gold was not much of an inflation hedge in the 1980s and 1990s – for many the best proof that the price of gold was systematically suppressed during those years. However, it would mean that the suppression was absent or ineffective in the 1970s and 2000s.

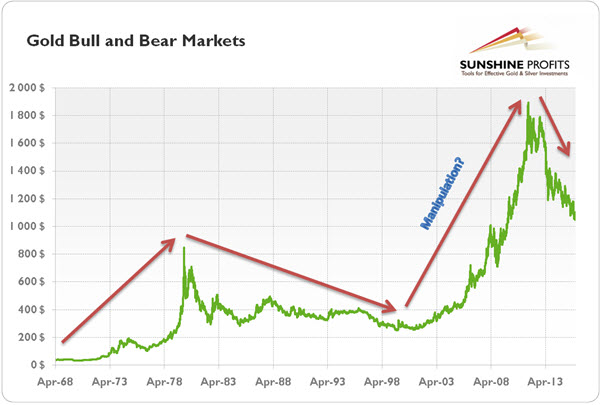

This is perhaps the strongest argument against theory of manipulation. When we look at the long-term behavior of gold prices (see the chart below), we see clear cyclical patterns, not a permanent downward trend (or even flat line).

Chart 1: Gold bull and bear markets (from April 1968 to January 2016, London PM Fix)

Therefore, from the long-term perspective, and especially from the perspective of the 2000s, it is hard to understand the accusation of manipulation in the gold market. The cries of “suppression” are extremely selective. When the price of gold is decreasing, then this is the obvious effect of evil conspirators, but when the price of gold is rising, then there is no manipulation and the true market forces are at work.

We do not buy it. The fundamental forces of supply and demand fully explain the long-term changes of gold prices. If so, investors should reject the theory of manipulation as inconsistent with Occam’s razor. The hypothesis of a global plot involving coordinated, complex and continuous actions of hundreds or thousands of people at central banks, governments, bullion banks and traders all over the world only to suppress the price of gold (considered as a barbarous relict!) simply requires more assumptions that the hypothesis that over the long run, the price of gold is driven (mainly) by the U.S. dollar and real interest rates.

We also do not believe in a conspiracy to manipulate the gold price. The gold market is simply too big and too liquid for any person, central bank or corporation to control. The influence on price may be only short-lived, as low prices cure low prices. Therefore, any attempts to systematically suppress gold prices would be counterproductive, since the reduction in the price of gold would trigger the market reaction in the form of higher demand and upward pressure on its price. The more determined the attempts to smash the gold price, the stronger the market response.

So why do so many gold investors believe in manipulation? The answer is psychological: many analysts refuse to admit that they were wrong in their predictions, so they blame some dark and sinister forces for the bear market they did not notice. These analysts and gold sellers, who convince investors to suppress, simultaneously promote investments in gold. But why anyone would invest in gold if it was constantly and effectively manipulated downwards? It is a contradiction. Similarly, the view that the recent bear market is caused by some external forces beyond one’s control comforts investors who rejected selling gold near the 2011 top or even later in 2013 after the major breakdown, and suffered heavy losses after that.

Summing up, the belief in the systematical suppression of gold prices cannot stand confrontation with empirical data, economic theory and rigorous, factual analysis. Investors should accept the existence of gold market cycles. Just as with other asset classes, there are both bull markets, when gold price goes up, as well as bear markets, when gold prices goes down. The bear markets do not imply that there is a deliberate suppression of the gold price. They are normal market behavior resulting from changes in the gold market’s fundamentals. Instead of crying “manipulation”, we strongly encourage investors to closely monitor the gold market and make use of our fundamental and trading analyses to also reap profits in the bear markets.

Is the Gold Price Manipulated? Part I

By: Arkadiusz Sieron, Sunshine Profits

Thank you.

Arkadiusz Sieron | Sunshine Profits

| Digg This Article

-- Published: Friday, 12 February 2016 | E-Mail | Print | Source: GoldSeek.com