-- Published: Monday, 4 April 2016 | Print | Disqus

By: Keith Weiner

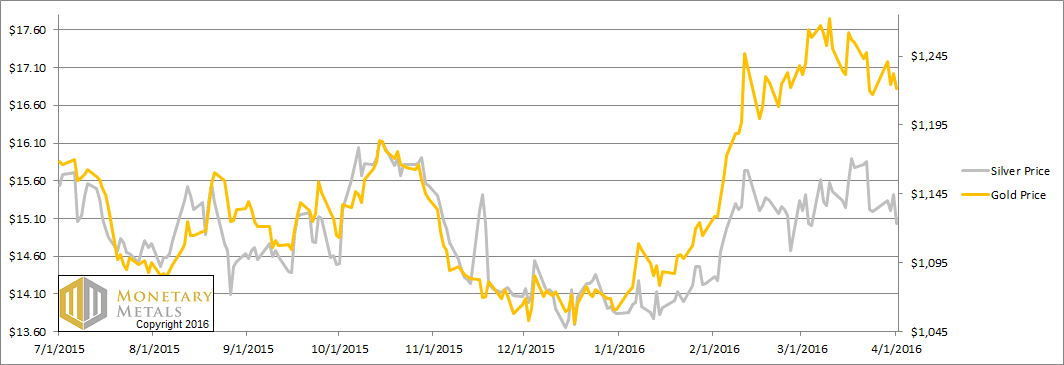

There were some fireworks this week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on Tuesday to drive this move down in the dollar? (We always use italics when referring to gold going up or down, because it is really the dollar going down or up).

Janet Yellen happened, thatís what.

Our Federal Reserve Chair spoke to the Economic Club of New York. We wonít parse her words, but we can see what effect they had on the markets. Markets were up. The S&P surged 45 points, well over 2 percent. The British pound was up almost 2 percent. There was speculative mania, if not irrational exuberance, everywhere. Well almost everywhere. Crude oil was down almost 7% for the week.

When Pavlov trained his dogs to salivate at the sound of the dinner bell, he had to actually serve food. It would not have worked without the reward.

Thus, we remain puzzled at the market salivation at prospects of a greater money supply (or what passes for money nowadays, the irredeemable paper dollar). Why do speculators buy gold and silver at every Fed hint of greater money supply to come? Pavlovís dogs had only the most rudimentary theory. Dinner occurs after that ringing sound. The market has a sophomoric theory. Higher prices will come after that printing sound. At least thatís the hope, which apparently springs eternal.

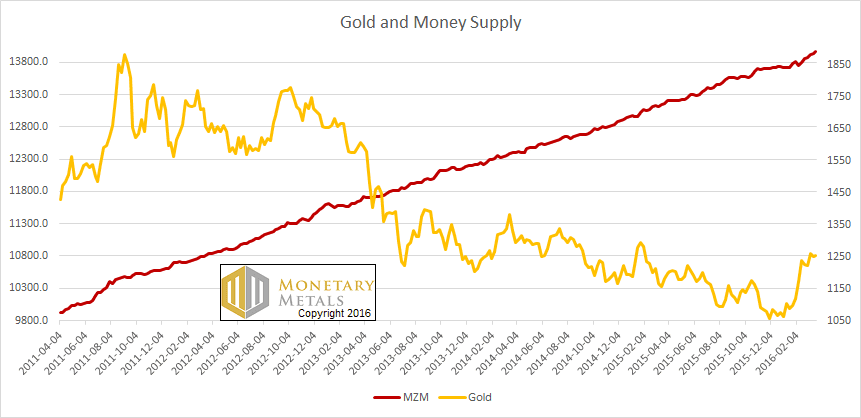

We thought we would graph the weekly money supply (MZM is Money of Zero Maturity), one of the measures tracked by the St Louis Fed and overlay the price of gold. We started the graph in April 2011, exactly 5 years ago. It happens to be just prior to the peak in the price of gold, but we donít think we are cherry-picking the date. A five-year data set ought to be enough to show the trend or lack thereof, as we see in money supply growth and gold price growth respectively.

The Price of Gold and Money Supply (MZM)

Could these two lines be more different in character (or slope)? Based on seeing this graph, would you borrow money, and lever up to bet on a rise in the price when the Fed promises to keep that straight red line moving straightly?

Well, someone did on Tuesday. Or lots of someones.

Unfortunately for them, they were proven wrong fairly quickly. The price of gold ended the week just about where it started. The price of silver ended down. The gold to silver ratio resumed its northward march.

Letís look at the supply and demand fundamentals. But first, hereís the graph of the metalsí prices.

The Prices of Gold and Silver

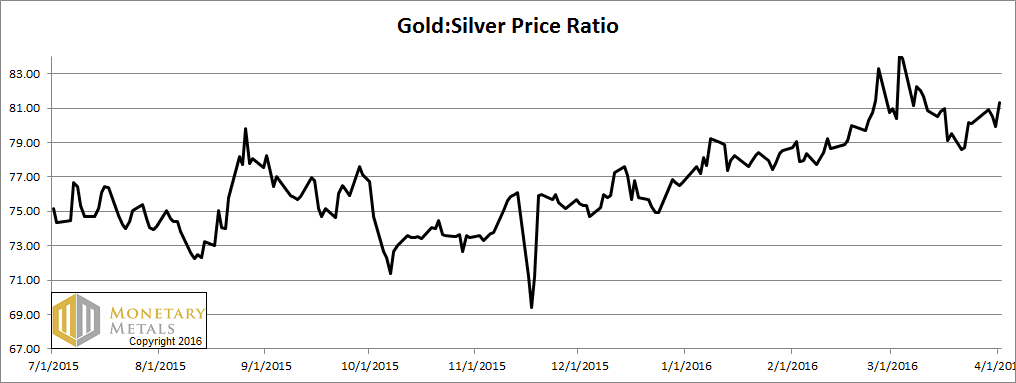

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was up this week.

