-- Published: Friday, 12 February 2016 | Print | Disqus

By Daniel R. Amerman, CFA

The average person may have no interest in capital controls, but to rephrase a well-known saying, capital controls are interested in you. The residents of Greece found this out in 2015 when capital controls were imposed, and they could not legally send the money in their bank accounts out of the country.

Like the rest of the world, they had been encouraged to move their data to the Cloud, and their software to subscriptions, each of which required small monthly payments. But if all our data is in the Cloud and we can't pay to access it as a matter of law, because the money would have to leave the country what can we do next?

If the software which our livelihood depends upon follows the new norm of being continuously updated and paid for by subscription and our bank won't pay that money because the government said it would be illegal to do so what happens when the software won't open because the payment wasn't made?

These days, most people take for granted their ability to move their money and savings between different nations, whether it be to send money out and invest overseas, or to pull money back that is currently invested over the border. We also can directly buy products and services from other nations over the internet, purchase a second residence in another country or even live in another nation in retirement.

Because the average person believes their money belongs solely to them, it is easy to see this as being the natural and only state of things. However, this perspective is not always shared by governments and economists.

For governments, the savings of the citizens are a resource for the nation, and there is a very long history of nations using capital controls on the amount and terms under which people's money is allowed to leave or enter a country. These restrictions have been seen most recently on a temporary basis during crisis in countries such as Greece and Cyprus but what few people realize these days is that long-term capital controls were the norm for the advanced economies of the West during the 1940s, 1950s and 1960s.

And capital controls may be on their way back if some leading financial authorities get what they want. Which, in a vastly changed world, could impact our daily lives in ways which most people have never considered.

"The Hottest Idea"

"The Hottest Idea In Finance: Capital Controls Are Good"

The above is the headline from a February 4th, 2016, Wall Street Journal article linked here. As covered in that newspaper article, the International Monetary Fund, the Bank of Japan and the European Central Bank (among others) are publicly making a case for a return to capital controls, after an absence of more than 40 years for most advanced nations and with a quite friendly reception from the leading financial newspaper in the United States.

The issue is that the globe is still in major economic trouble, and it is rapidly getting worse in 2016. Around the world, central banks are trying to address persistent problems with economic growth and unemployment (as well as underemployment) through monetary policy.

Monetary policy has included creating vast sums of money to intervene in markets (aka quantitative easing) as well as forcing interest rates to near zero in the United States and other nations. Actual negative interest rates now becoming more common in Europe and have spread to Japan, and some say that they could come to the US as well.

Amplifying The Storm Waves & The Impossible Trinity

The problem facing the governments is that there are trillions of dollars in "hot money" that may cross borders as a result of changes in monetary policy. If major institutional investors like the monetary policy change of Country A, and don't like the monetary policy change of Country B, then a veritable flood of investor money may flee from Country B and pour into Country A. This may send markets soaring in Country A and plunging in Country B, even as the currency value of A climbs relative to B.

Because of limited liquidity and other current global financial risks explored here, the stampede for the exits funnels through doors that are smaller than they used to be, and this could set off a financial crisis in Country B, that could quickly engulf the global financial system and economy.

Assuming that doesn't happen, investors in Country A may be feeling pretty good for a while, because the values of their retirement portfolios are booming, and they are all looking like financial geniuses. Until their monetary policy changes in a way that global investors don't like, about the same time that Country C makes a change in monetary policy that investors do like.

Money flees out of Country B, the markets plunge, and individual investors are whipsawed as their beautiful gains evaporate and are replaced by major losses. This plunge is also exacerbated by the limited liquidity as the investors again stampede for the exits at the same time, and this could also set off a global crisis. At this point in our example, two nations have seen investment markets devastated, and there have been two potential triggers for global crisis.

This could be likened to ship in a storm at sea where the cargo in the hold is loose and rolling from side to side. As a rising wave rolls the ship to the left, the cargo rolls fast to the left, and amplifies the force of the wave. When the ship then rolls right as the wave crests and recedes, the cargo now rushes from the far left to the far right, even further amplifying the force of the wave. Until ultimately, the ship rolls all the way over, or breaks in half, and it is straight down to the bottom of the Pacific for the SS Global Financial System.

The situation is indeed highly unstable over time, and the source of this instability is not controversial among economists, but rather is accepted theory. The aggressive use of monetary policies and a free flow of capital are two incompatible components of what is referred to by economists as the "impossible trinity" (along with fixed exchange rates), as is further discussed in the previously linked Wall Street Journal article. They are not supposed to coexist, and if they do coexist then unstable markets are the expected outcome.

However, they do coexist in the world around us right now, as central banks get ever more aggressive with their monetary policies of quantitative easing along with negative and near-zero interest rates, and the money then quickly surges from one nation to the next.

Indeed, if one wants to understand why emerging market economies and markets went from stellar performers to being enveloped by crisis, the "impossible trinity" as central bank monetary actions created waves of money that moved between nations could be called the primary culprit. The foreign money flooded in and pushed emerging market asset prices to record highs as investors fled the advanced economies in search of better returns. Then the investors left in a wave, the money flooded out, and asset prices, currency values and national economies all crashed.

