-- Published: Tuesday, 22 March 2016 | Print | Disqus

By Frank Holmes

During a trip to New York last week I was able to talk gold and commodities on Bloomberg TV, and also had the pleasure of hearing Canadian Prime Minister Justin Trudeau address Wall Street investors in the Bloomberg studios the same day. Trudeau discussed his plan for new infrastructure spending of C$60 billion over the next 10 years, as a means to lift the countryís highly oil-dependent economy. Trudeau answered questions on his countryís federal fiscal deficit and I was able to ask him about the amount of Ontarioís debt in particular. Ontario has twice the debt as the state of California and only half of its population.

In the U.S., states are held to a strict balanced budget standard when it comes to fiscal taxation and spending, while the federal government can let the budget go into deficit spending. In Canada, however, itís the opposite, and the provinces seem to have abused their debt levels, but Trudeau is ready to help.

The former Prime Minister of Canada, Stephen Harper, never smiled like Justin Trudeau. But he was a great defensive leader, and his conservative leadership allowed the country to successfully weather the financial crash of 2008. Now the current government can leverage that strong balance sheet to stimulate economic activity.

During the Bloomberg conference, Trudeau sought to reassure his audience that he will remain cautious on spending.

Creeping Taxation and Negative Interest Rates Ignite Global Caution

Compliance and regulation measures have intensified from the financial sector to the food industry, from the U.S. all the way to Brazil. Many CEOs of banks, as well as brokers that I have spoken with recently, have lamented on the financial burden of excessive regulation and the indirect taxation that comes along with this rise in rules on steroids. Regulations are fueled with good intentions; however, the unexpected consequences like slow global growth need to be adjusted.

In Brazil, the government promotes short-term government bonds to fund its bloated government workforce. The anti-capitalist nature of Brazilís government extends to extreme limitations on public markets, where new companies can only go public by offering shares at $1,000. And Iíve shared with you before how Colombiaís citizens are taxed at every turn.

Meanwhile, central bankers around the world captured headlines last week, and it looks as if easy money is here to stay for the time being, as well as high taxes and regulations. The prevailing message was that global economic conditions have not improved well enough to support any significant changes to monetary policy, which now has interest rates around the globe at near-zero or, in some cases, subzero levels.

The week before last, the European Central Bank (ECB) came out with deeper cuts to already-negative rates and steeper purchases of bonds, from 60 billion euros to 80 billion euros. This was followed on Tuesday by the Bank of Japanís (BoJ) decision to leave negative rates unchanged as it assesses the impact of its controversial policy, which shocked global markets when it was unveiled in January. Likewise, the Bank of England decided on Thursday to keep interest rates at the historic low of 0.5 percent.

As I (and many others) expected, the Federal Reserve also put rates on hold, even as the U.S. economy is showing signs of improvement in employment, housing and inflation. According to Fed Chair Janet Yellen, a soft global economy made a rate hike too risky.

Be that as it may, our emphasis on central bank actions is way overdone and in many ways a distraction from whatís really important: balanced fiscal policy. Today, many investors expect central banks to jumpstart the global economy, and indeed their decisions can have huge consequences. But they canít do it alone. What we need is a commitment to streamline regulation and relax taxes, with prudent spending on economy-boosting infrastructure, manufacturing and construction. Until that happens, it doesnít matter how low policymakers drop rates or how much debt they purchase.

Tailwinds to Global Growth

Iíve written before about how we use the purchasing managersí index (PMI) as a forward-looking indicator. Itís like using the high beams on your car, to see where the economy is headed three or six months from now. In the latest PMI update from February, the reading trended downward to 50.

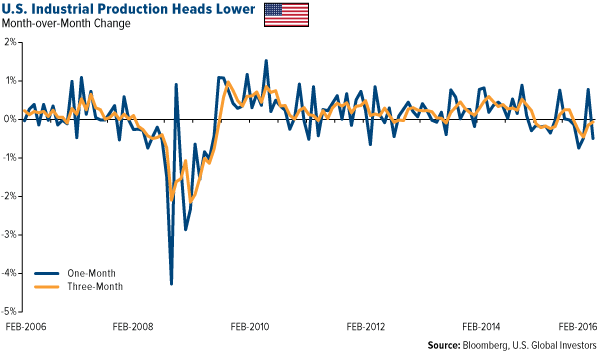

Industrial production data came out last week down 0.5 percent in February. As Iíve discussed numerous times, industrial production is a subset of GDP, both of which indicate where the markets have been.

click to enlarge

Regulations and high taxes are headwinds to global growth. Whether we are looking ahead or looking back, the data are showing slowdown in the global economy. We need a fiscal policy intervention to be the tailwind that pushes the economy in the right direction. We hope that the Trans-Pacific Partnership (TPP) will be signed soon, eliminating many tariffs and restrictions to trade, but it is currently held up by protests from unions. Once passed, we are optimistic the TPP will facilitate and accelerate global trade.

