William McChesney Martin, the longest sitting Federal Reserve Chairperson in history, once famously quipped that it was the Fed's job to "order the punch bowl removed just when the party" really starts to get going. His point was that the Fed should raise interest rates and restrict liquidity to preempt an overheating economy before the economy actually overheats and it is too late. The metaphor is a bit dusty as it's been over a decade since the Fed was in a tightening mode, but the "punchbowl" reference is increasingly relevant again.

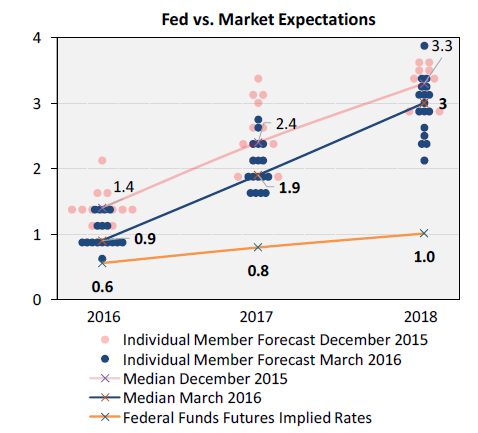

Following the first interest rate hike last December, the Fed, like chaperones at a fraternity house party, has appeared overly concerned about the prospect of upsetting the party-goers and has backed off from earlier indications that it would raise rates four times this year. In mid-March, the Fed not only passed on hiking rates but also issued its updated FOMC median projection for the year-end Fed Funds rate. The median forecast was lowered by 50 basis points, effectively signaling there will now be only two rate hikes over the course of 2016. At the April FOMC meeting the Fed remained cautious about raising rates. As things stand, rates will remain below 1% for the rest of the year.

The news was greeted by some (including me) as a total capitulation by the central bank to the more dovish views held by traders in the financial markets. It added fuel to the notion that central banks have lost control and are letting markets dictate monetary policy. Fed Chair Janet Yellen's comments about a very gradual path were reinforced at a recent speech before The Economic Club of New York where she used the word "gradual" nine times. But those assurances may be part of what's driving expectations in the Fed Funds futures market where traders are not even pricing in those two hikes. At this point, traders don't believe the Federal Funds Rate will hit a full 1% by the end of 2018! As that famous monetary economist Crocodile Dundee might have said, "Now that's gradual!"

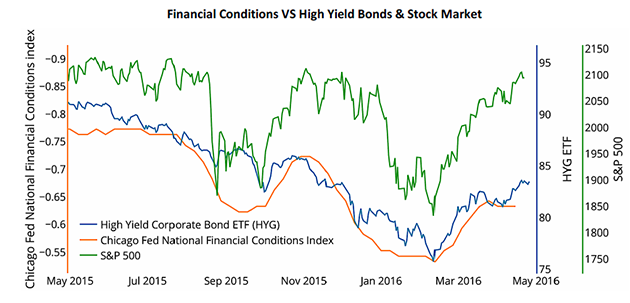

Janet Yellen has defended the Fed's dovish shift on the grounds that "financial conditions" had tightened during the first quarter. She cited "declines in broad measures of equity prices and higher borrowing rates for riskier borrowers." In other words, stocks went down and junk bond spreads widened. But, those moves in securities prices were more a function of the fleeting fear and greed impulses of Wall Street traders than that of some highly complex model that measures "financial conditions." Could it then be that the whims of Wall Street traders are driving monetary policy at the most powerful central bank in the world?

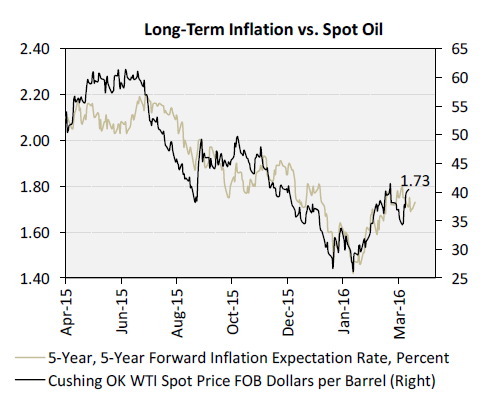

There is an even more scary feedback loop from the "frat boys" to the Fed. Some Fed officials had cited a sharp decline in long-term inflation expectations as another concern during the first quarter. Inflation expectations in the markets are usually quantified by taking the difference between the yield-to-maturity ("YTM") of a conventional Treasury coupon bond and that of a Treasury Inflation-Protected Security (TIPS) bond of the same maturity term. This difference produces the breakeven inflation rate, so named because if future inflation were equal to this value, then the realized return of the conventional UST bond would be the same as for the TIPS bond. One can extract inflation expectations for the next five years beginning five years from now by using the 10-year and 5-year conventional and TIPS bonds.

