-- Published: Thursday, 14 April 2016 | Print | Disqus

Gold has had one heck of run this year, being one of the best performers in the commodity market.

There are many reasons for this, but what’s important to me is that the rally has defied what was expected. Do you recall Goldman’s call for $1000 an ounce at the beginning of the year?

Admittedly I had no idea on what to expect from Gold prices at the start of the year. A major gold website owner wrote me in December asking me to write an article on gold. Knowing how large their readership is I looked upon this offer as a lost opportunity and did not write the article because I had no opinion on gold.

Over the past four months I have joined the bull camp and happy to say that subscribers to my research just closed out a large winning trade in gold.

With interest rates now negative in many parts of the world, including the US on some days if you subtract yield from inflation, gold prices have shifted back into the bull camp. This is also being seen in the ETF market as investors have flocked back into those vehicles.

Bullish bets as reported by the CFTC in their weekly Open Interest Report have increased in the futures markets sharply. Keep in mind that some ETFs use the futures markets to balance ownership of gold as funds move in and out of them.

If pressed as to why gold has gained in price, I’d say its loss of confidence in central bank policies, a worldwide move to negative interest rates and the uncertainty concerning energy prices the impact lower prices have had on world economies.

A key reason to NOT own gold has always been that it pays no interest. Now that bonds/notes don’t pay interest, that argument no longer works.

Speaking about negative interest rates, the idea that negative interest rates would lower the currency value of an economy that embraced such a policy is a subject that is going to be discussed in classrooms and by central bankers for years to come. The common thinking has been that as a currency’s interest rate fell, investors moved to higher yielding currencies, assuming all things being fairly equal. (I’m not comparing emerging markets to G-7 or G-20 economies.) This means negative rates as employed by Japan and the ECB should have caused the Yen and the Eurocurrency to weaken. However, up until today, the Japanese Yen and Eurocurrency have been soaring against the US Dollar even though both have negative interest rates.

Another bullish factor leading into the summer is the June 23rd referendum vote in the United Kingdom. This will determine whether or the U.K. elects not to stay in the European Union. If the U.K. votes to leave, some believe this will be the end of European Union. I don’t know if things will get to that point or not, but I believe that owning gold into that vote is already a popular strategy.

From all I’m reading, China is not headed to a “hard landing”. Yes, their economy is transitioning and that has been taking its toll. We know that as China moves to more of a “service economy” and less of an “exporting of goods” economy, demand for raw materials that convert to goods for exports has been hurt. What’s being helped however is the overall Chinese economy, as the economy going forward is no longer one dimensional, based on exports. Now it has a new element, one of servicing its own needs. However, the transition has and continues to cause concern as less demand for raw materials has a deflationary impact. That caused fear and adds a bid to gold.

Crude oil prices pull on stock markets and therefore attract the attention of gold traders. Too low a price for crude spells trouble for banks, employment and of course revenue. Too high causes inflation.

There’s a meeting this Sunday taking place between major oil producers with the goal of freezing output. This is not bullish since the freeze if enacted at current levels guarantees overproduction when compared to demand. However, if enacted it is a first step towards gaining control and putting floor in place in crude oil. Failure meaning no agreement is reached could cause crude oil to nose dive, which would be bullish gold prices.

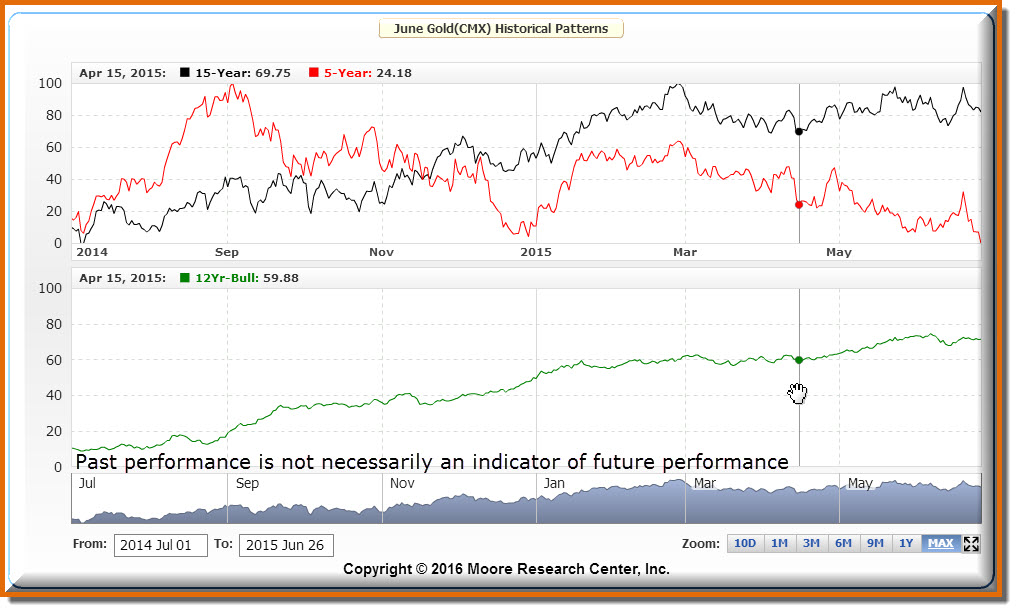

Seasonal Chart

In historical terms, the “hand print” on the above chart shows where the market is in terms of history.

