Ever since beginning the ‘Macrosom‘ theme in July (and updating it here), NFTRH has been managing macro changes that would positively affect the gold sector, and quite possibly have a negative effect on broad stock markets. Early on in the precious metals bear market we noted they were “in the mirror” and opposite the stock market, which on the post-2011 cycle has been the beneficiary of the Fed’s inflation, instilling confidence in their policies by conventional market participants (after all, the right assets were going up on this cycle). In August, it appeared that the first real thrust in the direction of our macro theme kicked in as the stock market cracked.

The mechanism of this confidence racket, which allowed the promotion of inflation right through QE 3, has been a global deflationary force muting inflation signals and providing the US with a Goldilocks benefit as the US dollar strengthened. To this day the economy continues to ‘service itself’. Manufacturing and exports weakened under the regime of the strong USD, but those strong dollars bought a lot of services (which make up the vast majority of the economy) and consumer-related commodities.

Against this backdrop, investor confidence had been on display every time the market reacted in line with a Central Banker’s speech or action. In 2016 the market still seems to be taking them halfway seriously, but there are cracks in the foundation as global policy makers enact negative interest rate policy (NIRP) and the US Fed, for the first time, actually admitted it could be open to it as well.

Speaking of which, in February Janet Yellen actually made the case for continued rate hikes and stated that NIRP is a possibility for the US… within a 2 day period! That kind of waffling is definitely not what the market is looking for in its Interest Rate Manipulator in Chief. Confidence took another hit.

Then came the March FOMC meeting, when the Fed rolled over and not only did not raise rates (in the face of a strong stock rally, relatively strong payrolls data and rising gold and commodities), not only did not add any tougher sounding language, but it actually eased rate hike expectations for 2016. But it gets better. With commodities, the 10 year breakeven inflation spread and stock markets all zooming upward after the Fed’s nod toward inflation, and the ink barely dry from the FOMC statement, out popped three entertainers in funny clothing from a little bright yellow car to manage the market’s expectations. From Bloomberg:

“St. Louis Fed President James Bullard joined a growing chorus of U.S. policy makers emphasizing evidence of an improving economy may mean rates have to be hiked sooner rather than later. San Francisco Fed President John Williams and Atlanta Fed President Dennis Lockhart made similar comments earlier this week, saying borrowing costs may need to be increased as soon as the April meeting.”

Bullard? The hawk in drag? He was a voting member who just a week earlier voted to go with the flow. So the economy got that much stronger in a week Jim? Does this kind of flip flopping inspire confidence in anyone, or is it just another chink in the armor of Fed credibility? From the FOMC just last week…

“Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo. Voting against the action was Esther L. George, who preferred at this meeting to raise the target range for the federal funds rate to 1/2 to 3/4 percent.”

Personally, I thought it was a perfect time for action with gold leading commodities higher and the stock market in full bounce mode. So here’s to Esther George! Bullard? He of the ‘QE 4’ jawbone speech in Q4 2014 the minute the market hiccuped? No credibility whatsoever, and he is emblematic of the slow decline in confidence in the Federal Reserve by the average investor. I mean, that’s the renowned hawk, after all!

It stands to reason that 2016’s acknowledgement by a wider investing public that US and global policy is little more than a Clown Show has gone hand in hand with the biggest upturn in the gold price (i.e. the number assigned to the value currently being placed on monetary insurance) of its entire post-2011 bear market.

In February we noted that the planets were aligning for the now 6 month old Macrocosm theme, and bullet pointed the list of important macro fundamentals, along with detailed analysis of each component. The primary holdout was, and still is the 10yr-2yr yield spread, which has not shown a sign of bottoming.

But now, as the stock market probes the upper reaches of our ‘bounce’ limits (it will either turn down obediently to our preferred view or break the bear trend) it is time to watch closely the relationship between gold (the ultimate anti-establishment asset) and the US stock market (very very establishment).

Gold had to correct its over bought status vs. SPX because those two black bars that changed the trend were flipping the bird to the Fed. So now we find Au-SPX in consolidation of the move. If it holds its trend change, we proceed as planned. If it does not, this will have been merely a near-death experience for confidence in the Fed. Thus far, it is a trend change and necessary consolidation.