Leaving nations and their inhabitants poorer and in worse shape than they were before the economic "miracle" was created by the foreign money flooding in.

Stopping The Waves

So how to stop the action of the waves before the SS Global Financial System breaks up and heads for the bottom of the ocean? Well, the simplest approach would be to stop creating the waves. For this to happen the nations would need to back away from aggressive monetary policies, stop creating money by the trillions in order to intervene in markets, and let interest rates go up and down in free markets that are driven by investors seeking to optimize their own outcomes.

In other words, a classic economics solution for escaping the "impossible trinity" is to remove the aggressive "monetary policy" component. Then, because the free flow of capital component (i.e. no capital controls) is no longer in conflict with central banking interventions, it becomes a lesser source of instability. This could be likened to the whole world moving back in time ten or twenty years, to a period when capital controls for advanced economies such as the United States and Europe were considered to be historical relics.

If the financial markets and economies were actually doing as well as they are often portrayed in the media, then this approach would not be a problem. However, the world is a very different place than it was ten or twenty years ago, and since that time some major and persistent risks have developed.

A particular risk is that the monetary policies started being used as emergency band-aids during the financial crisis of 2008 and instead of being temporary, the markets have become addicted to these policies. Globally, the fundamentals in the advanced nations remain toxic. Unemployment is high (particularly when looking at workforce participation rates), economic growth is anemic at best, and already heavily indebted nations with aging populations face crushingly expensive burdens in the form of future retirement promises.

The markets should be devastated but they aren't. Even with toxic long-term fundamentals that have been exacerbated by the very negative developments of early 2016, stock and bond valuations are still near record highs (from a long-term perspective). And the reason is that the markets are reliant on the central banks overriding the fundamentals through aggressive interventions as part of monetary policy.

If one wanted to imagine a financial catastrophe scenario picture what would happen in the United States, Europe, Japan and China if all the central banks were to pledge to stop creating money, sell their huge portfolios which they bought with artificially created money, let interest rates rise, and to let the free markets sort out on their own what prices for stock and bonds should be.

So, it might appear that the world is stuck in a "damned if you do, and damned if you don't" dilemma. If the governments were to simultaneously back off of their extraordinary monetary and market interventions, and investors were faced with toxic fundamentals and no help the stampede for the exits could take down the SS Global Financial System in a matter of days or weeks.

Yet, if they don't back off, then money jumping from one country to another as the result of changes in monetary policies creates an amplification of the waves that could also send the SS Global Financial System to the bottom in the months and years ahead.

Many "Gloom & Doomers" might say this is an impossible situation. But, as it turns out, there is an alternative solution that is widely understood, accepted and even recommended by economists. Indeed it is the "Hottest Idea In Finance"! Just put barriers up inside the hull. Compartmentalize investors, so they can't take money from one compartment and put it into another compartment, and then they no longer amplify the waves.

In other words - impose capital controls once again.

The alternative solution is to use regulations to suppress the investors, to keep them from freely and rationally acting in their own self-interests in response to pervasive governmental interventions, and the problems cause by investors are mitigated. Because that is what capital controls are all about using regulations to force individuals and companies to do what their governments want them to do.

Capital Controls & The Debt Supercycle

There is a second major reason for capital controls that is at least as important as the stabilization of financial markets, even if there is no reference to it in the press releases or the media articles. It is also why capital controls are not mere theory, but were in fact law for most of the world for decades.

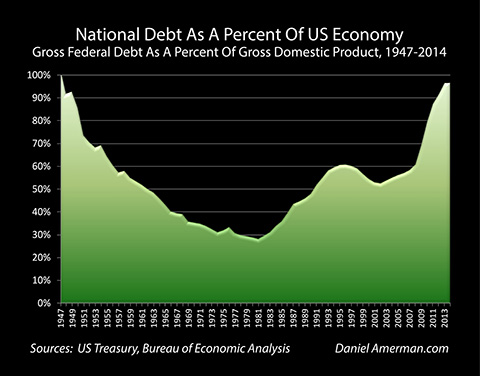

The United States government is overwhelmingly in debt again, as can be seen in the graph above of federal debt as a percent of the economy. The key word that is relevant for any discussion of capital controls is again.

Capital controls were pervasive during the 25 years that the government debt was rapidly falling from equaling 100% of the national economy down to about 30% of the national economy. Then the capital controls went away, and everybody forgot about them.

Now the United States is again overwhelmingly in debt, as are many other advanced economies. And once again, some of the globe's leading financial decision makers are talking about the need to use capital controls.

This is not a coincidence, not by any means.

Capital controls are a key component of what economists refer to as Financial Repression, which is one half of a long term supercycle (explored in more depth here) that alternates between Financial Liberalization and Financial Repression. When the economy is good, debts are low, and markets are healthy, then rules and regulations often liberalize and free markets gain dominance over government controls. When markets get in trouble while the economy goes bad and governments become heavily indebted - then rules and regulations often increase as government controls become dominant over free markets.