I see the current gold price pattern NOT following the five year pattern shown as the red line. Rather, the 15-year pattern, the very top line seems to be what prices are following. As such, the pullback now occurring might lead to a buying opportunity with price expectations for even higher prices going into June as this pattern shows.

Keep in mind that past performance is but a picture of what’s occurred in the past. As such, I rely heavily on Daily and Weekly Charts to help pinpoint trade opportunities, using seasonal trends to obtain an idea of what occurred in past market conditions that were either bullish, bearish or neutral in their bias.

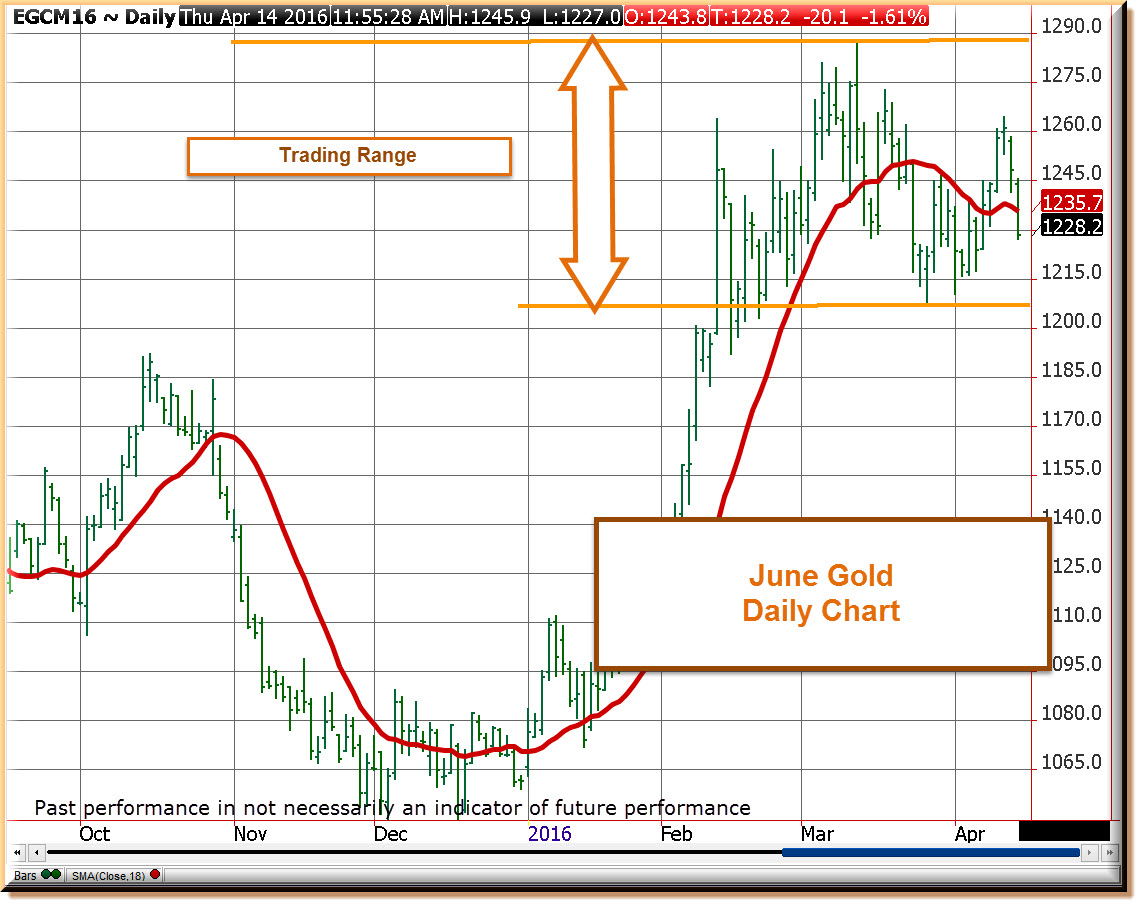

Daily Chart with Price Counts…created on April 13 2016

Gold satisfied it’s Upside PriceCounts and in the process has setup a series of downside counts. The downside counts either get satisfied by prices moving down to the first PriceCount target of 1181 or prices reverse, move up and close over 1273, the high of the “kick back” that occurred on March 17th. If this occurs the Downside PriceCount will be negated.

At this point, I favor the idea that gold will move back up and through 1273 but am not at all pleased that prices are under the influence of a Downside PriceCount. We have a cautionary signal, one I do pay attention to.