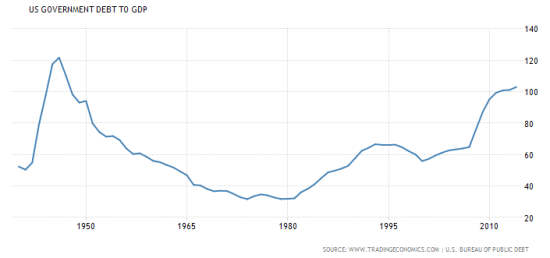

But we know the Fed has inflated and I think they would like to find a way to stir up more inflationary effects because inflation can go a long way toward reducing a government’s debt problems. Funny how that works, isn’t it? Meanwhile, they massage us every week with the wax on (inflation) and wax off (we are serious about anti-inflationary policy, we really mean it this time!) routine.

Let’s simply state that inflation is coming. Well, it is here and its effects reside within many areas of the vast services economy. But the NFTRH theme has been evolving more and more toward 1999-2001 as a template for current events. Generally, that would entail gold bottoming vs. stock markets and leading the initial surge in inflation expectations. That part is now behind us as gold first trended up vs. commodities, has changed trend in nominal terms and moved up vs. stocks and currencies.

This trend change is now in consolidation with an expected correction in gold. We have also been noting that no new bull market is yet technically indicated and commodities remain strictly in down trends. Therefore, the bounce that seems to be terminating now was only labeled just that, a bounce. The CRB target was ‘175+’ and it recently made it to 178. Close enough.

The gold sector on the other hand is the canary in the coal mine. Just as the Semiconductor Equipment sector played that role for us in January 2013 for the economy, the counter-cyclical sector plays that role as the gatekeeper to an environment where policy makers are no longer able to hide behind deflation. As with the bald faced NIRP disgraces in Japan and Europe, the US Fed’s protective moat is drying up and some Barbarians are actually starting to storm the gate in questioning them loudly in the mainstream media.

With debt to GDP at 103% and rising, such levels of debt for economic growth have not been seen since the 1940’s, which just happens to correspond with the 2nd World War. From Tradingeconomics.com…

Q4 GDP was just revised up… all the way up to 1.6%! This along with other economic data may be interpreted as a reason to fear the Fed but in reality, gold (and the ‘inflation trade’) needed to correct and the US dollar needed to bounce. Things were just getting too extreme on the bounce.

It is what comes after said reaction that is going to tell us where we are going. I am already in danger of writing a book here, so we will leave out the myriad data points about inflation and so many different technical views and time frames on the precious metals and commodities that I feel like going into and just leave it to one simple chart, showing the historical ‘comp’ of 1999-2001.

The top panel is in log scale to better show the lunge upward in gold in 1999. This happened before the stock market had topped and gold went on to consolidate downward for another 1.5 years before the massive bull market began. Notably, the stock market was already in full decline by then. So that makes the current stock market situation (with gold in the mirror) extremely important. The market is in a topping structure, but has not yet broken down. Depending on what happens in the stock market, gold could consolidate for a while here.

Given the time shift between the two situations (gold has surged much later in the potential stock market topping structure than in 1999), if the stock market breaks down, I expect gold’s consolidation to be nothing like the extended 2000 ‘comp’. If however, the stock market fails to follow through on its rather obvious looking topping pattern, it could be ‘look out below!’ for gold.

As for HUI, it as well has made a higher high and looks good to go. But key – and I mean absolutely critical – support is noted. It must also make a higher low.

We appear to be following the blueprint that saw rapidly increasing inflation expectations under Alan Greenspan after the recession had unfolded and first the gold miners (in 2000) and then gold (in 2001) bottomed and turned up for real. Later the gates will open as a more traditional inflationary phase gets under way.

But first things first, we need to do as we have been doing since introducing the Macrosom theme, take it step by step with a lot of patience. Please don’t go on automatic thinking, especially to the tune of the cheerleaders who have emerged over the last couple of months. It’ll take honest work to see this through and benefit from the coming inflation phase.