Looking at the green graph above, there was a cycle of repression and tight government controls as the debt was brought down (relative to the economy), this was followed by a cycle of liberalization as many of the most onerous regulations went away. With the very quick return of stratospheric national debts in the aftermath of the financial crisis of 2008 a return to formal and long-term policies of capital controls could be called "right on schedule".

But being "on schedule" does not mean that a return to capital controls is the right thing to do, or that there won't be many millions of innocent victims. When we move from the lofty perspective of national governments and central bankers looking down at us all in our teeming multitudes, and consider the personal implications capital controls have the potential to be life-changing for many people, and possibly in a very negative way.

Fencing Savers In & Forcing Losses On Them

Financial Repression has a much more specific meaning as well. It is the name for a process in which nations effectively take wealth from savers, and use that wealth to reduce the effective size of national debts, or at least slow down the growth of national debts.

As I have written extensively on the subject and most of my readers are already familiar with Financial Repression, I will not repeat that information here, but will provide links to where the information is available, for those who are not aware.

The linkage between current pervasive low interest rates and heavily indebted governments, and why interest rates could remain low for decades to come (assuming the governments can maintain control) is explained here.

A tutorial on Financial Repression is linked here, and it explores how the United States government and other nations around the world historically used very low interest rates to take saver wealth and thereby produce the reduction in national debts seen in the preceding green graph, as well as the return of Financial Repression in the aftermath of the financial crisis of 2008.

The financial mechanics for how wealth is quite deliberately taken from voters without their realizing what is happening are explored here.

As explored in the tutorial, there are five traditional components to Financial Repression, with the first two components being 1) very low interest rates, and 2) a somewhat higher real rate of inflation (which can be quite different from the official rate of inflation).

That situation is painful for savers, so the other three components effectively involve putting up fences so investors can't escape. These fences include 3) forced participation by financial intermediaries; 4) capital controls; and 5) discouraging or outlawing precious metals investment.

Capital controls are indeed straight out of the historical textbook for how to create and maintain Financial Repression. And a return to capital controls would mark an increase in Financial Repression, rather than a decrease.

A Dangerous Divergence

The return of capital controls could also bring a new and very dangerous divergence to the world economy, and the lives of many millions of people.

Globalization and the free flow of both capital and people has been assumed by many to be the only possible future ahead. What happens if it isn't? What is being seen in Europe right now with regard to the migrant crisis is that assumptions about the future don't actually determine the future, and they are subject to change.

Some might say for instance, "too bad about the Greeks and Cypriots, but I live in the United States, so I'm not worried." Unfortunately, however, much of the American economy and stock market is built around the assumption of the unending free flow of money between nations.

The problem with building an entire world around the free flow of money is what happens if that flow becomes restricted. If Apple can no longer get its money out of China, or India, or much of the world, then what happens to Apple's profits? Or stock value? Or employment?

How about Google? Facebook? Microsoft? Adobe? Citibank? JPMorgan? General Electric? Caterpillar? Boeing?

Now, some might say that because of the importance of those companies to the United States economy and government, they would be immune to the imposition of capital controls. And if the US government were the sole decision maker, that belief would likely be correct. Even if the United States does choose to return to capital controls, it would likely be in a way that would turn out to put the pain on the ordinary people and small businesses, while shielding the major corporations and the truly wealthy (not to be too cynical, but that has been the trendline for some decades now).

But to say that would be to miss the point capital controls are defensive measures, which are imposed either in times of crisis, or as a measure to prevent crisis, or to help heavily indebted governments to financially survive. Any one nation can impose capital controls unilaterally in the form that they wish, and in the manner that they wish (with surprise moves over the weekend while the markets and banks are closed being the traditional choice, at least during times of crisis).

The world is at this time getting more unstable at a rapid pace. Extreme monetary policies in the form of negative interest rates continue to spread, even as the doubts continue to grow over the strength of the European banking system, even as fears grow about the strength of the Chinese economy, all of which are leading investors to flee equities and seek out safe havens around the world.

Now some might say that this means global financial meltdown is inevitable, but even if conditions do continue to deteriorate, that is also missing the point. What is more likely than global meltdown is governments around the world deploying the stabilization methods that their economists already know quite well, in the attempt to contain or prevent crisis.

As to whether the stabilization mechanisms can then successfully contain a true, existential future global financial crisis - if such a crisis does materialize - now that is the question, isn't it?

But, what needs to be recognized is that the meltdown scenarios are a subset of the attempted crisis containment scenarios. In some possible futures, the stabilization mechanisms are deployed and fail, and in many other possible futures, the stabilization mechanisms are deployed and succeed albeit at a potentially very high cost for the nations, their economies, retirement investors and individual freedoms in general.

And capital controls are a potent form of stabilization.

Enabling More Extreme Measures

Part II of this article explores 1) the much more extreme measures available to the Fed and other central banks in the event the markets do start to collapse; 2) how capital controls provide the needed stability for those extreme measures; 3) how the financial survival of governments may override Wall Street and Silicone Valley business models; and 4) the powerful implications for overseas investors and expatriate retirees.

Continue Reading The Article

Contact Information:

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: dan@danielamerman.com This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

| Digg This Article

-- Published: Friday, 12 February 2016 | E-Mail | Print | Source: GoldSeek.com