As a young man of fourteen with my older brother Donny having introduced me to Ring Magazine a few year earlier, I can't remember ever being so hyped up for a heavyweight title fight than when Cassius Clay took on Sonny Liston and "whupped" him to take the title and then repeated in the rematch. From that point onward, the hero of my youth (excluding Bobby Orr, of course) in the world of sports became Cassius Clay-turned-Muhammad Ali, who became the greatest heavyweight fighter of all time and dominated the game for over a decade, despite being banned from boxing for refusing to join the army in 1967. Ali was a big man standing over 6'4" tall but he moved with the fluidity, speed and lethal grace of a jaguar.

The greatest series of boxing matches ever seen were not the Joe Louis-Max /Schmeling/U.S.-versus-Germany matches of the mid-1930s, nor even the Ali-Foreman "Rumble in the Jungle," but rather the 1970s matches between Ali and Joe Frazier. What made these matches so legendary was the pure hatred demonstrated toward each other by the combatants, as well as the high levels of emotion they evoked, with Ali the bastion of the Liberal Left, anti-war movement of the 1960s and 1970s while Frazier had the hearts of the right-wing neo-con, pro-war conservative element. Ali was the loud-mouthed radical Black Muslim while Frazier was the slow-speaking Uncle Tom, and the tension of their battles was like no others before and certainly none since—at least in BOXING, that is.

Fast forward 45 years and we are now witnessing an epic battle of another nature and it isn't in Manila and it isn't in Zaire and you can't buy tickets for it and it sure as hell ain't on TV, closed circuit or otherwise, but it is just as much a "Battle of the Titans" and it's happening at the Crimex in good ol' Chicago, Illinois. In the red corner, wearing golden trunks, sits the champion, the Bullion Bank Behemoth complete with his entourage of lawyers, politicians, regulators and mainstream media types all patting him on the back. In the black and blue corner sits the Large and Small Speculator, with his band of supporters including sound money advocates, free market believers, hard asset investors, pension funds, mutual funds and small investors. They are now in the fifth round of a twelve-round battle with both fighters having been knocked to the canvas only to claw back up and launch counter-attacks with ferocious intensity. I have never seen such a knock-down-drag-'em-out slugfest in the Crimex pits probably since the very late 1970s when the Hunt Brothers cornered the silver market. By the way, the official record was that the Hunts tried to execute a corner on the silver futures market illegally, but the reality was that they actually DID corner the market and they did it legally until the Powers-That-Be changed the laws to save their banker buddies that had shorted the silver market against the Hunts and were just about toast.

Today's NFP Report was yet another case of the U.S. services sector composed of waiters and bartenders and burger-flippers all conspiring to allow the U.S. stock market to magically shrug off a 100+ point down opening by way of a 200,000-plus jobs number that has everyone buzzing, including the Bullion bankers who decided to smash gold down to $1,210 before a reversal in the USD set up the bounce. The HUI has beaten back the raid beautifully and is actually up on the day, which reminds me of something that I wrote back in December: "Gold could stay at $1,100 for the next six months while the HUI doubles because gold and silver mining companies have, on a fundamental basis such as price-to-book, price-to-cash-flow, price-to-earnings, and market-cap-per-ounce-of-gold basis, NEVER been this absurdly undervalued EVER."

So, it's no surprise to me that the miners are holding in well and I sincerely hope that they do so all the while gold gets tapped back to the sub-$1,190 level where I will certainly be inclined to re-think my position.

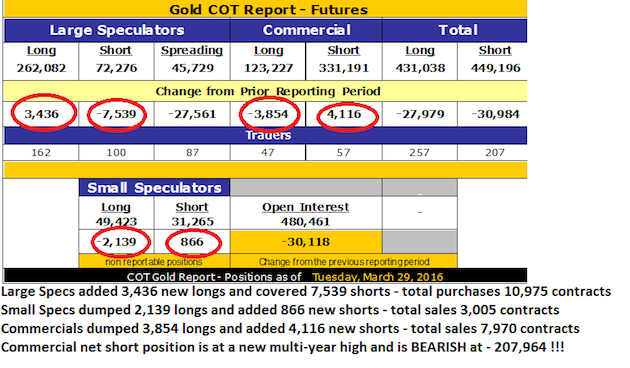

Now—the April 1 COT report…

Read it and weep: the Commercials have actually ADDED to their aggregate short position despite the fact that even as of last Tuesday's pit session close with gold at around $1,240, they continue to execute a FULL-COURT PRESS to the DOWNSIDE. Now, with the HUI standing in at just under 180, this is definitely going down as an Ali-Frazier of the utmost vintage and like all great sporting battles, the manner in which both sides are carrying themselves is impressive and I truly believe that no matter who emerges as the victor, the crowd will be on their feet with an ovation befitting to world-class champions.

BUT, if the bad guys win and the metals get smoked, my hedges will be immaterial and my partner will be armed with a rolling pin while my dog chews on my slippers. . .which sure beats a woman with a 357 Magnum and the mutt chewing on my. . .

. . .never mind.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment.

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All images/charts courtesy of Michael Ballanger