But as we show in the chart above, inflation for the five-year period beginning five years from now seems to correlate highly with changes in the spot price of oil from two nanoseconds ago. When hedge funds were heavily shorting crude and prices were plunging into the high 20s, the inflation expectation for five years from now plunged as well. The correlation is over 0.9. Huh? And now, with spot oil prices having risen smartly since mid-February, traders' expectations of what inflation will be in the five year period beginning five years from now have risen accordingly. Bizarre! Even more bizarre was the fact that some FOMC members would cite the plunge as "worrisome."

This punchbowl experience is somewhat reminiscent of the prolonged cycle of easy money maintained by the Fed in the period leading up to Y2K, an era of monetary policy aptly characterized by the notion of the "Greenspan Put." This was the idea that, by lowering interest rates to create cheap money and prop up markets whenever they might get shaky, then Fed Chairman Alan Greenspan was essentially providing investors with a put option used to insure against market declines.

So now what?

Will every dip in stock or junk bond prices be justification for further delaying the path to more "normal" interest rates? In our view, if the Fed continues to postpone further tightening, market participants will experience a worse hangover than we are already headed for. As the WSJ characterized recently, it is as if the Fed has given inflation a hall pass. . .suggesting that the central bank is willing to fall behind the curve on inflation as opposed to getting ahead of it. At the risk of sounding like the old curmudgeon at the party, things are likely to end badly.

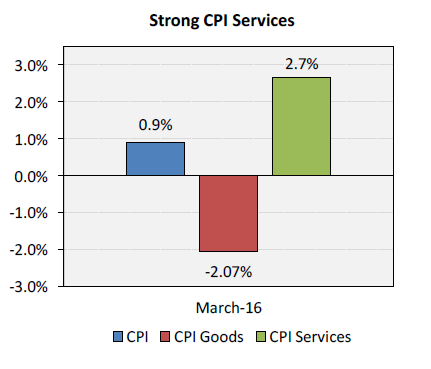

But perhaps not. The Fed Committee has repeatedly stated that it is going to be data-dependent, and there are reasons to expect a strengthening GDP through the second half of 2016. More importantly, since the Fed has already achieved its target for unemployment, which is now at 5%, greater attention is likely to be paid to the 2% inflation target. Already, the CPI for March is showing an inflation awakening: although the aggregate index is up only 0.9% year-over-year, that figure masked the upward trend of Services (60% of CPI), which rose 2.7% from a year ago. Even the core PCE Deflator, the Fed's preferred inflation measure, was up 1.6% YoY in March, and has matched the FOMC expectations of 1.6% for year-end 2016. We believe future inflation numbers will rise sharply as energy prices recover.

At this point, the markets have improved dramatically since the mid-February trough: junk bond yields have dropped almost 200 basis points and stocks have rallied 15%, and are now flirting with all-time highs. By keeping the fed funds rate unchanged in March, the Fed has certainly made the frat boys happy. But it won't take much further deterioration in the inflation numbers for the data-dependent Fed to get back to cutting off the punch bowl. If the Fed is indeed data dependent, new inflation numbers suggesting it is falling behind the curve could lead it to put those rate hikes right back on the table, causing the markets to slip once again into correction mode. Notably, in the April statement the Fed deleted the reference to "financial developments."

Fortunately, there are always groups of securities that do well even when the leading indexes are not. MRP has outlined four themes in our Market Viewpoints reports over the past six months that should prove to be resilient even in a renewed broad market correction. First, MRP believes that during periods of increasing interest rates value stocks will outperform growth stocks. We also believe that as the Fed "gradually" tightens monetary policy, U.S. inflation will be rising faster than interest rates, causing the inflation-adjusted rate to fall. This in turn will cause the USD to weaken.

As the USD falls, investors will turn to inflation-protected assets such as gold, which will also boost gold miner shares. In recent months the dollar has fallen more than 8% since its peak last year. The downturn has sparked a rally in emerging markets, which we recommended as an attractive opportunity in early December. And finally, we believe that crude oil prices have bottomed and will rise steeply as supply shrinks while demand surges ahead.

Joe McAlinden has over 50 years of investment experience. He is the founder of McAlinden Research Partners and its parent company, Catalpa Capital Advisors. Previously, McAlinden spent more than 12 years with Morgan Stanley Investment Management, first as chief investment officer and then as chief global strategist, where he articulated the firm's investment policy and outlook. He received a bachelor's degree cum laude in economics from Rutgers University and holds the Chartered Financial Analyst designation. McAlinden has served on the board of the New York Society of Security Analysts.

Disclosure:

1) Statements and opinions expressed are the opinions of Joe McAlinden and not of Streetwise Reports or its officers. Joe McAlinden is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation or editing so the author could speak independently about the sector. Joe McAlinden was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Charts courtesy of Joe McAlinden