-- Published: Sunday, 20 March 2016 | Print | Disqus

By Gary Tanashian

Our main theme has been that the ironclad post-2011 confidence in the Federal Reserve among conventional market participants would slowly but surely start to fade because macro parlor tricks, so vigorously employed by the Bernanke Fed, were only tricks or in some cases (Operation Twist) borderline magic, after all.

At biiwii.com (still unsure if or in what capacity the site may reappear) we used to have fun with clown car videos, as the various Fed members piled out honking horns, doing somersaults and shouting incomprehensible phrases and announcements.

Like Rosco’s clown car above, that is all fading away now. The pretense that the Fed is the steward of a sound financial system and currency has been stripped away. We are no longer anticipating a waning of confidence. In rolling over last week and playing dead, the Fed announced for all the world to see that it is no more secure or respectable than the clown known as ‘the Draghi’, Kuroda the Klown or the troupes in Canada, Australia, England and China’s Central Planning.

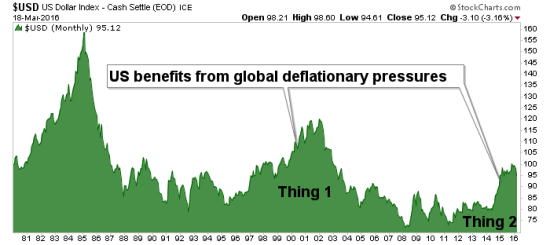

The US Fed, through no good work of its own was the beneficiary of a Goldilocks environment in which global economic pressures resulted in capital flight into the US.

That was all well and good while the Goldilocks benefit lasted. The Fed, or more accurately Benny the Clown was made out to be a genius, somehow managing to promote inflation and asset market appreciation while suffering none of the traditional drawbacks, like outwardly visible inflation problems.

An upward surge in the US dollar (reserve currency) due to global deflationary pressures only cemented Benny’s already bestowed reputation as “the Hero”.

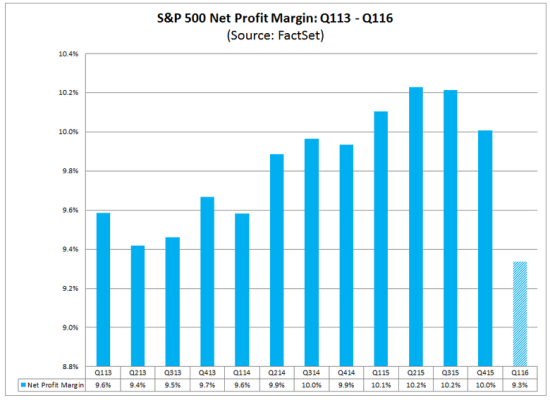

But then the stock market started to roll over under the pains of US dollar strength. This was due to weakening exports and manufacturing in general. Here in Q1 2016 we find a deceleration in corporate profits, hot off the press from FactSet.com:

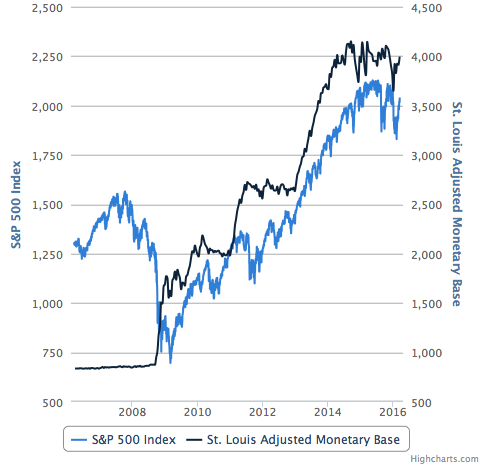

Now we again consider the chart of the S&P 500 and US dollar above. Taking it a step further, consider the real reason that the stock market has risen post-2008, unbridled inflation. From Slopeofhope.com:

The entire span of the black line – during its upward surge phases – was Bernanke. The roll over? That is happening on Janet Yellen’s watch. She is not to blame.

For some time after Bernanke had taken center ring I continued to focus on Alan Greenspan. That is because the ‘nank was sent into the Big Top to clean up the fallout from Greenspan’s inflationary mess.

Today we look back to Benny the Clown and the tricks he played on us, with poor Janet Yellen the fall guy in waiting. It’s a sort of tradition, a right of passage for those who would assume the lead roll in this show. One employs a bag of tricks and the other… holds the bag.

Yet multitudes of conventional market participants have proceeded on as if any of this were normal. They are like the poor elephants in the circus, trained to just go along with the show, the planners of which are well above their pay grade. But the biggest takeaway from last week, from NFTRH’s perspective, is that our theme of waning confidence got rammed to the forefront of the average investor’s consciousness.

The Fed appears ready to continue the inflation, this time without pretense or the aid of a global deflationary ‘Goldilocks’ benefit. Aside from the stock market and economic motives, might the Fed also be considering the post-2007 buildup in Debt-to-GDP? A little inflation can go a long way in inflating away a government’s debt problems.

We will continue to watch for market-based inflation signals in items like the Silver-Gold ratio (to be covered later in the report) and Treasury bonds vs. inflation indexed T bonds. While inflation expectations have bounced to date, a breakout in inflation expectations would only be signaled by a rise above the 1.6% area.

Regardless, the Fed is dropping its pretense and starting to gets serious in the game of global inflationary Whack-a-Mole.

NFTRH 387 then gets down to business and covers the relevant markets with respect to US and global policy and the inflation they are attempting to promote.

| Digg This Article

-- Published: Sunday, 20 March 2016 | E-Mail | Print | Source: GoldSeek.com