-- Published: Tuesday, 19 April 2016 | Print | Disqus

By Steve St. Angelo

Sales of the U.S. Mint Gold Eagles surged last week as investors were spooked by the emergency Fed meetings. As several news sources reported last week, this was the first time both the President and Vice President “unexpectedly” met with the Fed Chairman to discuss the state of the American and global economy.

In addition, according to the news release, SuperStation95 – TWO MORE! Closed-Door, Expedited Meetings of Federal Reserve:

Many rumors were spread around the blogosphere as to why there were several emergency Fed meetings. One such rumor is the U.S. government being force to enact martial law due to a systemic breakdown of the banking industry. Other rumors floating around are tied to the ramifications of the U.S. Dollar and U.S. Treasury market when China launches its gold-backed Yuan tomorrow, April 19th.

Regardless, the rumors had investors spooked enough to purchase the most Gold Eagles in a week since Jan 11th. Last week, the U.S. Mint sold 33,000 oz of Gold Eagles and 6,000 Gold Buffalos. That’s a lot of Gold Eagles sold in a week compared to 38,500 oz sold in the entire month of March:

The majority of Gold Eagle sales were the 1 oz coin which totaled 29,500, followed by 1,000 oz of the 1/2 oz coin, 1,500 oz of the 1/4 oz coin and 1,000 oz of the 1/10th oz coin. Again, these are shown in total ounces. For example, the U.S. Mint sold a total of 10,000 of the 1/10th oz Gold Eagle coins which equals 1,000 oz.

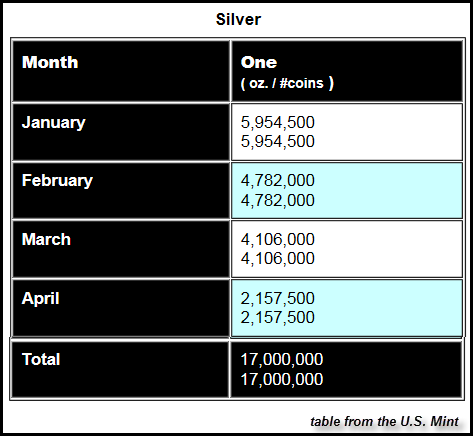

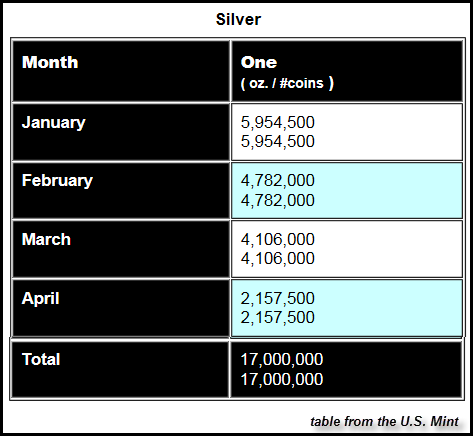

Furthermore, the U.S. Mint continues to sell out of its weekly allocation of Silver Eagles as total sales for the year reached 17 million– 26% higher than sales during the same period last year (CoinNews.net):

It will be interesting to see what takes place after the Chinese Yuan-denominated gold benchmark starts tomorrow. If this wasn’t going to be such a big deal, then why all the emergency Fed meetings?

The U.S. and global financial markets are in serious trouble. Investors who haven’t taken a position in owning physical precious metals may be running out of time to do so.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below:

| Digg This Article

-- Published: Tuesday, 19 April 2016 | E-Mail | Print | Source: GoldSeek.com