The Ratio of the Gold Price to the Silver Price

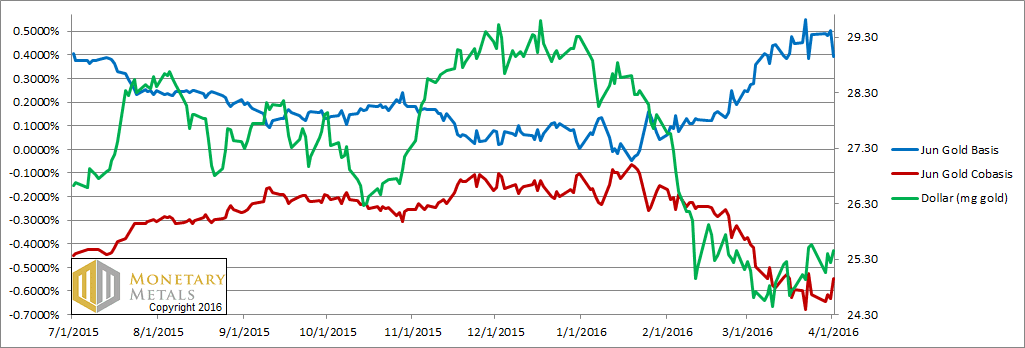

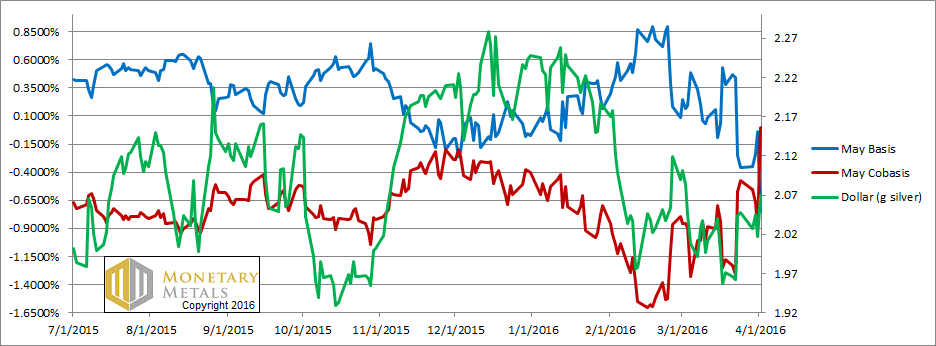

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The green line is the price of the dollar, measured in gold terms (i.e. the inverse of the price of gold). The red line is the gold cobasis, our measure of scarcity of the metal. For many weeks, as it fell (i.e. the gold price rose) gold became less scarce. And when it rose, gold became more scarce. There was an almost uncanny tracking of these two lines (which is less pronounced in the June contract).

That relationship deviated last week, and we responded by dropping our fundamental gold price by a hundred bucks.

The fundamentals actually weakened during all that speculative buying on Tuesday, but firmed up later in the week. Our fundamental price ended the week up a few bucks, to just over $1,300. Gold is selling $90 below that, and itís not a bad buy.

Now letís look at silver.

The Silver Basis and Cobasis and the Dollar Price

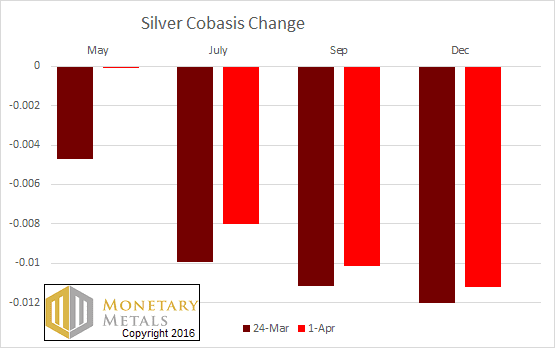

Our scarcity measure, the silver cobasis, continues to show strength when the price of silver drops sufficiently (i.e. the price of the dollar, shown in green) rises. The May cobasis actually ended the week at 0.0000, just on the verge of backwardation. That said, the cobases for farther months are still very negative, and didnít rise as much proportionally as May. Hereís a graph.

The Change in the Silver Cobasis

Speculators sold silver off on Friday. And their selling was concentrated in the May contract.

If the May cobasis goes positive this week, it will be a recurrence of temporary backwardation. For years, we documented the tendency of each contract to tip into backwardation as it neared expiry. For silver it tended to happen a bit farther out than for gold. If it happens this week, it will not be particularly early compared to what we saw occur in contract in contract.

We have a silver fundamental around $14.50.

We hope everyone enjoyed the Voldemort Effect, an article we released for April Foolís Day. It was Bronís first article since coming on board, and there will be many more.

© 2016 Monetary Metals

| Digg This Article

-- Published: Monday, 4 April 2016 | E-Mail | Print | Source: GoldSeek.com