-- Published: Friday, 15 April 2016 | Print | Disqus

By: SRSrocco Report

As Central Banks continue to prop up the financial system with massive monetary printing, the death of paper money grows closer each passing day. While it is true that the Fed and Central Banks have been able to postpone the day of reckoning much longer than most precious metals investors imagined, the inevitable collapse of the fiat monetary system will turn out to be much worse.

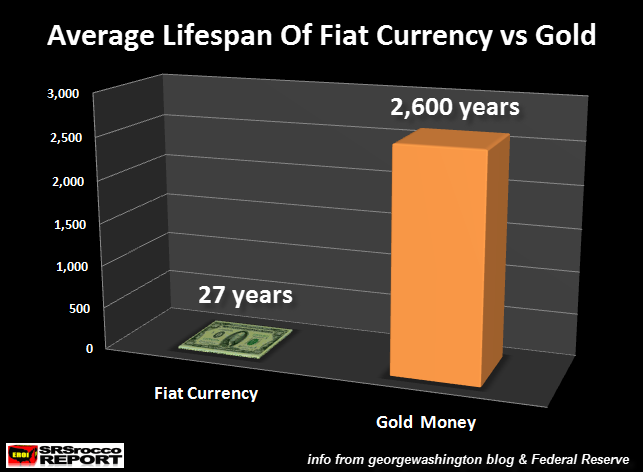

There have been over 3,400 fiat currencies, and all of them have failed. According to the article on Washington’s blog, The Average Life Expectancy For A Fiat Currency Is 27 Years … :

The average life expectancy for a fiat currency is 27 years, with the shortest life span being one month. Founded in 1694, the British pound Sterling is the oldest fiat currency in existence. At a ripe old age of 317 years it must be considered a highly successful fiat currency. However, success is relative. The British pound was defined as 12 ounces of silver, so it’s worth less than 1/200 or 0.5% of its original value. In other words, the most successful long standing currency in existence has lost 99.5% of its value.

Given the undeniable track record of currencies, it is clear that on a long enough timeline the survival rate of all fiat currencies drops to zero.

If we compare the average life expectancy for fiat currencies versus gold, we have the following chart:

As we can see, gold has enjoyed a monetary status nearly a hundred times greater than the average fiat currency. I came up with the 2,600 year gold money history according to date of one of the oldest gold coins shown below:

This coin was sold in 2013, and in the press release, Austin Rare Coins and Bullion Sells One of the World’s Oldest and Most Treasured Coins it stated the following:

“We have never encountered an Ancient gold coin of this age in such remarkable quality,” said Ryan Denby, president of Austin Rare Coins and Bullion. “It’s hard to imagine this was crudely produced nearly 2,600 years ago.”

The first coins struck for commerce, created by King Croesus in Lydia (modern Iran), are referred to as third-stater coins and are made of Electrum – a combination of gold and silver. This amazing coin, dating to 560 BC, is one of the first staters – struck from pure gold. This Ancient Lydian coin is about the size of a U.S. dime and contains ¼ ounce of gold. Middle Eastern and European treasures such as this have been becoming increasingly harder to find as governments have dramatically restricted the export of such artifacts – preferring to keep them for museum display or for the private collections of ruling monarchies.

This pure gold coin produced in Ancient Lydia is one of the best quality ancient coins in existence. However, another even older gold coin was found recently by a diver in Bulgaria. According to the article, Diver accidentally discovers world’s oldest gold coin:

A diver in Bulgaria discovered what is thought to be the world’s oldest gold coin — and the find was apparently accidental.

The scuba diver saw the coin near Sozopol on Bulgaria’s Black Sea coast, Bulgaria’s BTA news agency reported, and gave it to Bozhidar Dimitrov, the head of the National History Museum in Sofia.

The museum found that the coin appears to have been minted in western Anatolia in the second half of the seventh century B.C.E., making it more than 2,750 years old. The coin is thought to be from Lydia, a land in Anatolia that’s believed to be the originator of gold and silver coins.

Okay, so there we have it… an even older gold coin. But this coin also comes from the region of Lydia which was believed to be the originator of gold and silver coins. What is interesting to understand about a gold coin is its ability to last for thousands of years while the lifespan modern paper money is considerably less.

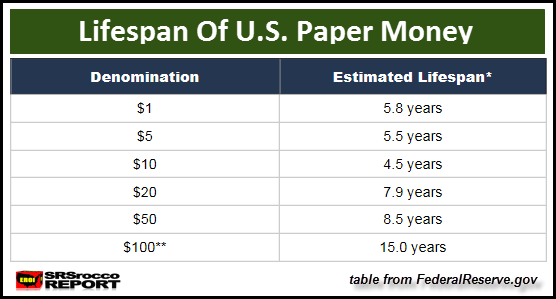

The lifespan of the lower denomination Federal Reserve notes are less than ten years. However, the $100 bill survives a bit longer due to it being handled less than a $10 or $20 bill:

Of course, when gold coins were used in circulation their faces would become worn down. Thus, these worn out gold coins were removed from circulation, melted down and made into new coins. However, the majority of the gold remained through this process.

Regardless, the lifespan of the U.S. Fiat Dollar is now 45 years old. How much longer does it have before it totally collapses? Currently, the U.S. Dollar’s value has declined 98.4% since the Federal Reserve came into existence in 1913. In 1913, gold was worth $20.64 an ounce.

NOTE: For those who wondered how the decline in the U.S. dollar is calculated, you just divide the 1913 price of $20.64 by the present price of $1,255 to get 0.0164. Subtract that from 100 and you get the 98.4%.

So, we are just waiting for the disintegration of the remaining 1.6%. Unfortunately, we won’t see a total collapse of the Dollars value as the price of gold can’t go to infinity. For example, if the price of gold was revalued to say $10,000, then the Dollar’s value would have lost 99.8%. We may never get the 100%, but who cares when your gold is worth $10,000… LOL.

Lastly, Jim Rickards has been doing the interview circuit to advertise his new gold book. Jim believes the Dollar will collapse and gold will be revalued to $10,000. This is due to a formula of backing outstanding M1 money supply by a certain percentage of gold. While I am in agreement with Mr. Rickards that the value of gold will revalue much higher, I don’t think it will be based on backing outstanding currency.

Why? Because we need a cheap and growing energy supply to maintain all that fiat currency that would be backed by gold in Rickards example. Unfortunately, we do no longer have a cheap and growing energy supply. This will become more apparent before the end of the decade.

Thus, gold will be revalued much higher due to its high quality store of value compared to the disintegration of most paper assets that will continue to lose their value as U.S. and global energy supplies peak and decline.

Interested in learning more about the current state of the changing gold market? The Gold Report: Investment Flows provides accurate information, charts and graphs in a way that is easy to understand and follow.

While the gold market has been evolving over the past 100+ years since the creation of the Federal Reserve, there has been a significant change in the gold market over the past decade. I believe the present conditions are leading to the dawn of a new age in the value of gold.

- SRSrocco Report.

| Digg This Article

-- Published: Friday, 15 April 2016 | E-Mail | Print | Source: GoldSeek.com