Gold is Smiling

The most welcome news was that the core consumer price index (CPI)ówhich excludes food and energyórose 2.3 percent year-over-year in February, representing the fourth straight month of inflation and the highest rate since October 2008.

click to enlarge

As Iíve pointed out many times before, gold has tended to respond well when inflationary pressure pushes real interest rates below zero. To get the real rate, you subtract the headline CPI from the U.S. Treasury yield. When itís negative, as it is now, gold becomes more attractive to investors seeking preservation of their capital. The yellow metal has risen more than 18 percent so far this year.

Other precious metals have also been strong performers in 2016, with silver up 13 percent, platinum 11 percent, and palladium 8 percent.

Good Olí American Ingenuity from Silicon Valley to U.S. Energy Fields

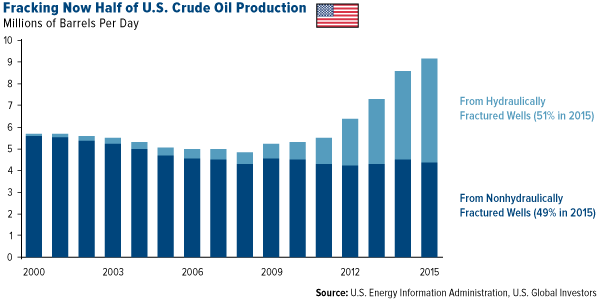

The U.S. Energy Information Administration (EIA) reported last week that hydraulic fracturing, or fracking, now accounts for a little more than half of current U.S. crude oil production. In 2000, fracking wells produced only 2 percent of the national total. Today, they make up over 50 percent of oil outputóa figure that will likely continue to climb as technology improves.

click to enlarge

But since the end of 2015, overall oil production in the U.S. has begun to taper down. Last week I shared with you the fact that Decemberís year-over-year change in output turned negative for the first time in five years, a sign that U.S. producers are finally responding to low prices.

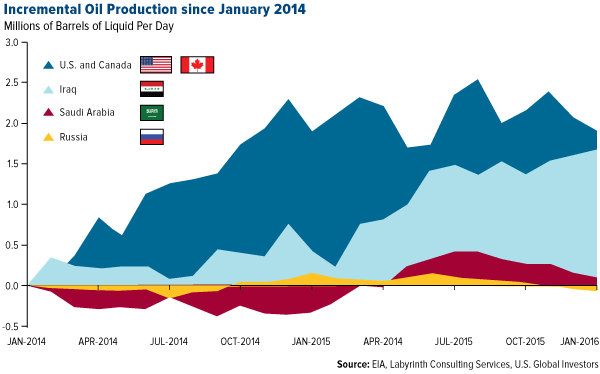

This decline in production is reflected in the chart below, which also shows that Iraqís share of the global oil market has grown comparatively more than Saudi Arabia and Russiaís.

click to enlarge

The anticipated production freeze between those two countries, therefore, probably wonít have as significant an impact on oil prices as markets are hoping for. It will only ensure that the two-million-barrels-per-day global surplus wonít get any worse.

Plus, thereís no guarantee such a freeze would stick, let alone could be agreed upon. Iran has already called the proposal ďridiculousĒ and plans not to reign in production until it reaches pre-sanction output levels, and Saudi Arabia is unlikely to let its chief political adversary in the region gain the upper hand.

As Iíve said before, short of geopolitics, the likeliest path to oil recovery is to coordinate a production cap on a global scale. The chances of that happening, however, are slim to none.

Tax-Free, Stress-Free Income with Calm Investing

No matter what happens with the Fedís interest rate decisions, be sure to register for our webcast on March 30. Learn about the power of municipal bonds in uncertain rate environments.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

The Purchasing Managerís Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

| Digg This Article

-- Published: Tuesday, 22 March 2016 | E-Mail | Print | Source: GoldSeek.com