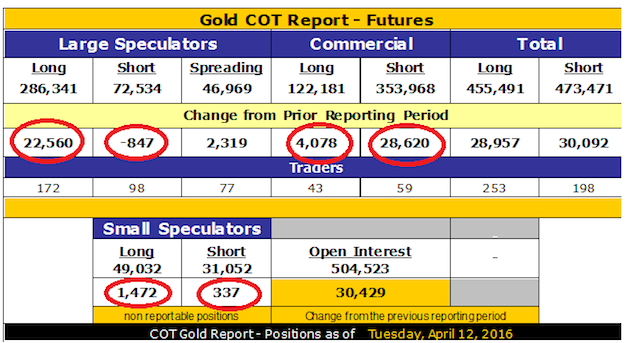

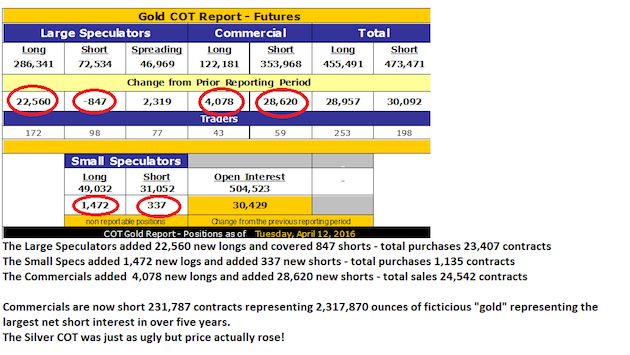

Last Friday afternoon after I read the COT (Commitment of Traders report) numbers, I immediately looked over at the quote terminal only to see that the HUI (NYSE Arca Gold BUGS Index) was going to close out the week a tad below 200 and nearly exactly double where it was on Jan. 19, and I shook my head with utter reverence. Here you have gold bullion trading as high as $1,287.80 on March 11, the same day that the HUI closed at 175.83, with the Commercials having moved from 2,911 net shorts on Dec. 4 to 195,000 net shorts the prior Tuesday. Gold is now over $50 lower than March 11 but the gold miners continue to defy both logic and gravity, begging the question, "Are they predicting another major leg northward in physical bullion?" Whatever the answer, the move in my beloved gold and silver miners has been simply AWESOME and while I have jettisoned all options and leveraged ETFs, I continue to hold all of my original GDXJ (Market Vectors Junior Gold Miners) position from late 2015 [< $19 ACB], as well as all of the penny explorers.

The Long and Intermediate-term trends for gold and silver continue to prevent the kinds of waterfall declines associated (in the past five years) with relatively high aggregate Commercial short interest numbers, such as the one we got tonight for gold (231,787 contracts) and silver (106,646 contracts). It's understandable that the Commercials have pressed their shorts in the physical metals, but that they have failed to turn sentiment for the miners is setting up a very real possibility of a Commercial Signal Failure that morphs into an epic short squeeze.

The chart shown below is enough to scare even the staunchest of gold bulls (like me) into treading timidly; the psychological damage of the past five years of financial trauma has certainly left its mark on behaviors. The criminality of the bullion bank behemoths is glaring, and their iron grip on price is undisputable, making it very difficult to foray unhedged into these oh-so-familiar and treacherous waters. These interventionalist bastards have added 36,000 new shorts representing 3,600,000 ounces of phony, synthetic, never-to-be-delivered gold and engineered a $50 drop since March 11, but what I don't think they were banking on was that the miners would ignore them.

As we head into the weekend and enter the second half of April, it is important to remember that May is typically strong in terms of seasonality for the gold miners, but then June and July are completely the reverse.

OK, with Fido pacing nervously outside my door and my partner's overnight bag sitting at the bottom of the stairs, I suspect that there are two members of this family that are desperately looking for "direction," as to not just the gold and silver prices and not just the gold and silver miners, but also the direction of my emotional stability over the next week or two. My lovely lady has become quite proficient lately with interpretation of the COT report and plans her getaways accordingly. Of course, the sound of a six-iron imbedding itself into a chair or a foot lifting a footstool into a thirteen-foot trajectory over the center island in the kitchen might also be a clue to whether or not "Daddy" is about to "LOSE IT" and bears no correlation to the COT or metal prices or anything else, for that matter. I think we ALL are in dire need of an educated guess as to the next $100 move in gold, so that at least Fido will know whether he should expect kibble and Filet Mignon add-ins or whether he needs to hone his instinctual food-gathering skills, which I had to re-teach him back in late 2015 with gold at $1,045 (the squirrels on my street will never forgive me).

Do we side with the tape action in the mining shares and go "ALL-IN"? Do we pay heed to the Commercials and get short? Do I trust my instincts and stay long the GDXJ and selected junior explorers? I was taught a great many years ago that when you are in doubt with any particular portfolio position, do nothing, and that especially applies when you are sitting on a big, fat profit. Let the market TELL YOU when it is time to ring the register instead of trying to finesse it. Having said that, I am going to freely admit that my short-term nervousness is getting worn down by the hundreds of articles telling me why I'm "Wrong! Wrong! Wrong!," which is exactly why I am going to do absolutely nothing except add to my silver holdings into any and all dips and tell the world to "Chill" when discussing the miners.

Before I sign off for the weekend, you all know that I like a number of metals and just as I am a big enthusiast on ZINC by way of my association with Tinka Resources Ltd. and its Ayawilca deposit, it should be no surprise that I am currently warming up to another mineral that represents the cleanest energy fuel on the planet—URANIUM. I haven't bought an energy stock in many, many years, so this one really has my interest thanks to some great work by a couple of dear friends that are a great deal smarter than I could ever pray to be.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Michael Ballanger: I or my family own shares of the following companies mentioned in this interview: Tinka Resources Ltd. I determined which companies would be included in this article based on my research and understanding of the sector. Statement and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation or editing so the author could speak independently about the sector. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. The companies mentioned in this interview were not involved in any aspect of the interview/article preparation or editing so the expert could comment independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts courtesy of Michael Ballanger