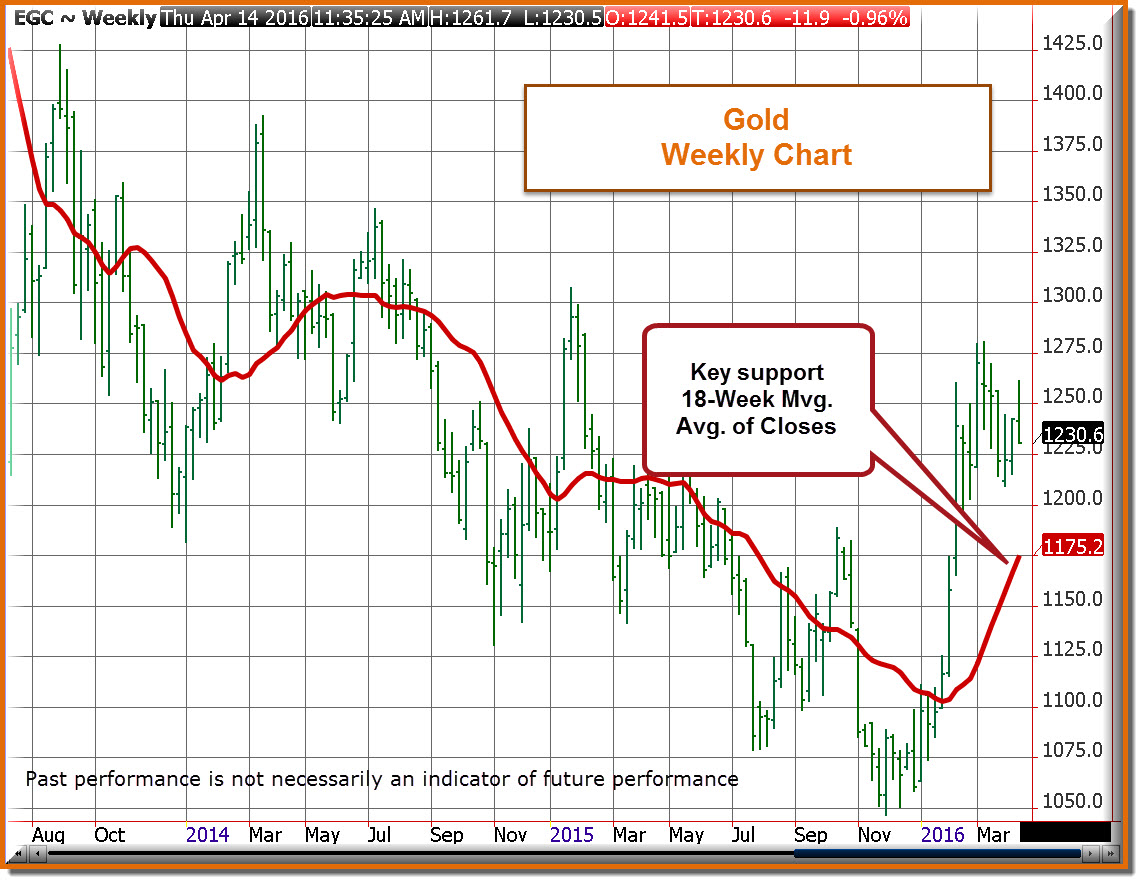

Weekly Gold Chart

As long as prices stay over the 18-Week Moving Average of Closes, bias remains to the upside.

This moving average will continue to work higher due to how the math is calculated. As it does so, if prices don’t move much, over time price and the average will converge. I don’t expect that anytime soon “if” I am correct and prices are going to remain bullish.

Daily Chart

Today’s market action has neutralized the uptrend on the Daily Chart. I now think the market is in a consolidation phase as it trades on either side of the 18-Day Moving Average of Closes, the red line with a value of 1235.7 on this chart.

I’ve labeled the current trading range as I see it. It has a low of 1207.7 and a high of 1287.8 in this contract. If I’m right, it won’t have a lot of downside and most likely won’t get under the most recent low of 1207.7.

Conclusion

Those of you who are subscribers to my Market Research know that you were long and took a nice chunk of profit of out the market this week prior to prices turning down. I expected a pullback given that the market had gotten overbought and had rallied into the upper Window Envelope without trying to extend the rally into the upper Bollinger Band.

I also think that there’s a “camp” of people like me who want to see what the Sunday meeting of oil producers meeting in Doha this coming week come up with.

Last, the rally in the Eurocurrency and Japanese Yen are correcting, which means the US Dollar is getting a bid which is weighing on gold prices. I expect a week or so of consolidation to now take place and from there, I’ll be taking another look at the chart action.

I remain in the bull camp for the time being, out of the market and looking for a chart setup to get my subscribers long from.

______________________________________________________________________________

© 2016 Ira Epstein Division of Linn & Associates, LLC.

For more information 866-973-2077 Local: 312-264-2805

DISCLAIMER: THIS IS A SOLICITATION. Reproduction or rebroadcast of any portion of this information is strictly prohibited without written permission. The information reflected herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. In an effort to combat misleading information Linn & Associates, LLC. has performed its due diligence to insure that all material information is provided within this report, though specific information related to your investment, hedging or speculative situation may not be included. Opinions expressed are subject to change without notice. This company and its officers, directors, employees and affiliates may take positions for their own accounts in contracts referred to herein. Trading futures involves risk of loss. Past performance is not indicative of future results.

Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades may have not actually been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

| Digg This Article

-- Published: Thursday, 14 April 2016 | E-Mail | Print | Source: GoldSeek.com