Over the last three weeks, U.S. equity markets have recovered and are now more overbought than any time since 2009. While this is the case with equities, it is not the case with high yield debt. As I have said many times before, credit analysts actually look under the hood to discern the real situation and credit at this point is not buying the equity bounce/short squeeze. In fact, high yield credit spreads are rivalling the dark days of 2008.

The other area of interest since January is gold and silver. Gold and to a lesser extent silver are quite overbought short term. Many analysts in the "alternative" space have been recently cautioning that gold and the mining shares are about to be monkey hammered. Other than being overbought, we also have COT numbers showing the commercials very net short and the same setup as prior to previous waterfall events. So where do we go from here?

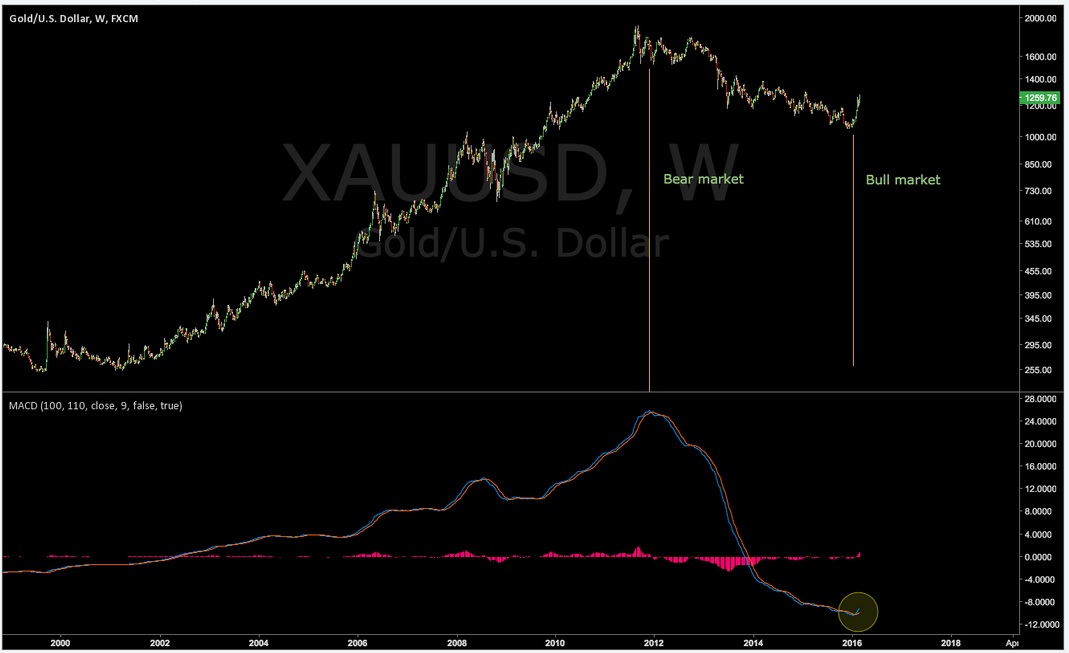

While we are very over bought short term, gold and silver are moving off of EXTREME OVERSOLD levels not seen in the last 18 years and possibly EVER! Let me explain this because it is more important to gold bulls than anything over these last 18 years. Looking at the chart below you will notice a "hook" at the very bottom right. This hook is occurring from the lowest levels for the MACD (moving average convergence divergence). The "hook" or crossover is coming at a time where gold and silver have been continually beaten down with paper contract for over four years. The apologists can argue all they want to but it is fact that physical demand has been strong and gotten stronger while supply has peaked and begun to shrink (particularly in silver). The "supply" over these years has been of the paper variety and hasn't been real metal by any stretch. In fact, it is the nature of this naked shorting and selling that will lead to something far different than just a garden variety rise in the metals! Paper exchanges will become irrelevant shortly as physical exchanges are opening up and none as important as the one opening in China next month.

courtesy David P/KWNews

I wanted to show this chart because this is truly a "danger zone" for the bulls. As I mentioned above, many long time bulls are now cautioning of another "whack a mole" scenario. This very well may be true but not something you should bet on. You see, something has definitely changed in not only the precious metals markets but ALL markets. You must ask the question "are they losing control"? I believe the answer is yes they "are" but have not "yet". It is the "yet" part that poses the risk.

Over the last four plus years I have said I thought it was a poor idea to try to time entry into gold and silver. Other than just a few months time, gold traded under $1,300. Now, in just over one month's time, gold has nearly regained the $1,300 level. This means that anyone who purchased over the last four years (after the June massacre) is at least breakeven or has a gain. Did anyone's "crystal ball" send out an alarm telling you NOW is the time to get back in? Harry Dent still advertises $700 (or possibly $250) gold. The danger now is to listen to those telling you we will have a pullback. This "danger" may very well have you waking up on a Monday morning and no way to reinstate a position you took a profit on.

Jim has said the upcoming (already here) rally will be the one you never sell. To clarify, he is saying this is the rally you never sell UNTIL some sort of new currency is introduced that has something tangible behind it and can be "trusted". No market will go straight up or straight down, however for gold, we are in a situation where mathematically not enough gold has been produced or exists to cover the paper contracts sold to put price where it is now. The "danger" for bulls is to try to trade this up move only to find out the FRAUD of naked sales and empty vaults is discovered ...and it will, only a matter of time. You are either in ...or you will be out!

Please, stare at the above chart. Print it out and put it on your wall! It tells you where we are in the big picture. We are massively oversold long term and on a launch platform 4-5 times higher than we were in 2001! In my opinion we will look back at this chart only to see the bear market caused by "dilution" with naked contracts was only an overdone (and very much FORCED) correction in huge overall bull market. I believe the big danger now is the mathematical fact that too much debt pervades the entire global financial system ...and the entire system comes down. Please ask yourself this question, what will be left after a credit meltdown? JP Morgan answered this question before Congress in 1907 when he testified "Gold is money, everything else is credit"!

Standing watch,